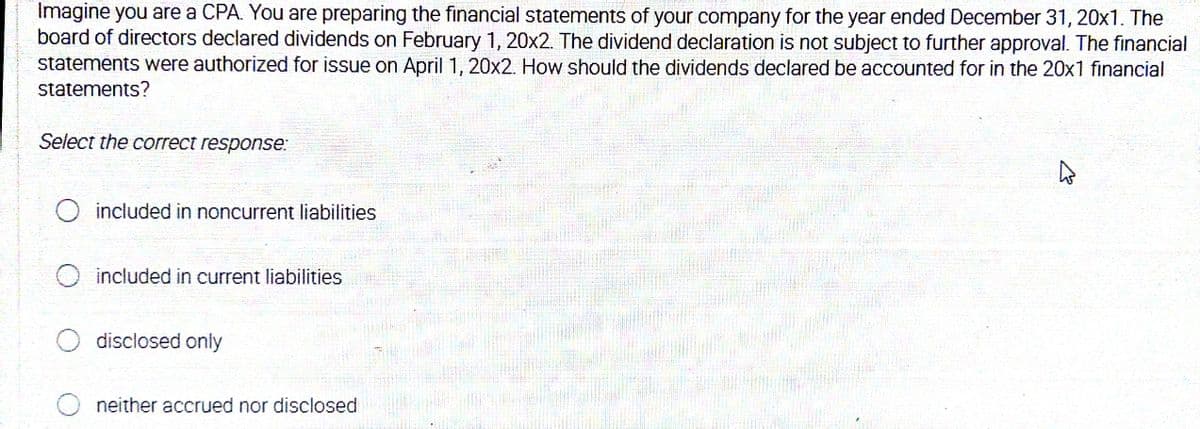

Imagine you are a CPA. You are preparing the financial statements of your company for the year ended December 31, 20x1. The board of directors declared dividends on February 1, 20x2. The dividend declaration is not subject to further approval. The financial statements were authorized for issue on April 1, 20x2. How should the dividends declared be accounted for in the 20x1 financial statements? Select the correct response: included in noncurrent liabilities O included in current liabilities disclosed only neither accrued nor disclosed

Imagine you are a CPA. You are preparing the financial statements of your company for the year ended December 31, 20x1. The board of directors declared dividends on February 1, 20x2. The dividend declaration is not subject to further approval. The financial statements were authorized for issue on April 1, 20x2. How should the dividends declared be accounted for in the 20x1 financial statements? Select the correct response: included in noncurrent liabilities O included in current liabilities disclosed only neither accrued nor disclosed

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter13: Corporations: Earning & Profits And Distributions

Section: Chapter Questions

Problem 3BD

Related questions

Question

Transcribed Image Text:Imagine you are a CPA. You are preparing the financial statements of your company for the year ended December 31, 20x1. The

board of directors declared dividends on February 1, 20x2. The dividend declaration is not subject to further approval. The financial

statements were authorized for issue on April 1, 20x2. How should the dividends declared be accounted for in the 20x1 financial

statements?

Select the correct response:

included in noncurrent liabilities

included in current liabilities

disclosed only

neither accrued nor disclosed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,