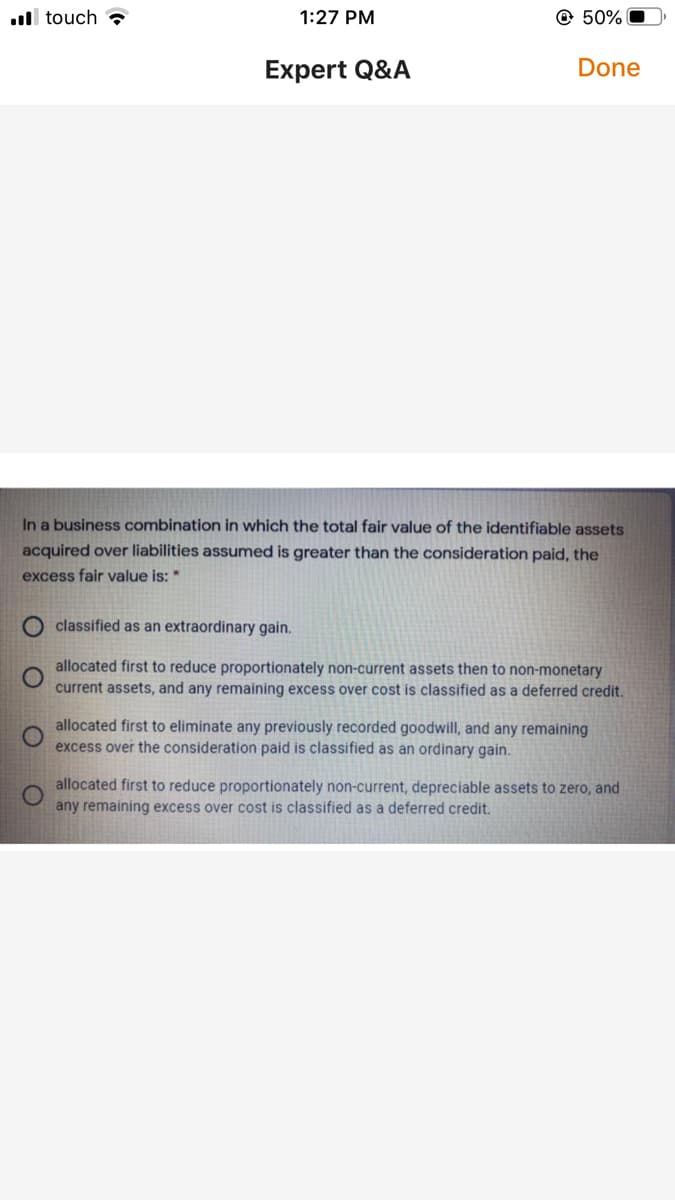

In a business combination in which the total fair value of the identifiable assets acquired over liabilities assumed is greater than the consideration paid, the excess fair value is:* O classified as an extraordinary gain. allocated first to reduce proportionately non-current assets then to non-monetary current assets, and any remaining excess over cost is classified as a deferred credit. allocated first to eliminate any previously recorded goodwill, and any remaining excess over the consideration paid is classified as an ordinary gain. allocated first to reduce proportionately non-current, depreciable assets to zero, and any remaining excess over cost is classified as a deferred credit.

In a business combination in which the total fair value of the identifiable assets acquired over liabilities assumed is greater than the consideration paid, the excess fair value is:* O classified as an extraordinary gain. allocated first to reduce proportionately non-current assets then to non-monetary current assets, and any remaining excess over cost is classified as a deferred credit. allocated first to eliminate any previously recorded goodwill, and any remaining excess over the consideration paid is classified as an ordinary gain. allocated first to reduce proportionately non-current, depreciable assets to zero, and any remaining excess over cost is classified as a deferred credit.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 1EA: Match the correct term with its definition. A. cost principle i. if uncertainty in a potential...

Related questions

Question

Transcribed Image Text:ull touch

1:27 PM

50%

Expert Q&A

Done

In a business combination in which the total fair value of the identifiable assets

acquired over liabilities assumed is greater than the consideration paid, the

excess fair value is: *

classified as an extraordinary gain.

allocated first to reduce proportionately non-current assets then to non-monetary

current assets, and any remaining excess over cost is classified as a deferred credit.

allocated first to eliminate any previously recorded goodwill, and any remaining

excess over the consideration paid is classified as an ordinary gain.

allocated first to reduce proportionately non-current, depreciable assets to zero, and

any remaining excess over cost is classified as a deferred credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning