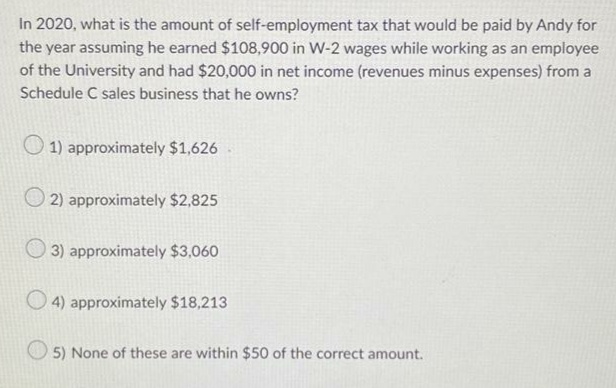

In 2020, what is the amount of self-employment tax that would be paid by Andy for the year assuming he earned $108,900 in W-2 wages while working as an employee of the University and had $20,000 in net income (revenues minus expenses) from a Schedule C sales business that he owns? 1) approximately $1,626 2) approximately $2,825 3) approximately $3,060 4) approximately $18,213

In 2020, what is the amount of self-employment tax that would be paid by Andy for the year assuming he earned $108,900 in W-2 wages while working as an employee of the University and had $20,000 in net income (revenues minus expenses) from a Schedule C sales business that he owns? 1) approximately $1,626 2) approximately $2,825 3) approximately $3,060 4) approximately $18,213

Chapter9: Deduct Ions: Employee And Self-employed - Related Expenses

Section: Chapter Questions

Problem 38P

Related questions

Question

Transcribed Image Text:In 2020, what is the amount of self-employment tax that would be paid by Andy for

the year assuming he earned $108,900 in W-2 wages while working as an employee

of the University and had $20,000 in net income (revenues minus expenses) from a

Schedule C sales business that he owns?

1) approximately $1,626

2) approximately $2,825

3) approximately $3,060

4) approximately $18,213

5) None of these are within $50 of the correct amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you