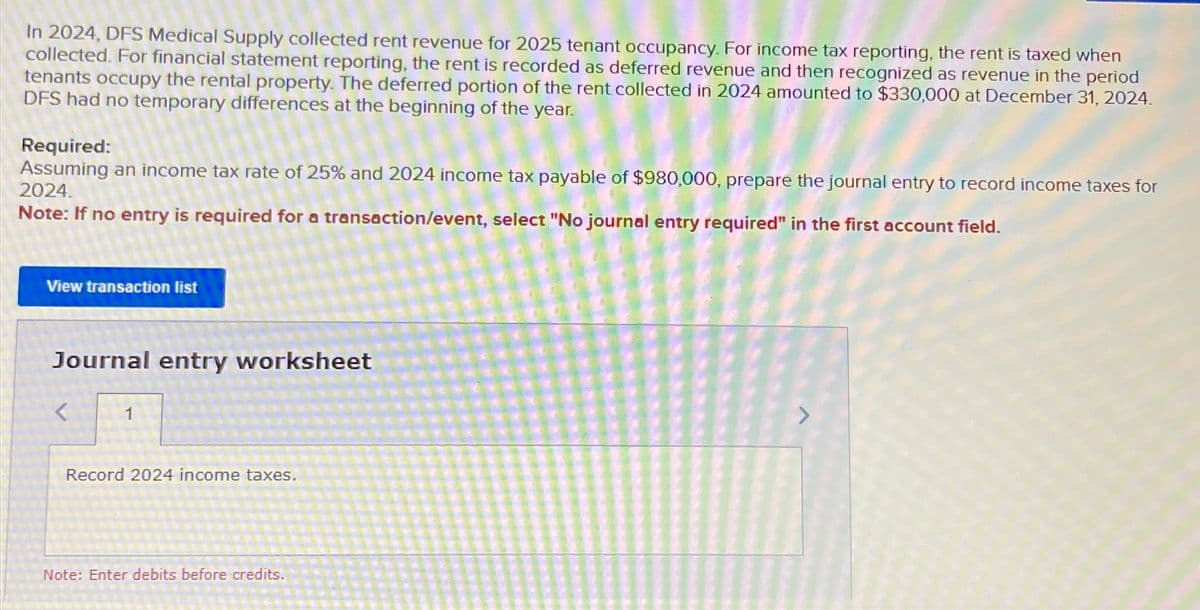

In 2024, DFS Medical Supply collected rent revenue for 2025 tenant occupancy. For income tax reporting, the rent is taxed when collected. For financial statement reporting, the rent is recorded as deferred revenue and then recognized as revenue in the period tenants occupy the rental property. The deferred portion of the rent collected in 2024 amounted to $330,000 at December 31, 2024. DFS had no temporary differences at the beginning of the year. Required: Assuming an income tax rate of 25% and 2024 income tax payable of $980,000, prepare the journal entry to record income taxes for 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < Record 2024 income taxes. Note: Enter debits before credits.

In 2024, DFS Medical Supply collected rent revenue for 2025 tenant occupancy. For income tax reporting, the rent is taxed when collected. For financial statement reporting, the rent is recorded as deferred revenue and then recognized as revenue in the period tenants occupy the rental property. The deferred portion of the rent collected in 2024 amounted to $330,000 at December 31, 2024. DFS had no temporary differences at the beginning of the year. Required: Assuming an income tax rate of 25% and 2024 income tax payable of $980,000, prepare the journal entry to record income taxes for 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < Record 2024 income taxes. Note: Enter debits before credits.

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 20CE

Related questions

Question

Transcribed Image Text:In 2024, DFS Medical Supply collected rent revenue for 2025 tenant occupancy. For income tax reporting, the rent is taxed when

collected. For financial statement reporting, the rent is recorded as deferred revenue and then recognized as revenue in the period

tenants occupy the rental property. The deferred portion of the rent collected in 2024 amounted to $330,000 at December 31, 2024.

DFS had no temporary differences at the beginning of the year.

Required:

Assuming an income tax rate of 25% and 2024 income tax payable of $980,000, prepare the journal entry to record income taxes for

2024.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Journal entry worksheet

<

Record 2024 income taxes.

Note: Enter debits before credits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT