Refer to additional information (b) only Prepare the following general ledger accounts for the year ended 31 July 2022: •Bank •Application and allotment •Share Capital- Class A •Non Current Liability- Class C 2. Refer to additional information (c) Calculate the number of Class B shares in issue at the beginning of the financial year. 3. Refer to additional information (d) Prepare the dividends and shareholders for dividends accounts as it would appear in the general ledger for the year ended 31 July 2022

Refer to additional information (b) only Prepare the following general ledger accounts for the year ended 31 July 2022: •Bank •Application and allotment •Share Capital- Class A •Non Current Liability- Class C 2. Refer to additional information (c) Calculate the number of Class B shares in issue at the beginning of the financial year. 3. Refer to additional information (d) Prepare the dividends and shareholders for dividends accounts as it would appear in the general ledger for the year ended 31 July 2022

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 5E: Multiple-Step and Single-Step In coin Statements The following items were derived from Gold...

Related questions

Question

1. Refer to additional information (b) only Prepare the following general ledger accounts for the year ended 31 July 2022: •Bank

•Application and allotment

•Share Capital- Class A

•Non Current Liability- Class C

2. Refer to additional information (c) Calculate the number of Class B shares in issue at the beginning of the financial year.

3. Refer to additional information (d) Prepare the dividends and shareholders for dividends accounts as it would appear in the general ledger for the year ended 31 July 2022

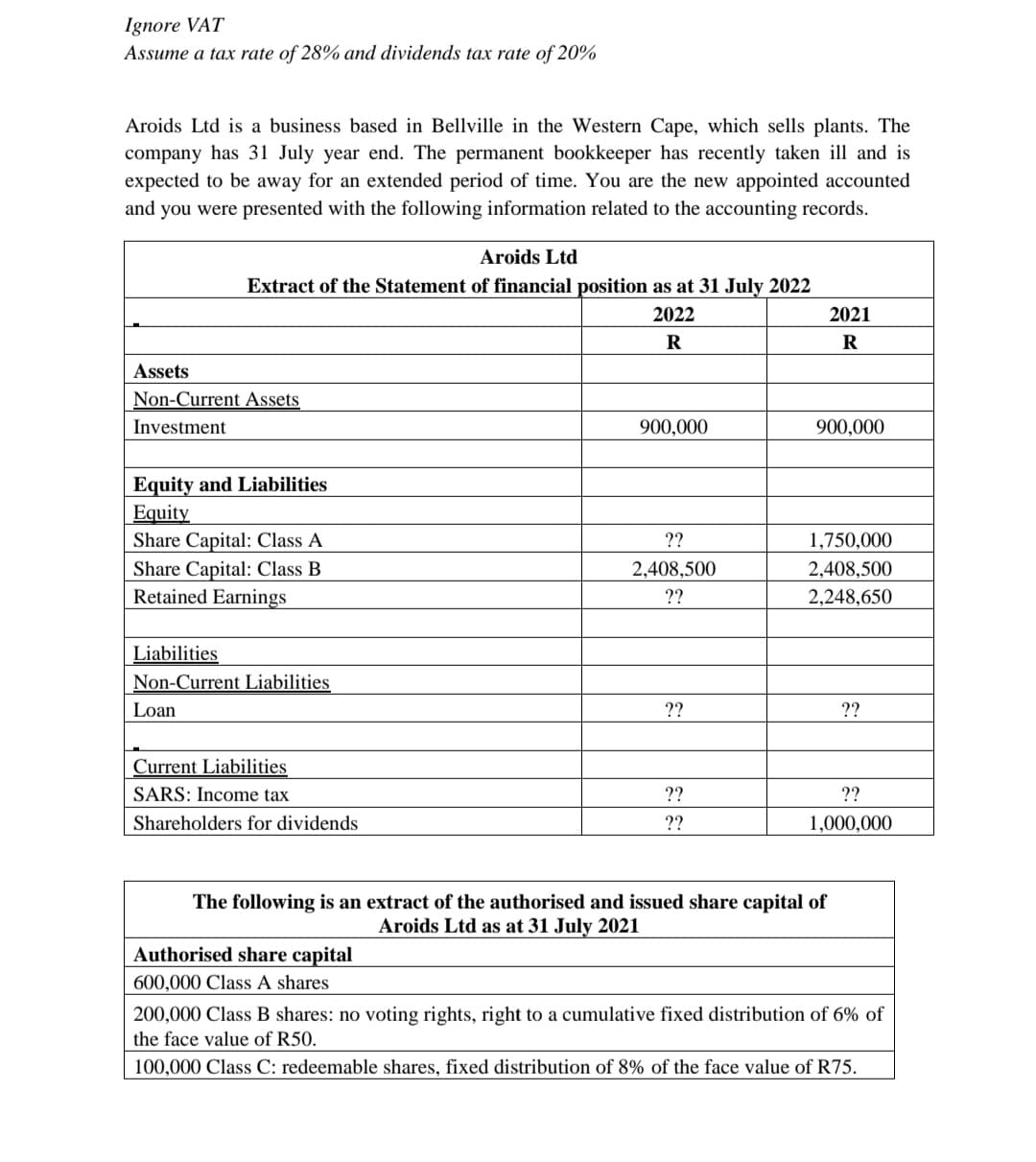

Transcribed Image Text:Ignore VAT

Assume a tax rate of 28% and dividends tax rate of 20%

Aroids Ltd is a business based in Bellville in the Western Cape, which sells plants. The

company has 31 July year end. The permanent bookkeeper has recently taken ill and is

expected to be away for an extended period of time. You are the new appointed accounted

and you were presented with the following information related to the accounting records.

Aroids Ltd

Extract of the Statement of financial position as at 31 July 2022

2022

R

Assets

Non-Current Assets

Investment

Equity and Liabilities

Equity

Share Capital: Class A

Share Capital: Class B

Retained Earnings

Liabilities.

Non-Current Liabilities

Loan

Current Liabilities

SARS: Income tax

Shareholders for dividends

900,000

Authorised share capital

600,000 Class A shares

??

2,408,500

??

??

??

??

2021

R

900,000

1,750,000

2,408,500

2,248,650

The following is an extract the authorised and issued share capital of

Aroids Ltd as at 31 July 2021

??

??

1,000,000

200,000 Class B shares: no voting rights, right to a cumulative fixed distribution of 6% of

the face value of R50.

100,000 Class C: redeemable shares, fixed distribution of 8% of the face value of R75.

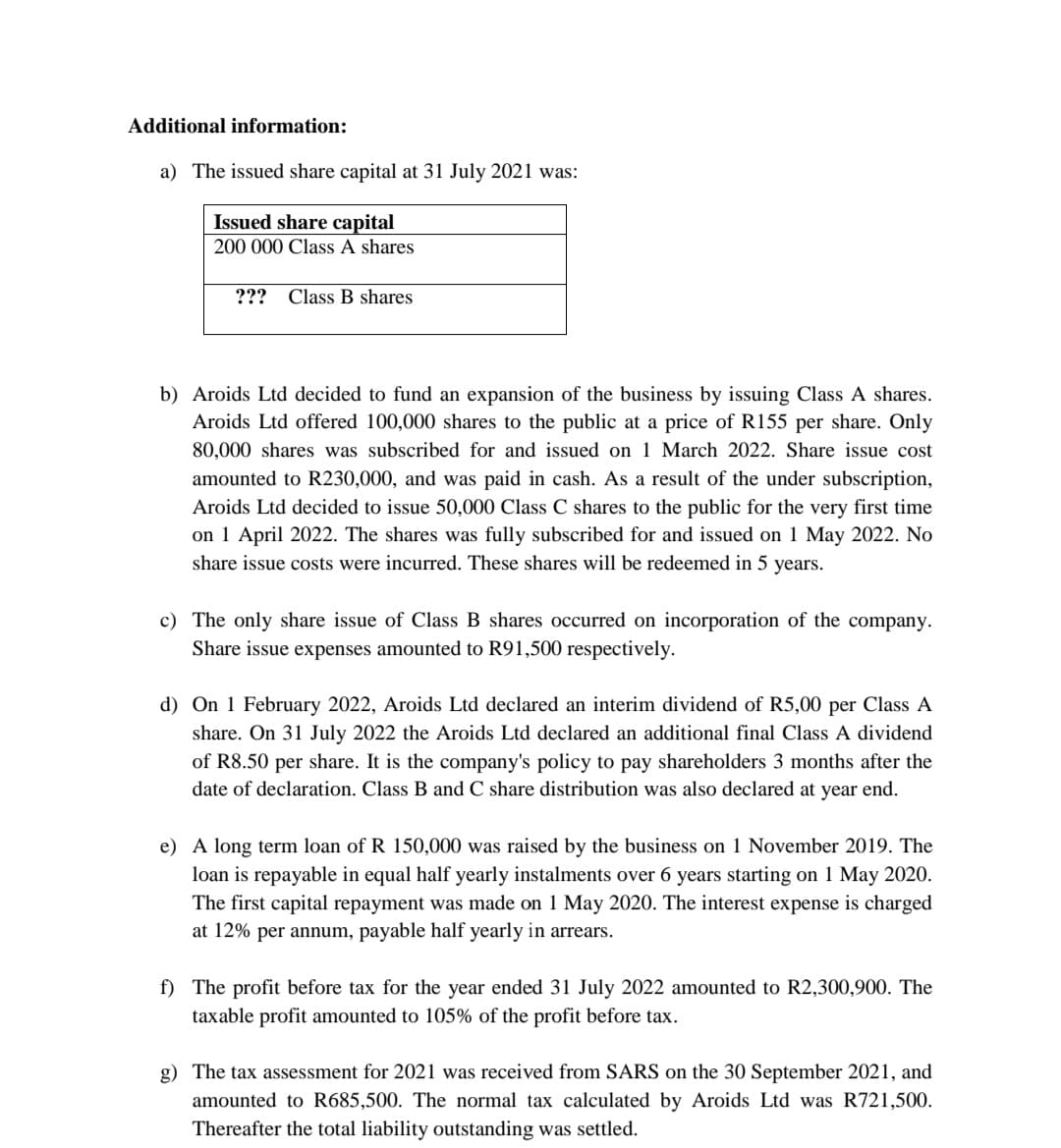

Transcribed Image Text:Additional information:

a) The issued share capital at 31 July 2021 was:

Issued share capital

200 000 Class A shares

??? Class B shares

b) Aroids Ltd decided to fund an expansion of the business by issuing Class A shares.

Aroids Ltd offered 100,000 shares to the public at a price of R155 per share. Only

80,000 shares was subscribed for and issued on 1 March 2022. Share issue cost

amounted to R230,000, and was paid in cash. As a result of the under subscription,

Aroids Ltd decided to issue 50,000 Class C shares to the public for the very first time

on 1 April 2022. The shares was fully subscribed for and issued on 1 May 2022. No

share issue costs were incurred. These shares will be redeemed in 5 years.

c) The only share issue of Class B shares occurred on incorporation of the company.

Share issue expenses amounted to R91,500 respectively.

d) On 1 February 2022, Aroids Ltd declared an interim dividend of R5,00 per Class A

share. On 31 July 2022 the Aroids Ltd declared an additional final Class A dividend

of R8.50 per share. It is the company's policy to pay shareholders 3 months after the

date of declaration. Class B and C share distribution was also declared at year end.

e) A long term loan of R 150,000 was raised by the business on 1 November 2019. The

loan is repayable in equal half yearly instalments over 6 years starting on 1 May 2020.

The first capital repayment was made on 1 May 2020. The interest expense is charged

at 12% per annum, payable half yearly in arrears.

f) The profit before tax for the year ended 31 July 2022 amounted to R2,300,900. The

taxable profit amounted to 105% of the profit before tax.

g) The tax assessment for 2021 was received from SARS on the 30 September 2021, and

amounted to R685,500. The normal tax calculated by Aroids Ltd was R721,500.

Thereafter the total liability outstanding was settled.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning