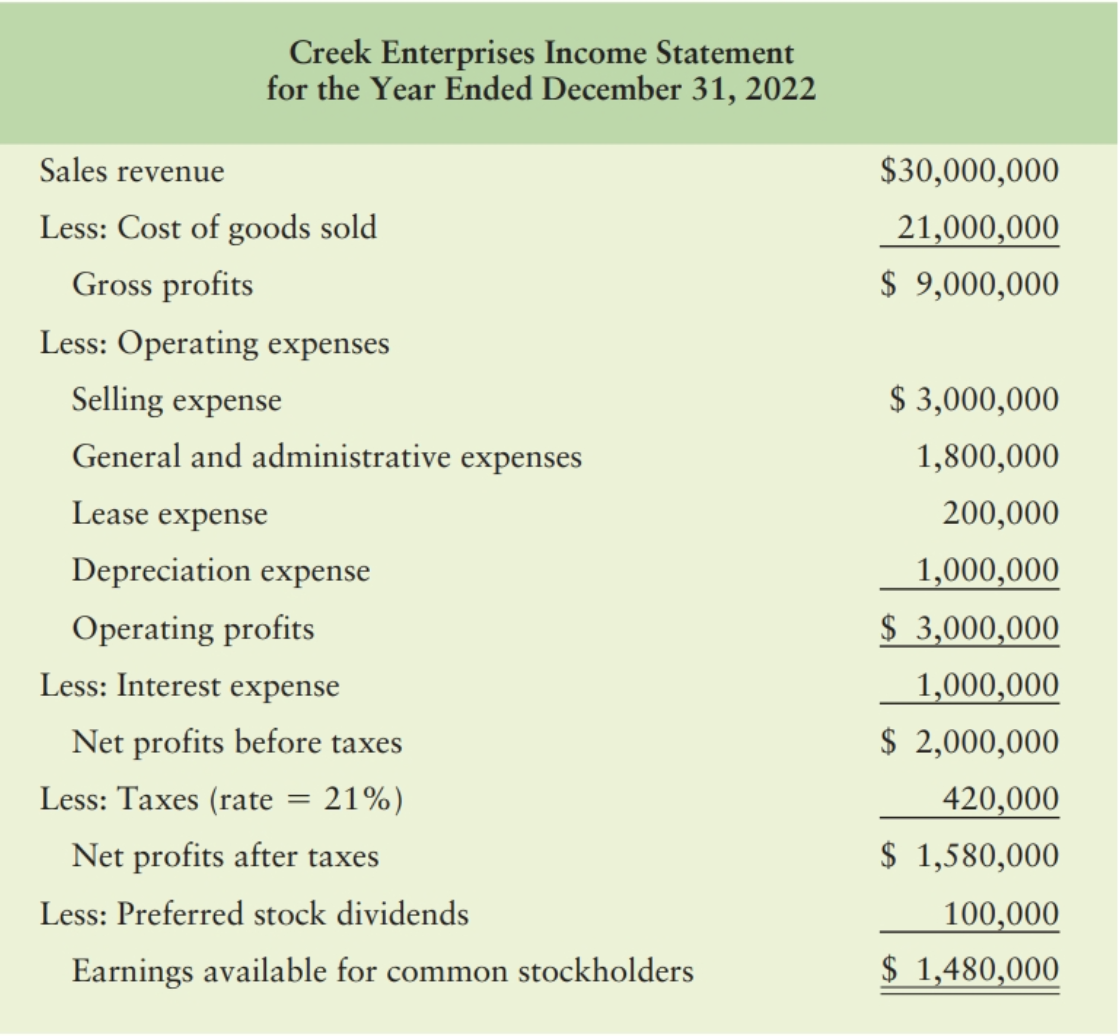

Creek Enterprises Income Statement for the Year Ended December 31, 2022 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Lease expense Depreciation expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 21%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders $30,000,000 21,000,000 $ 9,000,000 $3,000,000 1,800,000 200,000 1,000,000 $3,000,000 1,000,000 $ 2,000,000 420,000 $ 1,580,000 100,000 $1,480,000

Financial Ratios

A Ratio refers to a figure calculated as a reference to the relationship of two or more numbers and can be expressed as a fraction, proportion, percentage, or the number of times. When the number is determined by taking two accounting numbers derived from the financial statements, it is termed as the accounting ratio.

