il 10: Declared semiannual dividends of $1.50 on 18,000 shares of preferred stock and s0.08 on the common stock to stockholders of record on May 10, payable on June 9. or. 10 e 9: Paid the cash dividends. ne 9 ober 10: Declared semiannual dividends of $1.50 on the preferred stock and $0.04 on the common stock (before the stock dividend). In addition, a 2% common stock dividend was declared on the common stock outstanding. The fair market value of the nmon stock is estimated at $36. t. 10 t. 10 cember 9: Paid the cash dividends and issued the certificates for the common stock dividend. c. 9 ec. 9 O 10 0 I II I

il 10: Declared semiannual dividends of $1.50 on 18,000 shares of preferred stock and s0.08 on the common stock to stockholders of record on May 10, payable on June 9. or. 10 e 9: Paid the cash dividends. ne 9 ober 10: Declared semiannual dividends of $1.50 on the preferred stock and $0.04 on the common stock (before the stock dividend). In addition, a 2% common stock dividend was declared on the common stock outstanding. The fair market value of the nmon stock is estimated at $36. t. 10 t. 10 cember 9: Paid the cash dividends and issued the certificates for the common stock dividend. c. 9 ec. 9 O 10 0 I II I

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 9SPA

Related questions

Question

Selected transactions completed by Breezeway Construction during the current fiscal year are as follows:

Required:

Journalize the transactions. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank or enter "0".

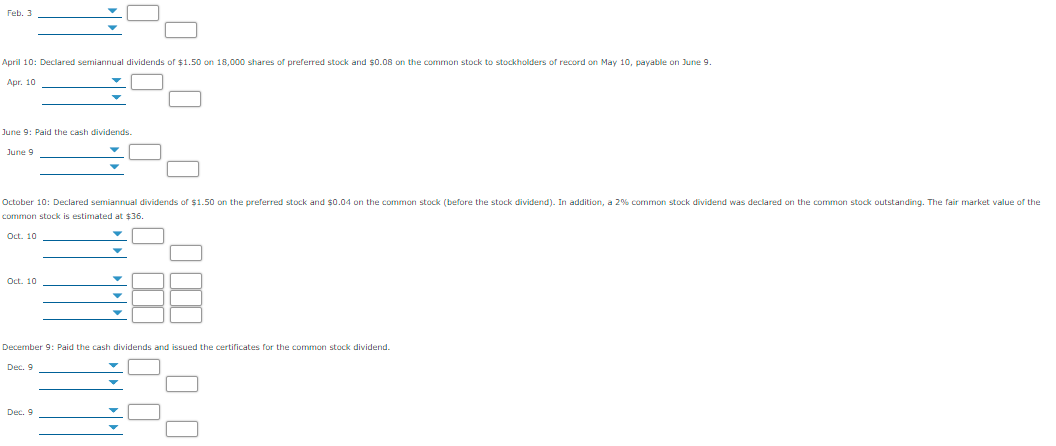

February 3: Split the common stock 2-for-1 and reduced the par from $40 to $20 per share. After the split, there were 250,000 common shares outstanding.

Transcribed Image Text:Feb. 3

April 10: Declared semiannual dividends of $1.50 on 18,000 shares of preferred stock and $0.08 on the common stock to stockholders of record on May 10, payable on June 9.

Apr. 10

June 9: Paid the cash dividends.

June 9

October 10: Declared semiannual dividends of $1.50 on the preferred stock and $0.04 on the common stock (before the stock dividend). In addition, a 2% common stock dividend was declared on the common stock outstanding. The fair market value of the

common stock is estimated at $36.

Oct. 10

Oct. 10

December 9: Paid the cash dividends and issued the certificates for the common stock dividend.

Dec. 9

Dec. 9

W 10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning