In a recent 5tear period, mutual fund manager Diana sharks produced the following percentage rates of return for the Mesozoic fund. Rates of return on the market index are given for comparison. A. Calculate the average return on both the fund and the index and the standard deviation of the returns on each. Did Ms. Sauros do better or worse than the market index on these measures?

In a recent 5tear period, mutual fund manager Diana sharks produced the following percentage rates of return for the Mesozoic fund. Rates of return on the market index are given for comparison. A. Calculate the average return on both the fund and the index and the standard deviation of the returns on each. Did Ms. Sauros do better or worse than the market index on these measures?

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter3: Data Visualization

Section: Chapter Questions

Problem 6P: The file MutualFunds contains a data set with information for 45 mutual funds that are part of the...

Related questions

Question

In a recent 5tear period, mutual fund manager Diana sharks produced the following percentage

A. Calculate the average return on both the fund and the index and the standard deviation of the returns on each.

Did Ms. Sauros do better or worse than the market index on these measures?

Transcribed Image Text:Help

Save & Exit

Subr

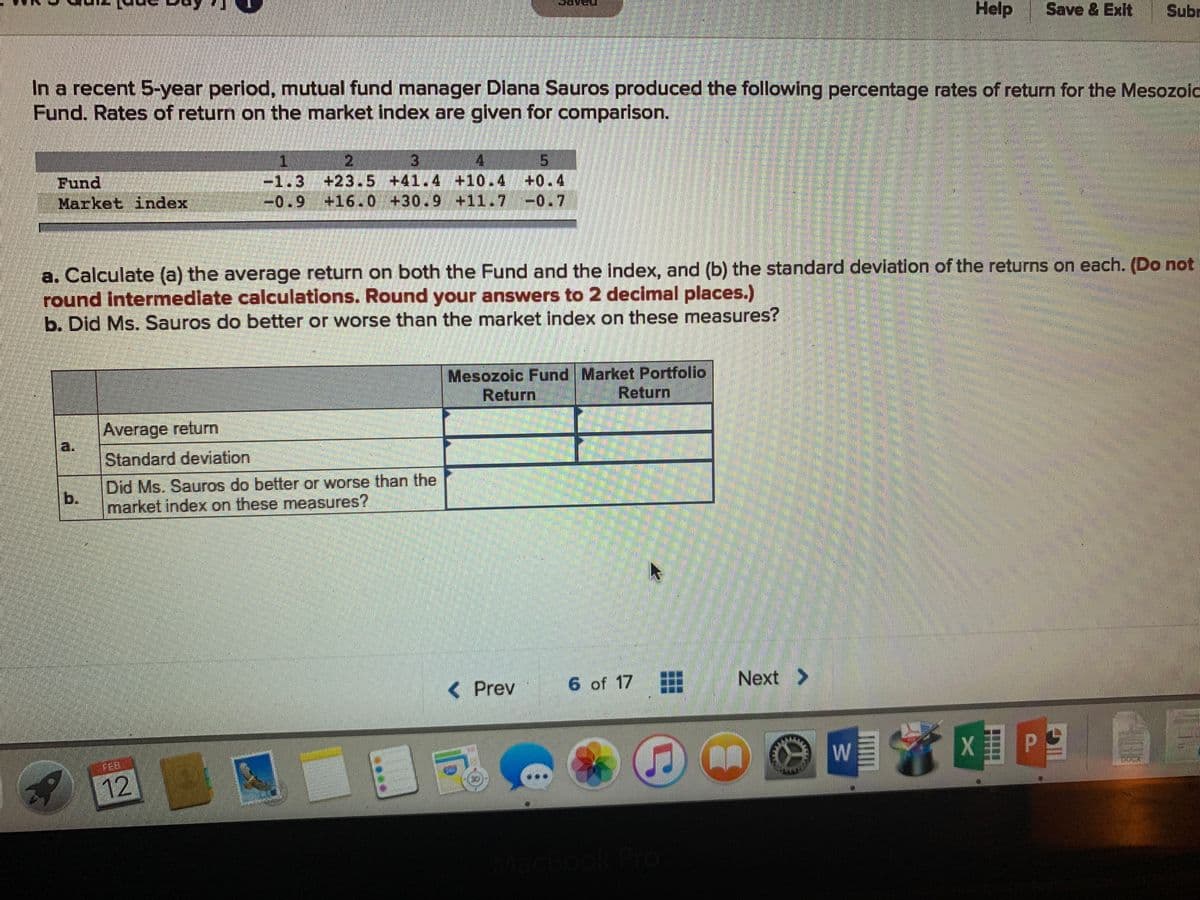

In a recent 5-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoid

Fund. Rates of return on the market index are given for comparison.

Fund

Market index

Wi-1.3 +23.5 +41.4 +10.4 +0.4

-0.9 +16.0 +30.9 +11.7 -0.7

a. Calculate (a) the average return on both the Fund and the index, and (b) the standard deviation of the returns on each. (Do not

round Intermedlate calculations. Round your answers to 2 decimal places.)

b. Did Ms. Sauros do better or worse than the market index on these measures?

Mesozoic Fund Market Portfolio

Return

Return

Average return

a.

Standard deviation

Did Ms. Sauros do better or worse than the

b.

market index on these measures?

< Prev

6 of 17

Next >

FEB

W

12

cBook Pro

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning