If the government imposes a price ceiling $50 per unit in the above market then which of the following would happen? O Surplus in the market. O Shortage in the market. O Neither surplus nor shortage in the market. O The market will stay at the equilibrium level. QUESTION 7 When the taxes are imposed O government does not gain anything out of it. O government distributes the tax revenue among the buyers and sellers. O government earns tax revenue based on quantity sold after taxes. O government earns tax revenue based on quantity demanded after taxes.

If the government imposes a price ceiling $50 per unit in the above market then which of the following would happen? O Surplus in the market. O Shortage in the market. O Neither surplus nor shortage in the market. O The market will stay at the equilibrium level. QUESTION 7 When the taxes are imposed O government does not gain anything out of it. O government distributes the tax revenue among the buyers and sellers. O government earns tax revenue based on quantity sold after taxes. O government earns tax revenue based on quantity demanded after taxes.

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Supply, Demand And Government Policies

Section: Chapter Questions

Problem 10PA

Related questions

Question

question 6and 7 please

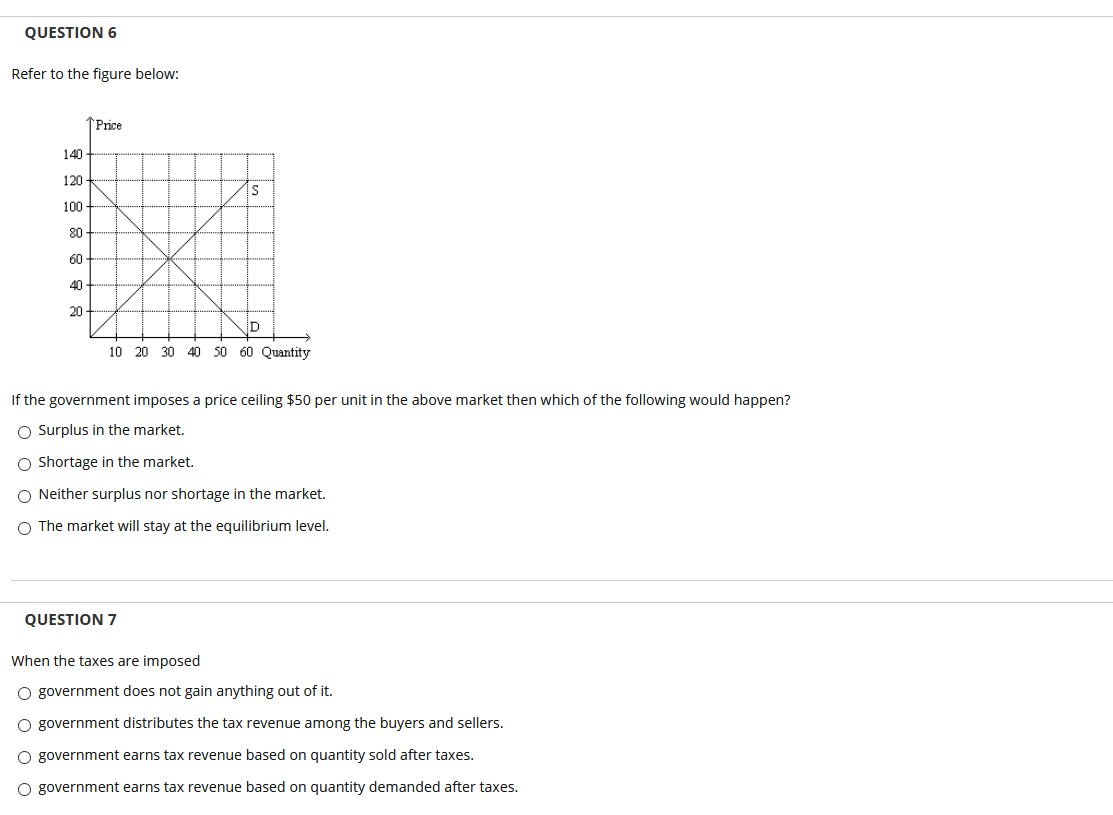

Transcribed Image Text:QUESTION 6

Refer to the figure below:

Price

140

120

IS

100

80

60

40

20

10 20 30 40 50 60 Quantity

If the government imposes a price ceiling $50 per unit in the above market then which of the following would happen?

O Surplus in the market.

O Shortage in the market.

O Neither surplus nor shortage in the market.

O The market will stay at the equilibrium level.

QUESTION 7

When the taxes are imposed

O government does not gain anything out of it.

O government distributes the tax revenue among the buyers and sellers.

O government earns tax revenue based on quantity sold after taxes.

O government earns tax revenue based on quantity demanded after taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning