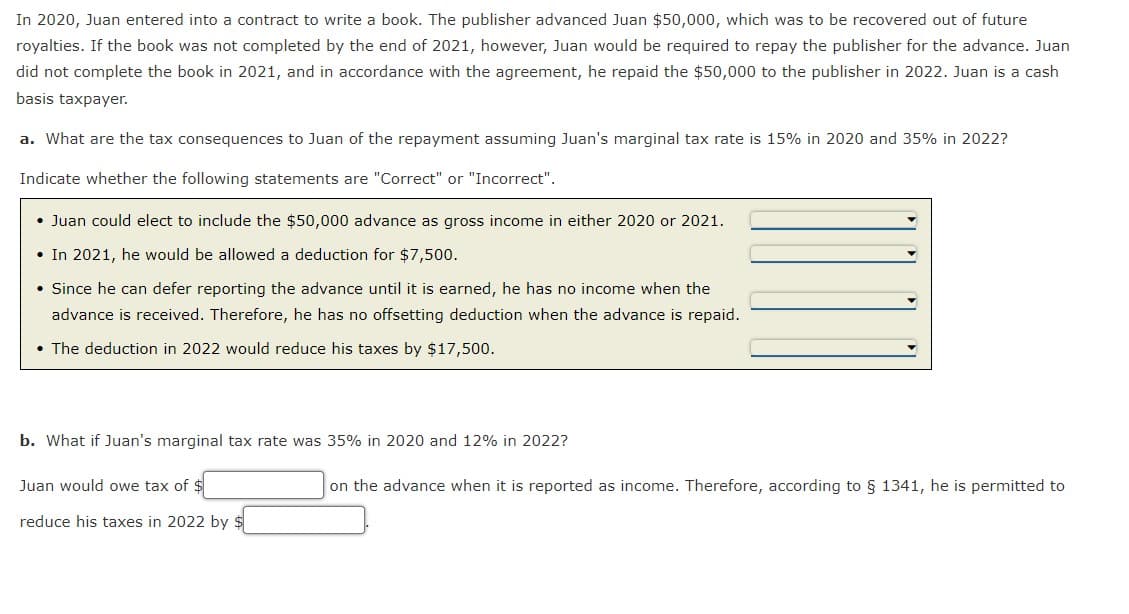

In 2020, Juan entered into a contract to write a book. The publisher advanced Juan $50,000, which was to be recovered out of future royalties. If the book was not completed by the end of 2021, however, Juan would be required to repay the publisher for the advance. Juan did not complete the book in 2021, and in accordance with the agreement, he repaid the $50,000 to the publisher in 2022. Juan is a cash basis taxpayer. a. What are the tax consequences to Juan of the repayment assuming Juan's marginal tax rate is 15% in 2020 and 35% in 2022? Indicate whether the following statements are "Correct" or "Incorrect". • Juan could elect to include the $50,000 advance as gross income in either 2020 or 2021. • In 2021, he would be allowed a deduction for $7,500. • Since he can defer reporting the advance until it is earned, he has no income when the advance is received. Therefore, he has no offsetting deduction when the advance is repaid. • The deduction in 2022 would reduce his taxes by $17,500. b. What if Juan's marginal tax rate was 35% in 2020 and 12% in 2022? Juan would owe tax of $ on the advance when it is reported as income. Therefore, according to § 1341, he is permitted to reduce his taxes in 2022 by $

In 2020, Juan entered into a contract to write a book. The publisher advanced Juan $50,000, which was to be recovered out of future royalties. If the book was not completed by the end of 2021, however, Juan would be required to repay the publisher for the advance. Juan did not complete the book in 2021, and in accordance with the agreement, he repaid the $50,000 to the publisher in 2022. Juan is a cash basis taxpayer. a. What are the tax consequences to Juan of the repayment assuming Juan's marginal tax rate is 15% in 2020 and 35% in 2022? Indicate whether the following statements are "Correct" or "Incorrect". • Juan could elect to include the $50,000 advance as gross income in either 2020 or 2021. • In 2021, he would be allowed a deduction for $7,500. • Since he can defer reporting the advance until it is earned, he has no income when the advance is received. Therefore, he has no offsetting deduction when the advance is repaid. • The deduction in 2022 would reduce his taxes by $17,500. b. What if Juan's marginal tax rate was 35% in 2020 and 12% in 2022? Juan would owe tax of $ on the advance when it is reported as income. Therefore, according to § 1341, he is permitted to reduce his taxes in 2022 by $

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:In 2020, Juan entered into a contract to write a book. The publisher advanced Juan $50,000, which was to be recovered out of future

royalties. If the book was not completed by the end of 2021, however, Juan would be required to repay the publisher for the advance. Juan

did not complete the book in 2021, and in accordance with the agreement, he repaid the $50,000 to the publisher in 2022. Juan is a cash

basis taxpayer.

a. What are the tax consequences to Juan of the repayment assuming Juan's marginal tax rate is 15% in 2020 and 35% in 2022?

Indicate whether the following statements are "Correct" or "Incorrect".

• Juan could elect to include the $50,000 advance as gross income in either 2020 or 2021.

• In 2021, he would be allowed a deduction for $7,500.

Since he can defer reporting the advance until it is earned, he has no income when the

advance is received. Therefore, he has no offsetting deduction when the advance is repaid.

• The deduction in 2022 would reduce his taxes by $17,500.

b. What if Juan's marginal tax rate was 35% in 2020 and 12% in 2022?

Juan would owe tax of $

on the advance when it is reported as income. Therefore, according to § 1341, he is permitted to

reduce his taxes in 2022 by $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT