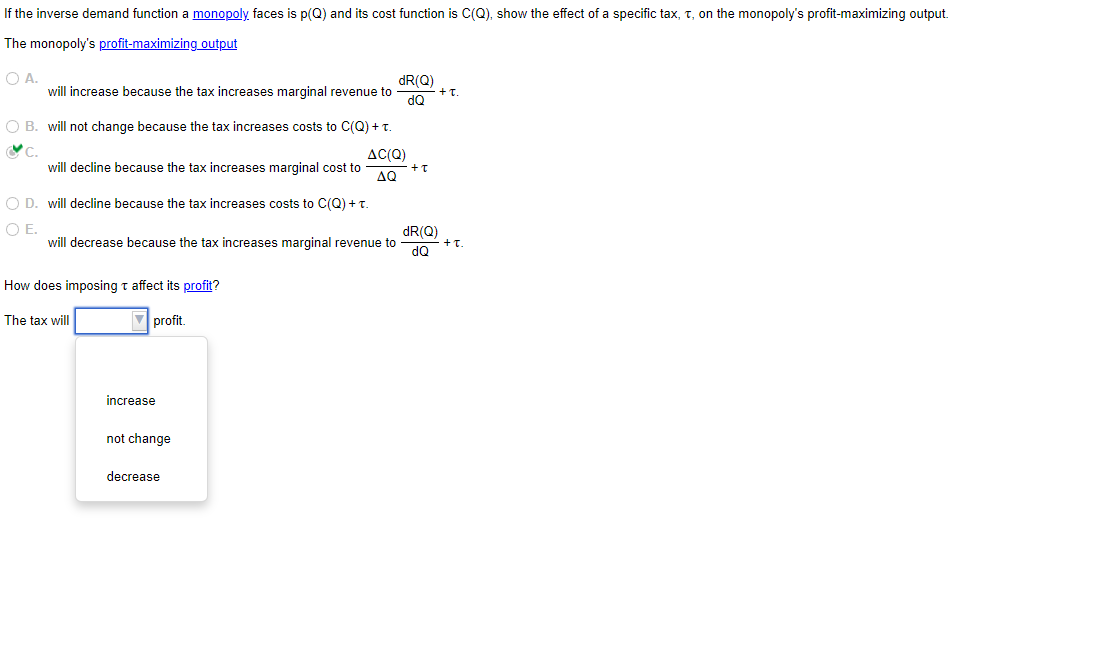

If the inverse demand function a monopoly faces is p(Q) and its cost function is C(Q), show the effect of a specific tax, t, on the monopoly's profit-maximizing output. The monopoly's profit-maximizing output A. will increase because the tax increases marginal revenue to OB. will not change because the tax increases costs to C(Q) + T. C. will decline because the tax increases marginal cost to AC(Q) AQ O D. will decline because the tax increases costs to C(Q) + T. O E. How does imposing t affect its profit? The tax will profit. dR(Q) will decrease because the tax increases marginal revenue to dQ increase dR(Q) dQ not change decrease + t + T. + T.

If the inverse demand function a monopoly faces is p(Q) and its cost function is C(Q), show the effect of a specific tax, t, on the monopoly's profit-maximizing output. The monopoly's profit-maximizing output A. will increase because the tax increases marginal revenue to OB. will not change because the tax increases costs to C(Q) + T. C. will decline because the tax increases marginal cost to AC(Q) AQ O D. will decline because the tax increases costs to C(Q) + T. O E. How does imposing t affect its profit? The tax will profit. dR(Q) will decrease because the tax increases marginal revenue to dQ increase dR(Q) dQ not change decrease + t + T. + T.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter11: Price And Output Determination: Monopoly And Dominant Firms

Section: Chapter Questions

Problem 4E

Related questions

Question

V2

Transcribed Image Text:If the inverse demand function a monopoly faces is p(Q) and its cost function is C(Q), show the effect of a specific tax, t, on the monopoly's profit-maximizing output.

The monopoly's profit-maximizing output

O A.

will increase because the tax increases marginal revenue to

O B. will not change because the tax increases costs to C(Q) + T.

C.

will decline because the tax increases marginal cost to

O D. will decline because the tax increases costs to C(Q) + T.

O E.

will decrease because the tax increases marginal revenue to

How does imposing t affect its profit?

The tax will

▼profit.

increase

not change

AC(Q)

AQ

decrease

dR(Q)

dQ

+ t

dR(Q)

dQ

+I.

+T.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning