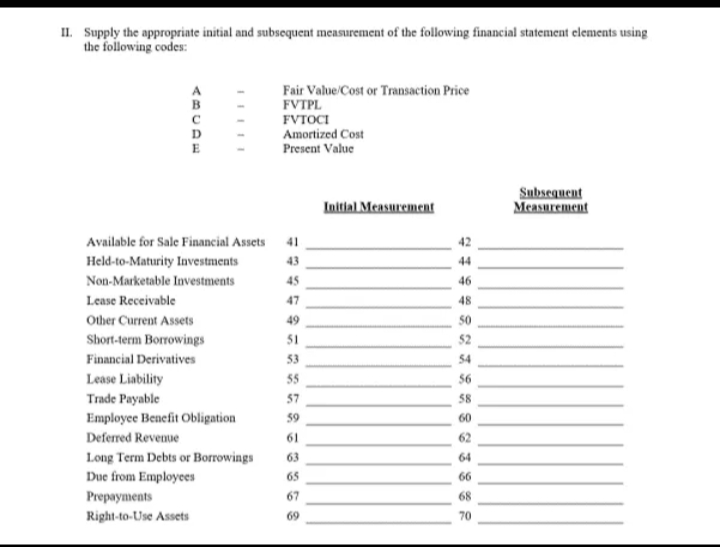

II. Supply the appropriate initial and subsequent measurement of the following financial statement elements using the following codes: Fair Value Cost or Transaction Price FVIPL FVTOCI Amortized Cost E Present Value Initial Measurement Sabsequent Measurement Available for Sale Financial Assets 41 42 Held-to-Maturity Investments 43 44 Non-Marketable Investments 45 46 Lease Receivable 47 48 Other Current Assets 49 50 Short-term Borrowings 51 52 Financial Derivatives 53 54 Lease Liability Trade Payable 55 56 57 58 Employee Benefit Obligation 59 60 Deferred Revenue 61 62 Long Term Debts or Borrowings Due from Employees Prepayments 63 64 65 66 67 68 Right-to-Use Assets 69 70

II. Supply the appropriate initial and subsequent measurement of the following financial statement elements using the following codes: Fair Value Cost or Transaction Price FVIPL FVTOCI Amortized Cost E Present Value Initial Measurement Sabsequent Measurement Available for Sale Financial Assets 41 42 Held-to-Maturity Investments 43 44 Non-Marketable Investments 45 46 Lease Receivable 47 48 Other Current Assets 49 50 Short-term Borrowings 51 52 Financial Derivatives 53 54 Lease Liability Trade Payable 55 56 57 58 Employee Benefit Obligation 59 60 Deferred Revenue 61 62 Long Term Debts or Borrowings Due from Employees Prepayments 63 64 65 66 67 68 Right-to-Use Assets 69 70

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 28GI

Related questions

Question

Answer only 47-50

Transcribed Image Text:II. Supply the appropriate initial and subsequent measurement of the following financial statement elements using

the following codes:

Fair Value Cost or Transaction Price

FVTPL

FVTOCI

Amortized Cost

Present Value

Initial Measurement

Subsequent

Measurement

Available for Sale Financial Assets 41

Held-to-Maturity Investments

43

44

Non-Marketable Investments

45

46

Lease Receivable

47

48

Other Current Assets

49

s0

Short-term Borrowings

51

52

Financial Derivatives

53

54

Lease Liability

Trade Payable

Employee Benefit Obligation

55

$6

57

58

59

60

Deferred Revenue

61

62

Long Term Debts or Borrowings

Due from Employees

63

64

65

66

Prepayments

Right-to-Use Assets

67

68

69

70

IIIII

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning