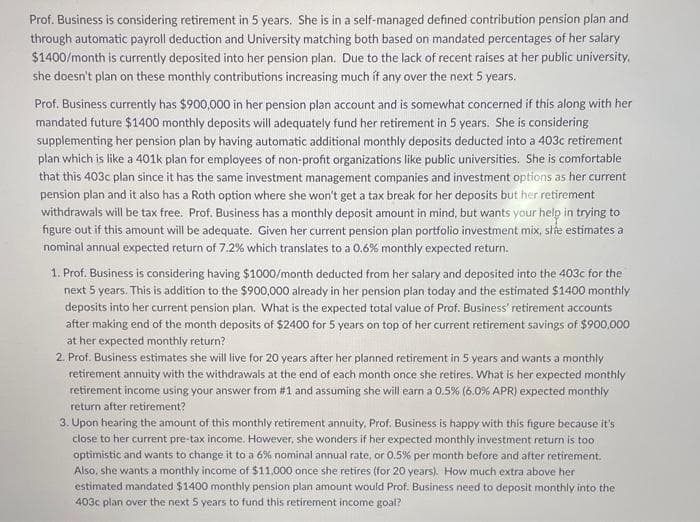

Prof. Business is considering retirement in 5 years. She is in a self-managed defined contribution pension plan and through automatic payroll deduction and University matching both based on mandated percentages of her salary $1400/month is currently deposited into her pension plan. Due to the lack of recent raises at her public university. she doesn't plan on these monthly contributions increasing much if any over the next 5 years. Prof. Business currently has $900,000 in her pension plan account and is somewhat concerned if this along with her mandated future $1400 monthly deposits will adequately fund her retirement in 5 years. She is considering supplementing her pension plan by having automatic additional monthly deposits deducted into a 403c retirement plan which is like a 401k plan for employees of non-profit organizations like public universities. She is comfortable that this 403c plan since it has the same investment management companies and investment options as her current pension plan and it also has a Roth option where she won't get a tax break for her deposits but her retirement withdrawals will be tax free. Prof. Business has a monthly deposit amount in mind, but wants your help in trying to figure out if this amount will be adequate. Given her current pension plan portfolio investment mix, slie estimates a nominal annual expected return of 7.2% which translates to a 0.6% monthly expected return. 1. Prof. Business is considering having $1000/month deducted from her salary and deposited into the 403c for the next 5 years. This is addition to the $900,000 already in her pension plan today and the estimated $1400 monthly deposits into her current pension plan. What is the expected total value of Prof. Business' retirement accounts after making end of the month deposits of $2400 for 5 years on top of her current retirement savings of $900,000 at her expected monthly return? 2. Prof. Business estimates she will live for 20 years after her planned retirement in 5 years and wants a monthly retirement annuity with the withdrawals at the end of each month once she retires. What is her expected monthly retirement income using your answer from #1 and assuming she will earn a 0.5% (6.0% APR) expected monthly return after retirement? 3. Upon hearing the amount of this monthly retirement annuity, Prof. Business is happy with this figure because it's close to her current pre-tax income. However, she wonders if her expected monthly investment return is too optimistic and wants to change it to a 6% nominal annual rate, or 0.5% per month before and after retirement. Also, she wants a monthly income of $11,000 once she retires (for 20 years). How much extra above her estimated mandated $1400 monthly pension plan amount would Prof. Business need to deposit monthly into the 403c plan over the next 5 years to fund this retirement income goal?

Prof. Business is considering retirement in 5 years. She is in a self-managed defined contribution pension plan and through automatic payroll deduction and University matching both based on mandated percentages of her salary $1400/month is currently deposited into her pension plan. Due to the lack of recent raises at her public university. she doesn't plan on these monthly contributions increasing much if any over the next 5 years. Prof. Business currently has $900,000 in her pension plan account and is somewhat concerned if this along with her mandated future $1400 monthly deposits will adequately fund her retirement in 5 years. She is considering supplementing her pension plan by having automatic additional monthly deposits deducted into a 403c retirement plan which is like a 401k plan for employees of non-profit organizations like public universities. She is comfortable that this 403c plan since it has the same investment management companies and investment options as her current pension plan and it also has a Roth option where she won't get a tax break for her deposits but her retirement withdrawals will be tax free. Prof. Business has a monthly deposit amount in mind, but wants your help in trying to figure out if this amount will be adequate. Given her current pension plan portfolio investment mix, slie estimates a nominal annual expected return of 7.2% which translates to a 0.6% monthly expected return. 1. Prof. Business is considering having $1000/month deducted from her salary and deposited into the 403c for the next 5 years. This is addition to the $900,000 already in her pension plan today and the estimated $1400 monthly deposits into her current pension plan. What is the expected total value of Prof. Business' retirement accounts after making end of the month deposits of $2400 for 5 years on top of her current retirement savings of $900,000 at her expected monthly return? 2. Prof. Business estimates she will live for 20 years after her planned retirement in 5 years and wants a monthly retirement annuity with the withdrawals at the end of each month once she retires. What is her expected monthly retirement income using your answer from #1 and assuming she will earn a 0.5% (6.0% APR) expected monthly return after retirement? 3. Upon hearing the amount of this monthly retirement annuity, Prof. Business is happy with this figure because it's close to her current pre-tax income. However, she wonders if her expected monthly investment return is too optimistic and wants to change it to a 6% nominal annual rate, or 0.5% per month before and after retirement. Also, she wants a monthly income of $11,000 once she retires (for 20 years). How much extra above her estimated mandated $1400 monthly pension plan amount would Prof. Business need to deposit monthly into the 403c plan over the next 5 years to fund this retirement income goal?

Chapter13: Capital, Interest, Entrepreneurship, And Corporate Finance

Section: Chapter Questions

Problem 4.8P

Related questions

Question

hi i need help with part 3 please

Transcribed Image Text:Prof. Business is considering retirement in 5 years. She is in a self-managed defined contribution pension plan and

through automatic payroll deduction and University matching both based on mandated percentages of her salary

$1400/month is currently deposited into her pension plan. Due to the lack of recent raises at her public university.

she doesn't plan on these monthly contributions increasing much if any over the next 5 years.

Prof. Business currently has $900,000 in her pension plan account and is somewhat concerned if this along with her

mandated future $1400 monthly deposits will adequately fund her retirement in 5 years. She is considering

supplementing her pension plan by having automatic additional monthly deposits deducted into a 403c retirement

plan which is like a 401k plan for employees of non-profit organizations like public universities. She is comfortable

that this 403c plan since it has the same investment management companies and investment options as her current

pension plan and it also has a Roth option where she won't get a tax break for her deposits but her retirement

withdrawals will be tax free. Prof. Business has a monthly deposit amount in mind, but wants your help in trying to

figure out if this amount will be adequate. Given her current pension plan portfolio investment mix, she estimates a

nominal annual expected return of 7.2% which translates to a 0.6% monthly expected return.

1. Prof. Business is considering having $1000/month deducted from her salary and deposited into the 403c for the

next 5 years. This is addition to the $900,000 already in her pension plan today and the estimated $1400 monthly

deposits into her current pension plan. What is the expected total value of Prof. Business' retirement accounts

after making end of the month deposits of $2400 for 5 years on top of her current retirement savings of $900,000

at her expected monthly return?

2. Prof. Business estimates she will live for 20 years after her planned retirement in 5 years and wants a monthly

retirement annuity with the withdrawals at the end of each month once she retires. What is her expected monthly

retirement income using your answer from #1 and assuming she will earn a 0.5% (6.0% APR) expected monthly

return after retirement?

3. Upon hearing the amount of this monthly retirement annuity, Prof. Business is happy with this figure because it's

close to her current pre-tax income. However, she wonders if her expected monthly investment return is too

optimistic and wants to change it to a 6% nominal annual rate, or 0.5% per month before and after retirement.

Also, she wants a monthly income of $11,000 once she retires (for 20 years). How much extra above her

estimated mandated $1400 monthly pension plan amount would Prof. Business need to deposit monthly into the

403c plan over the next 5 years to fund this retirement income goal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you