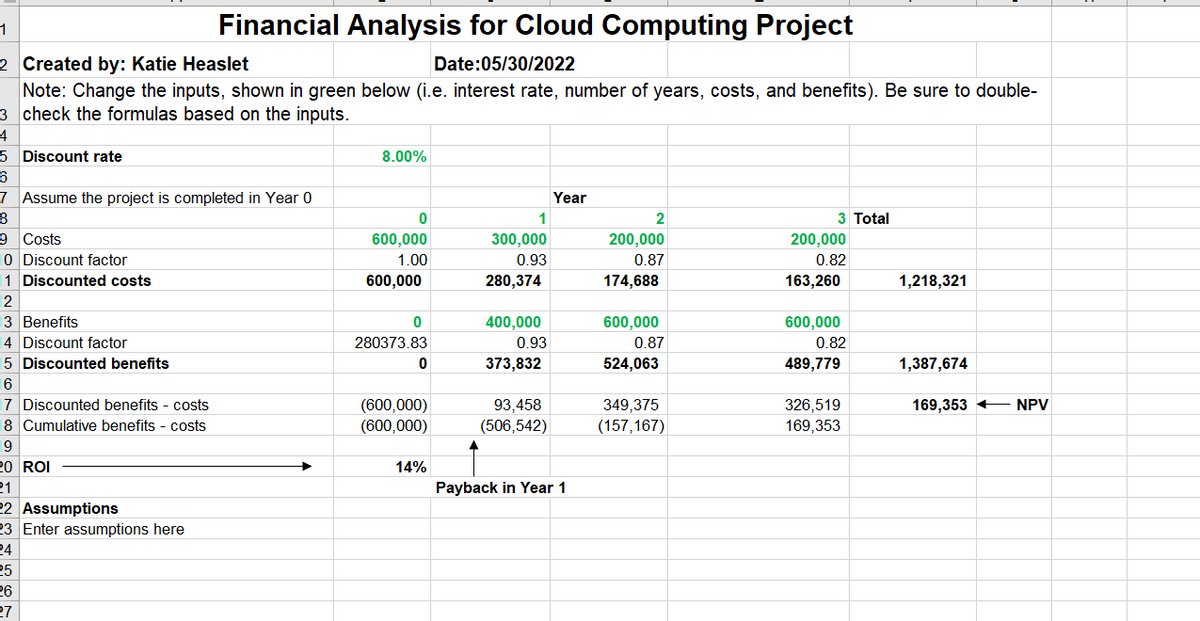

Prepare the financial section of a business case for the Cloud-Computing Case that is listed above this assignment in Canvas. Assume that this project will take eight months to complete (in Year 0) and will cost $600,000. The costs to implement some of the technologies will be $300,000 for year one and $200,000 for years two and three. Estimated benefits will start in year 1 at $400,000 and will be $600,000 for years 2 and 3. There is no benefit in year 0. Use the business case spreadsheet template (business_case_financials.xls) template provided below this assignment in Canvas to calculate the NPV, ROI, and the year in which payback occurs. Assume a 7 percent discount rate for the template. notes* Payback occurs in the first year that there is a positive value for cumulative benefits - costs. (*Negative values are presented in parenthesis) What I have so far is attached I need to make it so Pay back occurs in year 3 where there is positive cumulative benefits - costs.

Prepare the financial section of a business case for the Cloud-Computing Case that is listed above this assignment in Canvas. Assume that this project will take eight months to complete (in Year 0) and will cost $600,000. The costs to implement some of the technologies will be $300,000 for year one and $200,000 for years two and three. Estimated benefits will start in year 1 at $400,000 and will be $600,000 for years 2 and 3. There is no benefit in year 0. Use the business case spreadsheet template (business_case_financials.xls) template provided below this assignment in Canvas to calculate the

What I have so far is attached

I need to make it so Pay back occurs in year 3 where there is positive cumulative benefits - costs.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images