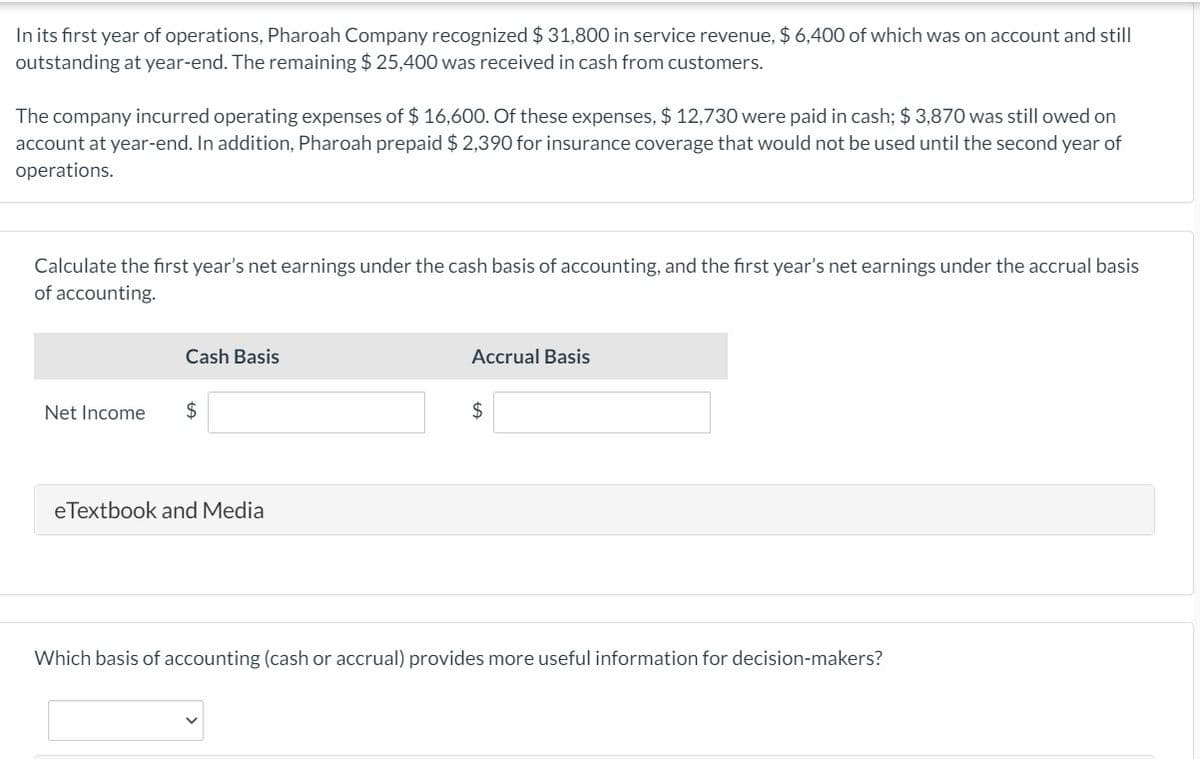

In its first year of operations, Pharoah Company recognized $31,800 in service revenue, $6,400 of which was on account and still outstanding at year-end. The remaining $ 25,400 was received in cash from customers. The company incurred operating expenses of $ 16,600. Of these expenses, $ 12,730 were paid in cash; $ 3,870 was still owed on account at year-end. In addition, Pharoah prepaid $ 2,390 for insurance coverage that would not be used until the second year of operations. Calculate the first year's net earnings under the cash basis of accounting, and the first year's net earnings under the accrual basis of accounting. Cash Basis Accrual Basis Net Income 2$ 2$ eTextbook and Media Which basis of accounting (cash or accrual) provides more useful information for decision-makers?

In its first year of operations, Pharoah Company recognized $31,800 in service revenue, $6,400 of which was on account and still outstanding at year-end. The remaining $ 25,400 was received in cash from customers. The company incurred operating expenses of $ 16,600. Of these expenses, $ 12,730 were paid in cash; $ 3,870 was still owed on account at year-end. In addition, Pharoah prepaid $ 2,390 for insurance coverage that would not be used until the second year of operations. Calculate the first year's net earnings under the cash basis of accounting, and the first year's net earnings under the accrual basis of accounting. Cash Basis Accrual Basis Net Income 2$ 2$ eTextbook and Media Which basis of accounting (cash or accrual) provides more useful information for decision-makers?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter3: Review Of A Company's Accounting System

Section: Chapter Questions

Problem 9RE: For the current year, Vidalia Company reported revenues of 250,000 and expenses of 225,000. At the...

Related questions

Question

Transcribed Image Text:In its first year of operations, Pharoah Company recognized $ 31,800 in service revenue, $ 6,400 of which was on account and still

outstanding at year-end. The remaining $ 25,400 was received in cash from customers.

The company incurred operating expenses of $ 16,600. Of these expenses, $ 12,730 were paid in cash; $ 3,870 was still owed on

account at year-end. In addition, Pharoah prepaid $ 2,390 for insurance coverage that would not be used until the second year of

operations.

Calculate the fırst year's net earnings under the cash basis of accounting, and the first year's net earnings under the accrual basis

of accounting.

Cash Basis

Accrual Basis

Net Income

$

2$

eTextbook and Media

Which basis of accounting (cash or accrual) provides more useful information for decision-makers?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,