Return on Equity

The Return on Equity (RoE) is a measure of the profitability of a business concerning the funds by its stockholders/shareholders. ROE is a metric used generally to determine how well the company utilizes its funds provided by the equity shareholders.

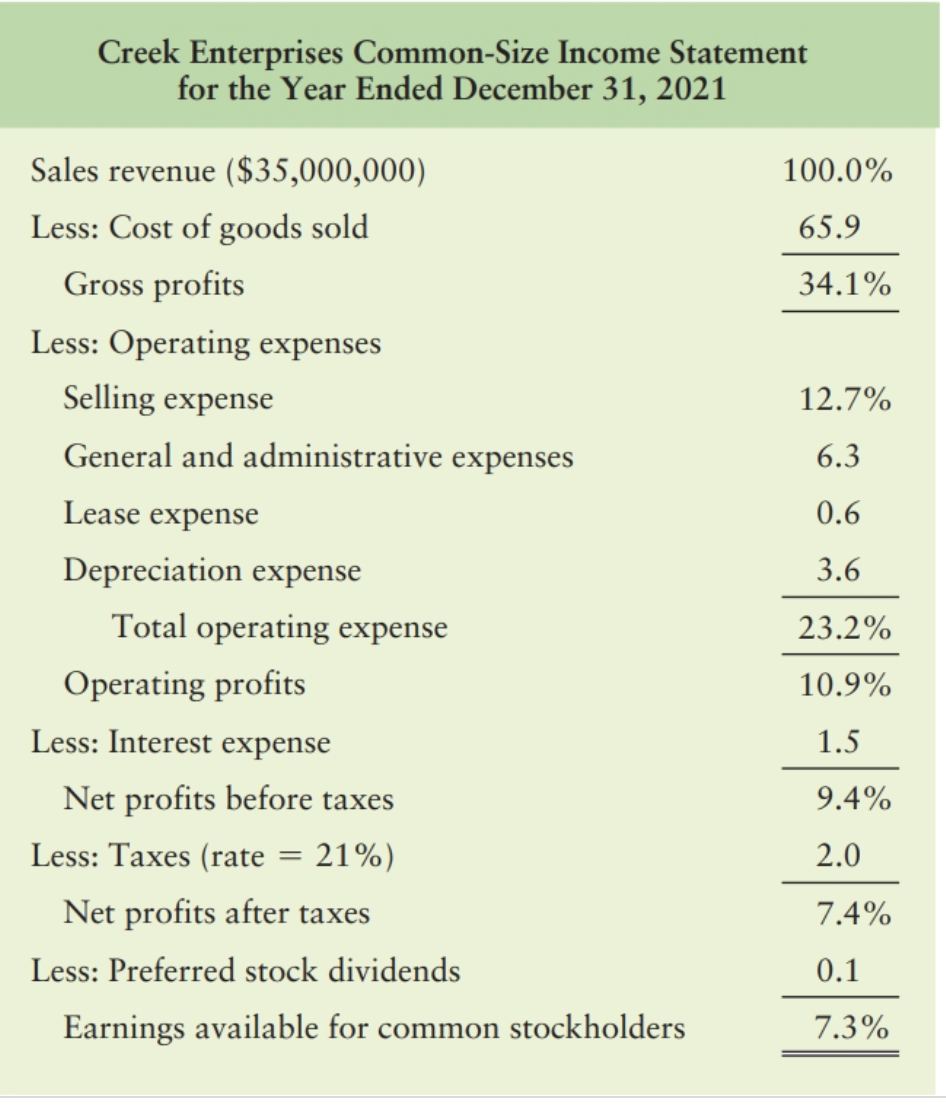

Common-size statement analysis A common-size income statement for Creek Enterprises’ 2021 operations follows. Using the firm’s 2022 income statement, develop the 2022 common-size income statement and compare it with the 2021 common-size statement. Which areas require further analysis and investigation?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps