In 2021, Henri, a U.S. citizen and calendar year taxpayer, reports $24,600 of income from France, which imposes a 10% income tax, and $44,400 from Italy, which imposes a 40 % tax. In addition, Henri reports taxable income of $92,000 from within the United States. Henri is married filling a joint return, and his U.S. tax before the foreign tax credit is $27,370. Do not round your intermediate computations. Round your final answer to the nearest dollar. Determine the amount of Henri's foreign tax credit.

In 2021, Henri, a U.S. citizen and calendar year taxpayer, reports $24,600 of income from France, which imposes a 10% income tax, and $44,400 from Italy, which imposes a 40 % tax. In addition, Henri reports taxable income of $92,000 from within the United States. Henri is married filling a joint return, and his U.S. tax before the foreign tax credit is $27,370. Do not round your intermediate computations. Round your final answer to the nearest dollar. Determine the amount of Henri's foreign tax credit.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 23P

Related questions

Question

26

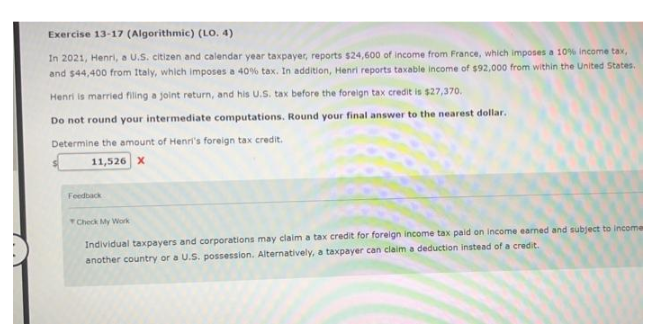

Transcribed Image Text:Exercise 13-17 (Algorithmic) (LO. 4)

In 2021, Henri, a U.S. citizen and calendar year taxpayer, reports $24,600 of income from France, which imposes a 10% income tax,

and $44,400 from Italy, which imposes a 40 % tax. In addition, Henri reports taxable income of $92,000 from within the United States.

Henri is married filing a joint return, and his U.S. tax before the foreign tax credit is $27,370.

Do not round your intermediate computations. Round your final answer to the nearest dollar.

Determine the amount of Henri's foreign tax credit.

11,526 X

Feedback

Check My Work

earned and subject to Income

Individual taxpayers and corporations may claim a tax credit for foreign income tax paid on incom

another country or a U.S. possession. Alternatively, a taxpayer can claim a deduction instead of a credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT