In 20x1, Newman Company paid P1,000,000 to purchase land containing a total estimated 160,000 tons of extractable mineral deposits. The estimated value of the property after the mineral has been removed is P200,000. Extraction activities began in 20x2, and by the end of the year, 20,000 tons had been recovered and sold. In 20x3, geological studies indicated that the total amount of mineral deposits had been underestimated by 25.000 tons. During 20x3; 30,000 tons were extracted, and

In 20x1, Newman Company paid P1,000,000 to purchase land containing a total estimated 160,000 tons of extractable mineral deposits. The estimated value of the property after the mineral has been removed is P200,000. Extraction activities began in 20x2, and by the end of the year, 20,000 tons had been recovered and sold. In 20x3, geological studies indicated that the total amount of mineral deposits had been underestimated by 25.000 tons. During 20x3; 30,000 tons were extracted, and

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 6PB: Underwoods Miners recently purchased the rights to a diamond mine. It is estimated that there are...

Related questions

Question

Transcribed Image Text:In 20x1, Newman Company paid P1,000,000 to purchase land

containing a total estimated 160,000 tons of extractable mineral

deposits. The estimated value of the property after the mineral

has been removed is P200,000. Extraction activities began in

20x2, and by the end of the year, 20,000 tons had been

recovered and sold. In 20x3, geological studies indicated that

the total amount of mineral deposits had been underestimated

by 25,000 tons. During 20x3; 30,000 tons were extracted, and

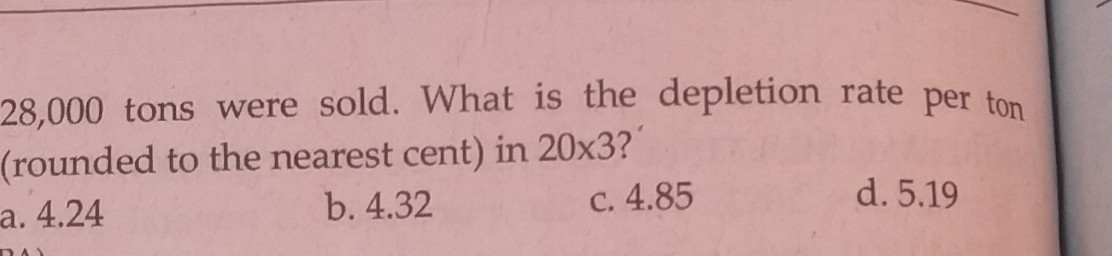

Transcribed Image Text:28,000 tons were sold. What is the depletion rate per ton

(rounded to the nearest cent) in 20x3?

a. 4.24

b. 4.32

C. 4.85

d. 5.19

DA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning