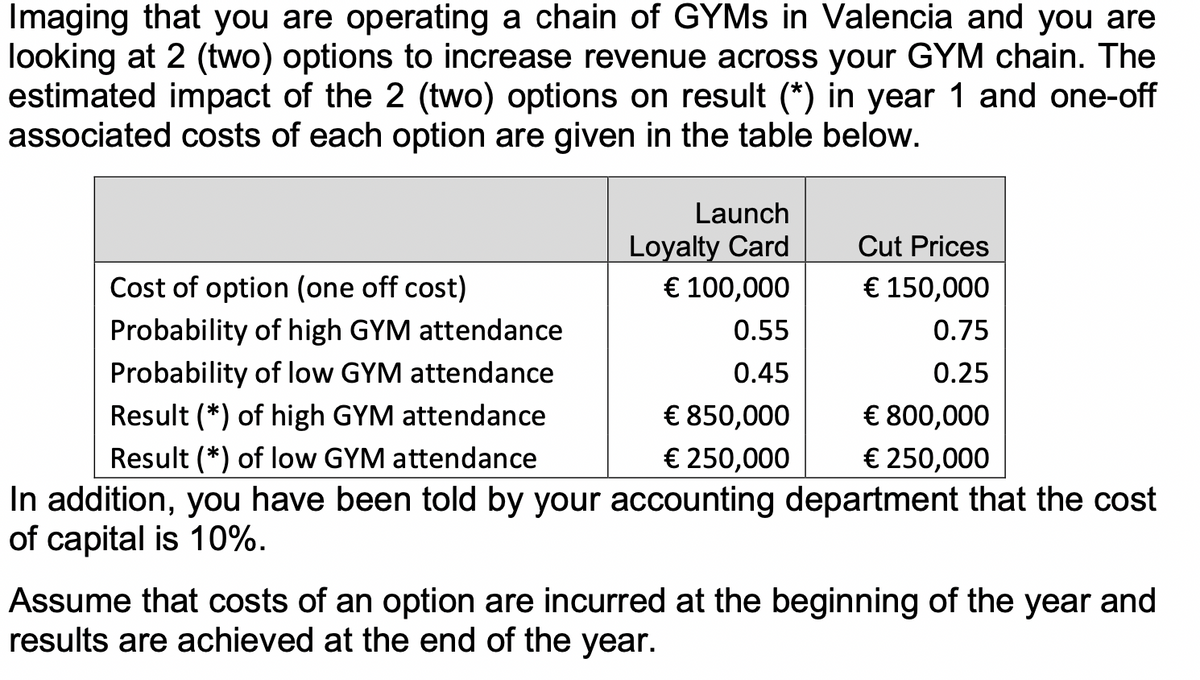

Imaging that you are operating a chain of GYMS in Valencia and you are looking at 2 (two) options to increase revenue across your GYM chain. The estimated impact of the 2 (two) options on result (*) in year 1 and one-off associated costs of each option are given in the table below. Launch Loyalty Card € 100,000 Cut Prices € 150,000 Cost of option (one off cost) Probability of high GYM attendance 0.55 0.75 Probability of low GYM attendance Result (*) of high GYM attendance 0.45 0.25 € 850,000 € 250,000 € 800,000 Result (*) of low GYM attendance € 250,000 In addition, you have been told by your accounting department that the cost

Imaging that you are operating a chain of GYMS in Valencia and you are looking at 2 (two) options to increase revenue across your GYM chain. The estimated impact of the 2 (two) options on result (*) in year 1 and one-off associated costs of each option are given in the table below. Launch Loyalty Card € 100,000 Cut Prices € 150,000 Cost of option (one off cost) Probability of high GYM attendance 0.55 0.75 Probability of low GYM attendance Result (*) of high GYM attendance 0.45 0.25 € 850,000 € 250,000 € 800,000 Result (*) of low GYM attendance € 250,000 In addition, you have been told by your accounting department that the cost

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 3TP: Brindis Babysitting Center currently rents a 1200 sq foot facility for her 20-child facility. Her...

Related questions

Question

Based on the information provided above which option should you take if any? Explain.

Note:

(*) Result = sales - costs. These costs do not include the cost of an option. (**) You can ́t launch loyalty card and cut prices at the same time.

Transcribed Image Text:Imaging that you are operating a chain of GYMS in Valencia and you are

looking at 2 (two) options to increase revenue across your GYM chain. The

estimated impact of the 2 (two) options on result (*) in year 1 and one-off

associated costs of each option are given in the table below.

Launch

Loyalty Card

€ 100,000

Cut Prices

€ 150,000

Cost of option (one off cost)

Probability of high GYM attendance

Probability of low GYM attendance

Result (*) of high GYM attendance

0.55

0.75

0.45

0.25

€ 850,000

€ 800,000

€ 250,000

Result (*) of low GYM attendance

€ 250,000

In addition, you have been told by your accounting department that the cost

of capital is 10%.

Assume that costs of an option are incurred at the beginning of the year and

results are achieved at the end of the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning