In a hypothetical economy, Shen earns $38,000, Valerie earns $76,000, and Antonio earns $114,000 in annual income. The following table shows the annual taxable income and tax liability for these three single individuals. For example, Shen, who earns $38,000, owes $12,540 in taxes. Use the tax liability figures provided to complete the following table by computing the average tax rate for Shen, Valerie, and Antonio with an annual income of $ 38,000, $76,000, and $114,000, respectively. Taxable Income Taxable by Liabilit x Date (Dollar allard rc

In a hypothetical economy, Shen earns $38,000, Valerie earns $76,000, and Antonio earns $114,000 in annual income. The following table shows the annual taxable income and tax liability for these three single individuals. For example, Shen, who earns $38,000, owes $12,540 in taxes. Use the tax liability figures provided to complete the following table by computing the average tax rate for Shen, Valerie, and Antonio with an annual income of $ 38,000, $76,000, and $114,000, respectively. Taxable Income Taxable by Liabilit x Date (Dollar allard rc

Economics (MindTap Course List)

13th Edition

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Roger A. Arnold

Chapter11: Fiscal Policy And The Federal Budget

Section: Chapter Questions

Problem 5WNG

Related questions

Question

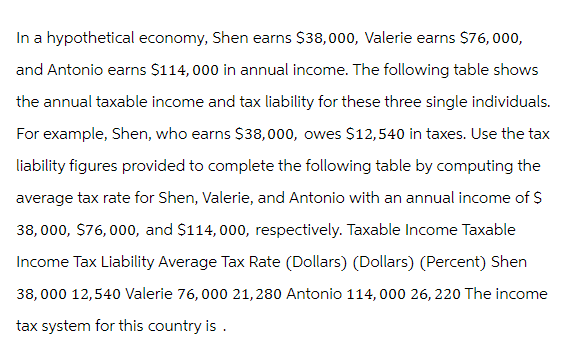

Transcribed Image Text:In a hypothetical economy, Shen earns $38,000, Valerie earns $76,000,

and Antonio earns $114,000 in annual income. The following table shows

the annual taxable income and tax liability for these three single individuals.

For example, Shen, who earns $38,000, owes $12,540 in taxes. Use the tax

liability figures provided to complete the following table by computing the

average tax rate for Shen, Valerie, and Antonio with an annual income of $

38,000, $76,000, and $114,000, respectively. Taxable Income Taxable

Income Tax Liability Average Tax Rate (Dollars) (Dollars) (Percent) Shen

38,000 12,540 Valerie 76,000 21,280 Antonio 114, 000 26, 220 The income

tax system for this country is .

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning