II. Consider an economy described by Fig. 6 on page 19 of the Ch.6 slides. a. Suppose the nominal policy interest rate is 5%. If expected inflation decreases from 3% to 2%, in order to keep the LM curve from shifting in Fig. 6, what must the central bank do to the nominal policy rate of interest? b. If the risk premium on risky bonds increases from 5% to 6%, does the LM curve shift? c. If the risk premium on risky bonds increases from 5% to 6%, does the IS curve shift? d. What are the fiscal policy options that prevent an increase in the risk premium on risky bonds from decreasing the level of output? e. What are the monetary policy options that prevent an increase in the risk premium on risky bonds from decreasing the level of output?

II. Consider an economy described by Fig. 6 on page 19 of the Ch.6 slides. a. Suppose the nominal policy interest rate is 5%. If expected inflation decreases from 3% to 2%, in order to keep the LM curve from shifting in Fig. 6, what must the central bank do to the nominal policy rate of interest? b. If the risk premium on risky bonds increases from 5% to 6%, does the LM curve shift? c. If the risk premium on risky bonds increases from 5% to 6%, does the IS curve shift? d. What are the fiscal policy options that prevent an increase in the risk premium on risky bonds from decreasing the level of output? e. What are the monetary policy options that prevent an increase in the risk premium on risky bonds from decreasing the level of output?

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter18: Six Debates Over Macroeconomic Policy

Section: Chapter Questions

Problem 1CQQ

Related questions

Question

d ,e

Transcribed Image Text:II. Consider an economy described by Fig. 6 on page 19 of the Ch.6 slides.

a. Suppose the nominal policy interest rate is 5%. If expected inflation decreases from 3%

to 2%, in order to keep the LM curve from shifting in Fig. 6, what must the central bank

do to the nominal policy rate of interest?

b. If the risk premium on risky bonds increases from 5% to 6%, does the LM curve shift?

c. If the risk premium on risky bonds increases from 5% to 6%, does the lIS curve shift?

d. What are the fiscal policy options that prevent an increase in the risk premium on risky

bonds from decreasing the level of output?

e. What are the monetary policy options that prevent an increase in the risk premium on

risky bonds from decreasing the level of output?

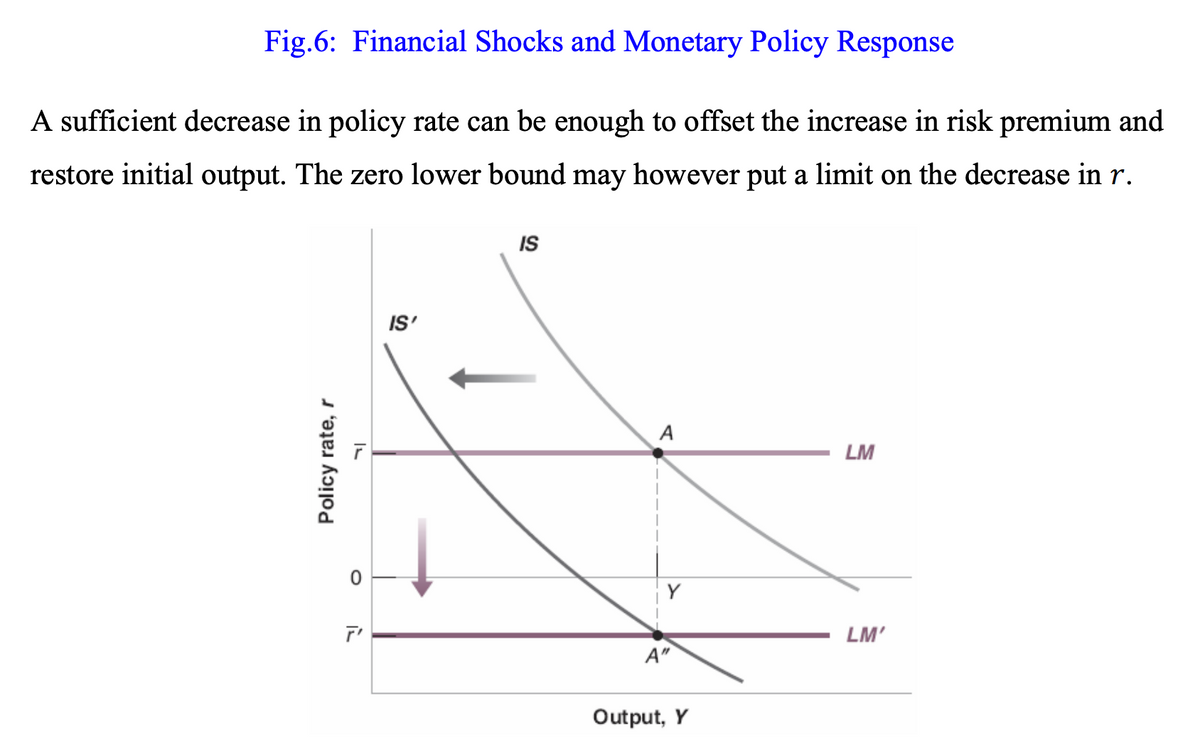

Transcribed Image Text:Fig.6: Financial Shocks and Monetary Policy Response

A sufficient decrease in policy rate can be enough to offset the increase in risk premium and

restore initial output. The zero lower bound may however put a limit on the decrease in r.

IS

IS'

A

LM

Y

LM'

A"

Output, Y

Policy rate, r

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning