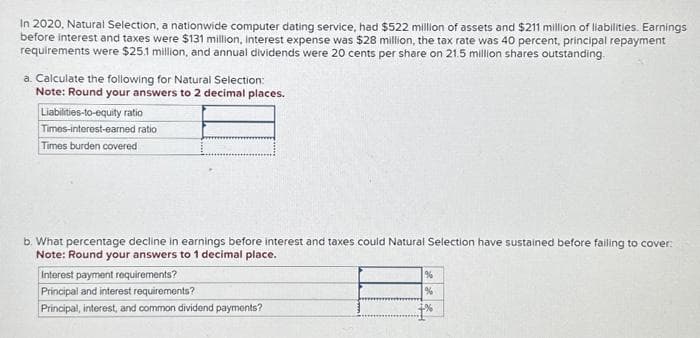

In 2020, Natural Selection, a nationwide computer dating service, had $522 million of assets and $211 million of liabilities. Earnings before interest and taxes were $131 million, Interest expense was $28 million, the tax rate was 40 percent, principal repayment requirements were $25.1 million, and annual dividends were 20 cents per share on 21.5 million shares outstanding. a. Calculate the following for Natural Selection: Note: Round your answers to 2 decimal places. Liabilities-to-equity ratio Times-interest-earned ratio Times burden covered b. What percentage decline in earnings before interest and taxes could Natural Selection have sustained before failing to cover: Note: Round your answers to 1 decimal place. Interest payment requirements? Principal and interest requirements? Principal, interest, and common dividend payments? ***** % %

In 2020, Natural Selection, a nationwide computer dating service, had $522 million of assets and $211 million of liabilities. Earnings before interest and taxes were $131 million, Interest expense was $28 million, the tax rate was 40 percent, principal repayment requirements were $25.1 million, and annual dividends were 20 cents per share on 21.5 million shares outstanding. a. Calculate the following for Natural Selection: Note: Round your answers to 2 decimal places. Liabilities-to-equity ratio Times-interest-earned ratio Times burden covered b. What percentage decline in earnings before interest and taxes could Natural Selection have sustained before failing to cover: Note: Round your answers to 1 decimal place. Interest payment requirements? Principal and interest requirements? Principal, interest, and common dividend payments? ***** % %

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 7P

Related questions

Question

ra

subject-Accounting

Transcribed Image Text:In 2020, Natural Selection, a nationwide computer dating service, had $522 million of assets and $211 million of liabilities. Earnings

before interest and taxes were $131 million, interest expense was $28 million, the tax rate was 40 percent, principal repayment

requirements were $25.1 million, and annual dividends were 20 cents per share on 21.5 million shares outstanding.

a. Calculate the following for Natural Selection:

Note: Round your answers to 2 decimal places.

Liabilities-to-equity ratio

Times-interest-earned ratio

Times burden covered

b. What percentage decline in earnings before interest and taxes could Natural Selection have sustained before failing to cover:

Note: Round your answers to 1 decimal place.

Interest payment requirements?

Principal and interest requirements?

Principal, interest, and common dividend payments?

%

%

+%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT