At the beginning of current year, Nilli Company purchased a coal mine for P30,000,000. Removable coal is estimated at 1,500,000 tons. Che entity is required to restore the land at an estimated ost of P3,600,000. The land is estimated to have a value of P3,150,000 after restoration. "he entity incurred P7,500,000 of development cost preparing he mine for production. During the current year, 450,000 ons were removed and 300,000 tons were sold. That total amount of depletion should be recorded for the urrent year? - 11,385,000 10,305,000 3,870,000 7,590,000

At the beginning of current year, Nilli Company purchased a coal mine for P30,000,000. Removable coal is estimated at 1,500,000 tons. Che entity is required to restore the land at an estimated ost of P3,600,000. The land is estimated to have a value of P3,150,000 after restoration. "he entity incurred P7,500,000 of development cost preparing he mine for production. During the current year, 450,000 ons were removed and 300,000 tons were sold. That total amount of depletion should be recorded for the urrent year? - 11,385,000 10,305,000 3,870,000 7,590,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 38BE

Related questions

Question

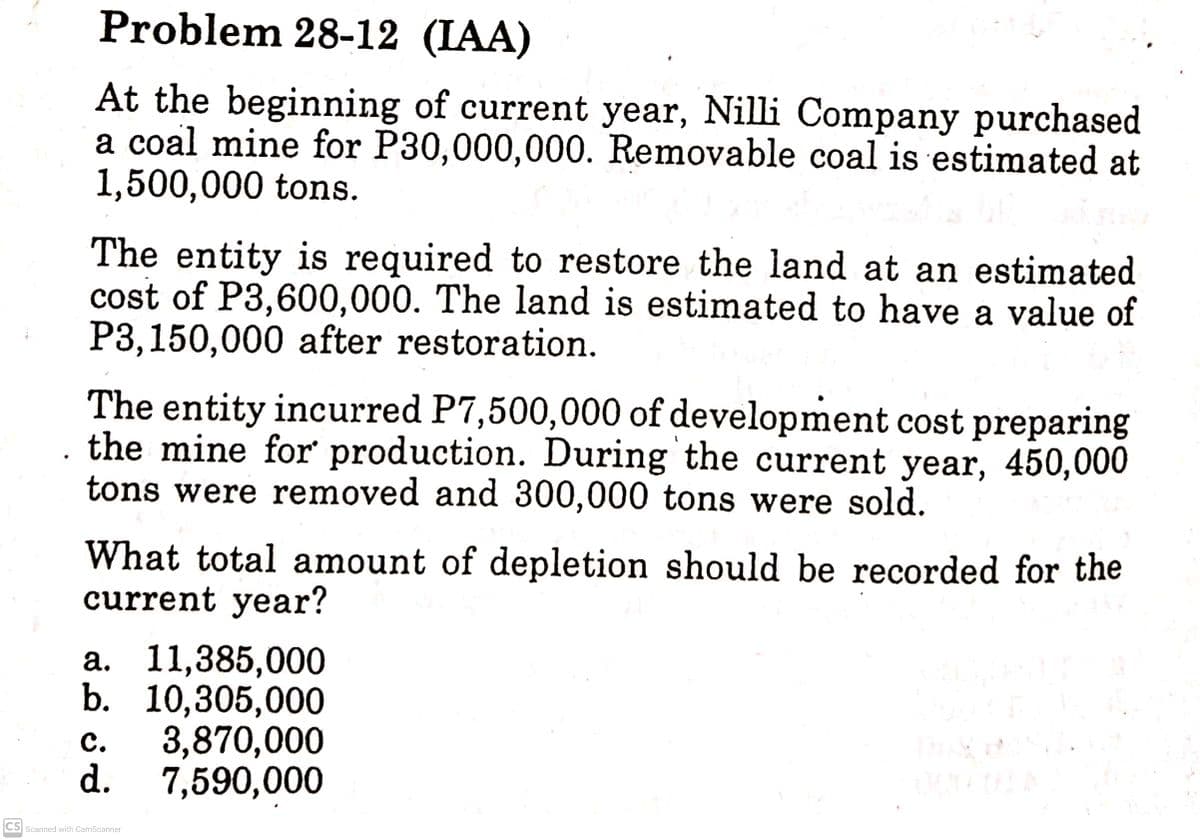

Transcribed Image Text:Problem 28-12 (IAA)

At the beginning of current year, Nilli Company purchased

a coal mine for P30,000,000. Removable coal is estimated at

1,500,000 tons.

The entity is required to restore the land at an estimated

cost of P3,600,000. The land is estimated to have a value of

P3,150,000 after restoration.

The entity incurred P7,500,000 of development cost preparing

the mine for production. During the current year, 450,000

tons were removed and 300,000 tons were sold.

What total amount of depletion should be recorded for the

current year?

а. 11,385,000

b. 10,305,000

3,870,000

d. 7,590,000

с.

CS Scanned with CamScanner

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning