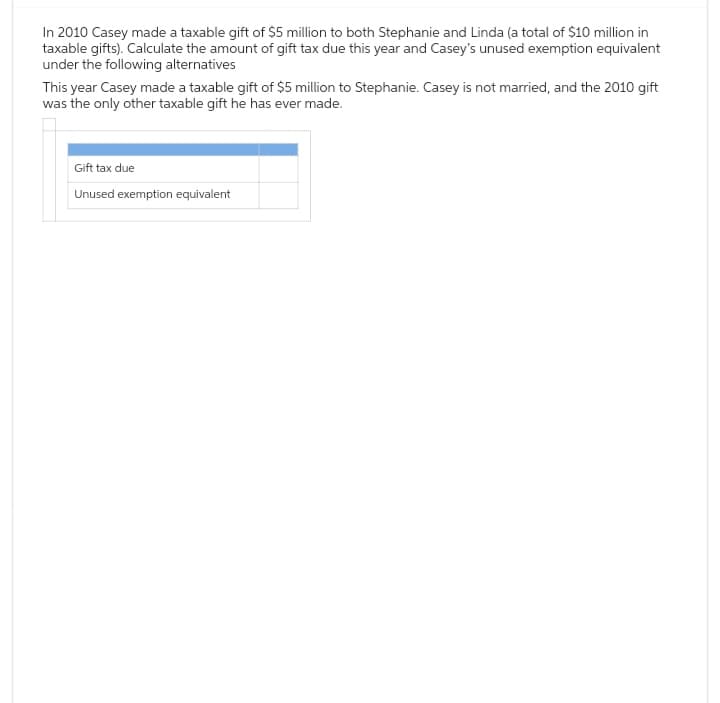

In 2010 Casey made a taxable gift of $5 million to both Stephanie and Linda (a total of $10 million in taxable gifts). Calculate the amount of gift tax due this year and Casey's unused exemption equivalent under the following alternatives This year Casey made a taxable gift of $5 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. Gift tax due Unused exemption equivalent

In 2010 Casey made a taxable gift of $5 million to both Stephanie and Linda (a total of $10 million in taxable gifts). Calculate the amount of gift tax due this year and Casey's unused exemption equivalent under the following alternatives This year Casey made a taxable gift of $5 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. Gift tax due Unused exemption equivalent

Chapter19: Family Tax Planning

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Sh13

Please help me.

Solution.

Transcribed Image Text:In 2010 Casey made a taxable gift of $5 million to both Stephanie and Linda (a total of $10 million in

taxable gifts). Calculate the amount of gift tax due this year and Casey's unused exemption equivalent

under the following alternatives

This year Casey made a taxable gift of $5 million to Stephanie. Casey is not married, and the 2010 gift

was the only other taxable gift he has ever made.

Gift tax due

Unused exemption equivalent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning