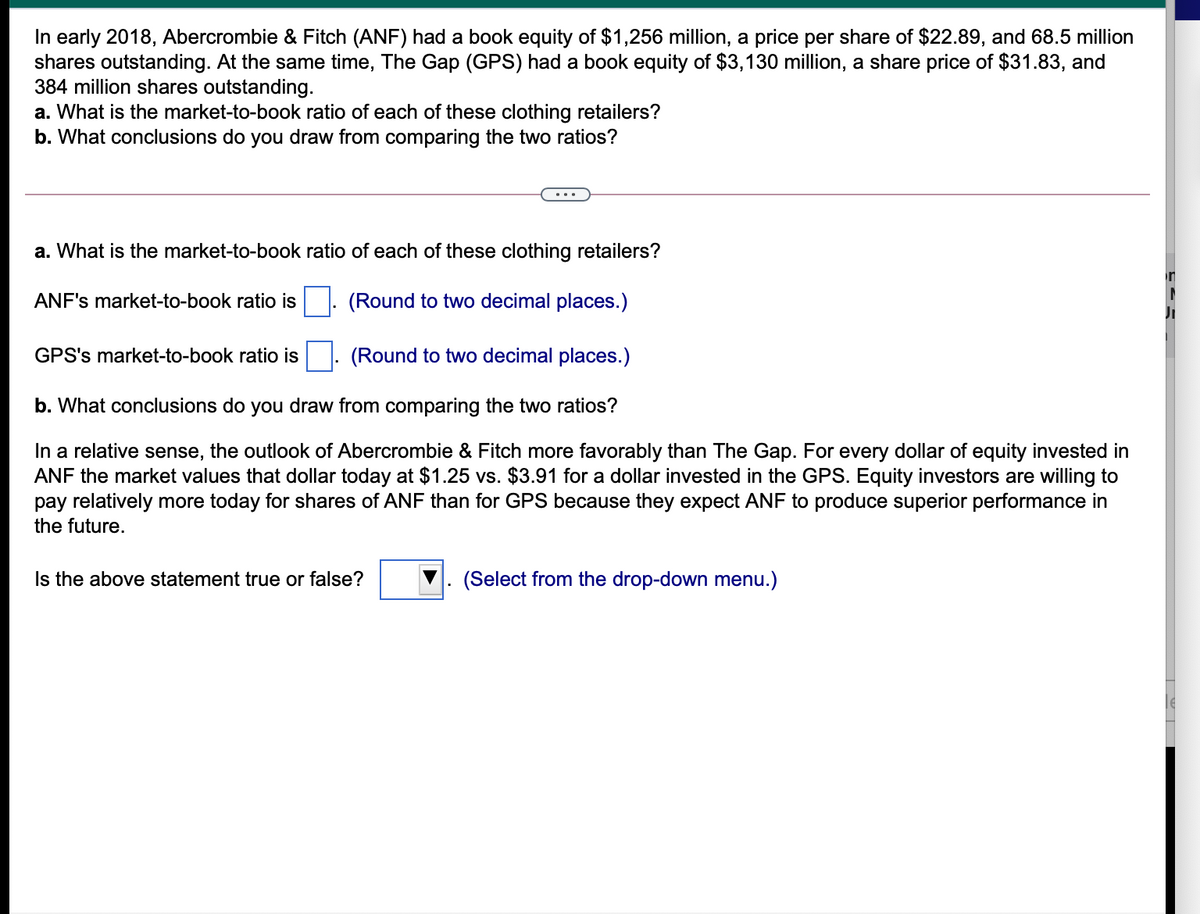

In early 2018, Abercrombie & Fitch (ANF) had a book equity of $1,256 million, a price per share of $22.89, and 68.5 million shares outstanding. At the same time, The Gap (GPS) had a book equity of $3,130 million, a share price of $31.83, and 384 million shares outstanding. a. What is the market-to-book ratio of each of these clothing retailers? b. What conclusions do you draw from comparing the two ratios? a. What is the market-to-book ratio of each of these clothing retailers? ANF's market-to-book ratio is (Round to two decimal places.) GPS's market-to-book ratio is (Round to two decimal places.) b. What conclusions do you draw from comparing the two ratios? In a relative sense, the outlook of Abercrombie & Fitch more favorably than The Gap. For every dollar of equity invested in ANF the market values that dollar today at $1.25 vs. $3.91 for a dollar invested in the GPS. Equity investors are willing to pay relatively more today for shares of ANF than for GPS because they expect ANF to produce superior performance in the future. Is the above statement true or false? (Select from the drop-down menu.)

In early 2018, Abercrombie & Fitch (ANF) had a book equity of $1,256 million, a price per share of $22.89, and 68.5 million shares outstanding. At the same time, The Gap (GPS) had a book equity of $3,130 million, a share price of $31.83, and 384 million shares outstanding. a. What is the market-to-book ratio of each of these clothing retailers? b. What conclusions do you draw from comparing the two ratios? a. What is the market-to-book ratio of each of these clothing retailers? ANF's market-to-book ratio is (Round to two decimal places.) GPS's market-to-book ratio is (Round to two decimal places.) b. What conclusions do you draw from comparing the two ratios? In a relative sense, the outlook of Abercrombie & Fitch more favorably than The Gap. For every dollar of equity invested in ANF the market values that dollar today at $1.25 vs. $3.91 for a dollar invested in the GPS. Equity investors are willing to pay relatively more today for shares of ANF than for GPS because they expect ANF to produce superior performance in the future. Is the above statement true or false? (Select from the drop-down menu.)

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 4CP

Related questions

Question

Transcribed Image Text:In early 2018, Abercrombie & Fitch (ANF) had a book equity of $1,256 million, a price per share of $22.89, and 68.5 million

shares outstanding. At the same time, The Gap (GPS) had a book equity of $3,130 million, a share price of $31.83, and

384 million shares outstanding.

a. What is the market-to-book ratio of each of these clothing retailers?

b. What conclusions do you draw from comparing the two ratios?

a. What is the market-to-book ratio of each of these clothing retailers?

ANF's market-to-book ratio is

(Round to two decimal places.)

GPS's market-to-book ratio is

. (Round to two decimal places.)

b. What conclusions do you draw from comparing the two ratios?

In a relative sense, the outlook of Abercrombie & Fitch more favorably than The Gap. For every dollar of equity invested in

ANF the market values that dollar today at $1.25 vs. $3.91 for a dollar invested in the GPS. Equity investors are willing to

pay relatively more today for shares of ANF than for GPS because they expect ANF to produce superior performance in

the future.

Is the above statement true or false?

(Select from the drop-down menu.)

Expert Solution

Step 1

The market-to-book ratio denotes how much the investors are willing to pay for each dollar in net assets. A lower market-to-book ratio is generally better because it gives better value to the investors. A low ratio (less than 1) indicates that the stock is undervalued (poor investment), whereas a high ratio (greater than 1) indicates that the stock is overvalued (excellent investment) (i.e. it has performed well).

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT