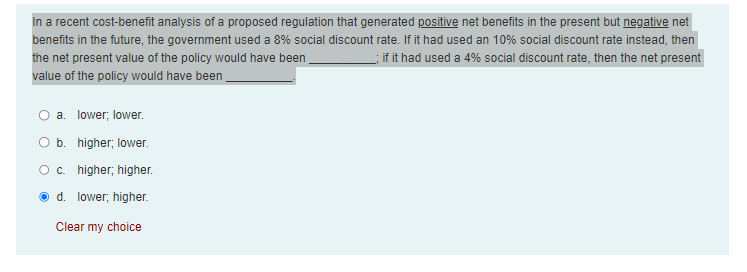

In a recent cost-benefit analysis of a proposed regulation that generated positive net benefits in the present but negative net benefits in the future, the government used a 8% social discount rate. If it had used an 10% social discount rate instead, then the net present value of the policy would have been __; if it had used a 4% social discount rate, then the net present value of the policy would have been a. lower; lower. O b. higher; lower. O c. higher; higher. d. lower; higher. Clear my choice

In a recent cost-benefit analysis of a proposed regulation that generated positive net benefits in the present but negative net benefits in the future, the government used a 8% social discount rate. If it had used an 10% social discount rate instead, then the net present value of the policy would have been __; if it had used a 4% social discount rate, then the net present value of the policy would have been a. lower; lower. O b. higher; lower. O c. higher; higher. d. lower; higher. Clear my choice

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter9: Operating Activities

Section: Chapter Questions

Problem 12QE

Related questions

Question

Note:-

Please avoid using ChatGPT and refrain from providing handwritten solutions; otherwise, I will definitely give a downvote. Also, be mindful of plagiarism.

Answer completely and accurate answer.

Rest assured, you will receive an upvote if the answer is accurate.

Transcribed Image Text:In a recent cost-benefit analysis of a proposed regulation that generated positive net benefits in the present but negative net

benefits in the future, the government used a 8% social discount rate. If it had used an 10% social discount rate instead, then

the net present value of the policy would have been

__; if it had used a 4% social discount rate, then the net present

value of the policy would have been

a. lower; lower.

O b. higher; lower.

O c. higher; higher.

d. lower; higher.

Clear my choice

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning