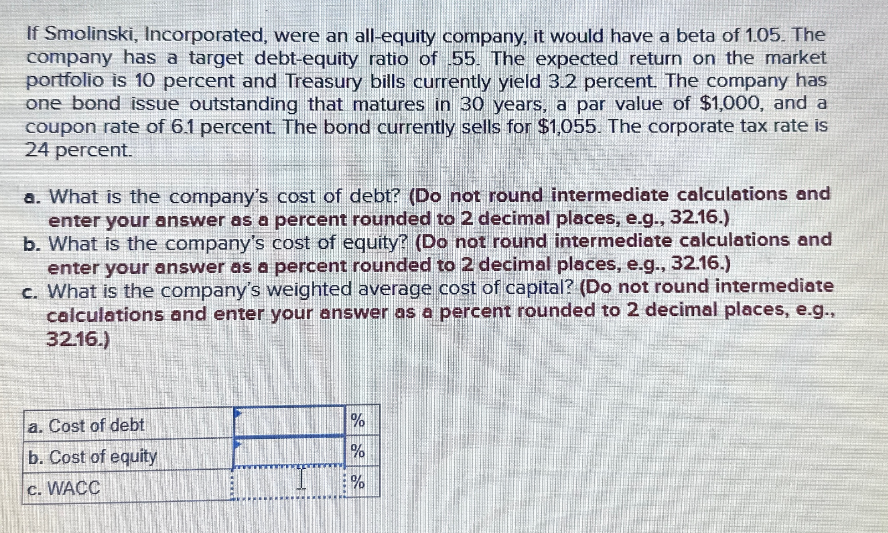

If Smolinski, Incorporated, were an all-equity company, it would have a beta of 1.05. The company has a target debt-equity ratio of 55. The expected return on the market portfolio is 10 percent and Treasury bills currently yield 3.2 percent. The company has one bond issue outstanding that matures in 30 years, a par value of $1,000, and a coupon rate of 6.1 percent. The bond currently sells for $1,055. The corporate tax rate is 24 percent. a. What is the company's cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the company's cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the company's weighted average cost of capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Cost of debt b. Cost of equity c. WACC % % %

If Smolinski, Incorporated, were an all-equity company, it would have a beta of 1.05. The company has a target debt-equity ratio of 55. The expected return on the market portfolio is 10 percent and Treasury bills currently yield 3.2 percent. The company has one bond issue outstanding that matures in 30 years, a par value of $1,000, and a coupon rate of 6.1 percent. The bond currently sells for $1,055. The corporate tax rate is 24 percent. a. What is the company's cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the company's cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the company's weighted average cost of capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Cost of debt b. Cost of equity c. WACC % % %

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 15P

Related questions

Question

100%

Am. 131.

Transcribed Image Text:If Smolinski, Incorporated, were an all-equity company, it would have a beta of 1.05. The

company has a target debt-equity ratio of 55. The expected return on the market

portfolio is 10 percent and Treasury bills currently yield 3.2 percent. The company has

one bond issue outstanding that matures in 30 years, a par value of $1,000, and a

coupon rate of 6.1 percent. The bond currently sells for $1,055. The corporate tax rate is

24 percent.

a. What is the company's cost of debt? (Do not round intermediate calculations and

enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

b. What is the company's cost of equity? (Do not round intermediate calculations and

enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

c. What is the company's weighted average cost of capital? (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.)

a. Cost of debt

b. Cost of equity

c. WACC

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT