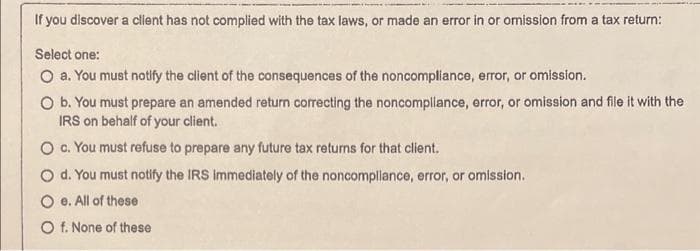

If you discover a client has not complied with the tax laws, or made an error in or omission from a tax return: Select one: O a. You must notify the client of the consequences of the noncompliance, error, or omission. O b. You must prepare an amended return correcting the noncompliance, error, or omission and file it with the IRS on behalf of your client. O c. You must refuse to prepare any future tax returns for that client. O d. You must notify the IRS Immediately of the noncompliance, error, or omission. Oe. All of these O f. None of these

If you discover a client has not complied with the tax laws, or made an error in or omission from a tax return: Select one: O a. You must notify the client of the consequences of the noncompliance, error, or omission. O b. You must prepare an amended return correcting the noncompliance, error, or omission and file it with the IRS on behalf of your client. O c. You must refuse to prepare any future tax returns for that client. O d. You must notify the IRS Immediately of the noncompliance, error, or omission. Oe. All of these O f. None of these

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 39P

Related questions

Question

Q. 1

Transcribed Image Text:If you discover a client has not complied with the tax laws, or made an error in or omission from a tax return:

Select one:

O a. You must notify the client of the consequences of the noncompliance, error, or omission.

O b. You must prepare an amended return correcting the noncompliance, error, or omission and file it with the

IRS on behalf of your client.

O c. You must refuse to prepare any future tax returns for that client.

O d. You must notify the IRS immediately of the noncompliance, error, or omission.

Oe. All of these

O f. None of these

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you