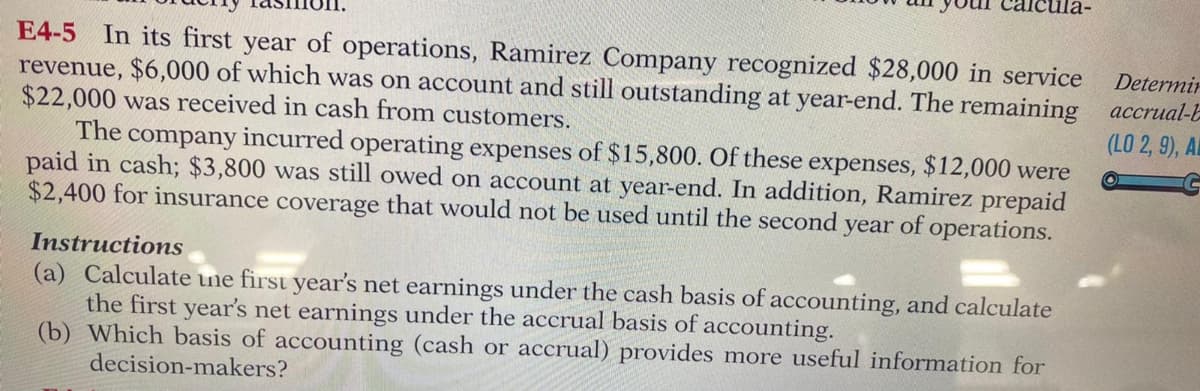

E4-5 In its first year of operations, Ramirez Company recognized $28,000 in service revenue, $6,000 of which was on account and still outstanding at year-end. The remaining $22,000 was received in cash from customers. The company incurred operating expenses of $15,800. Of these expenses, $12,000 were paid in cash; $3,800 was still owed on account at year-end. In addition, Ramirez prepaid $2,400 for insurance coverage that would not be used until the second year of operations. Instructions (a) Calculate ne first year's net earnings under the cash basis of accounting, and calculate the first year's net earnings under the accrual basis of accounting. (b) Which basis of accounting (cash or accrual) provides more useful information for decision-makers?

E4-5 In its first year of operations, Ramirez Company recognized $28,000 in service revenue, $6,000 of which was on account and still outstanding at year-end. The remaining $22,000 was received in cash from customers. The company incurred operating expenses of $15,800. Of these expenses, $12,000 were paid in cash; $3,800 was still owed on account at year-end. In addition, Ramirez prepaid $2,400 for insurance coverage that would not be used until the second year of operations. Instructions (a) Calculate ne first year's net earnings under the cash basis of accounting, and calculate the first year's net earnings under the accrual basis of accounting. (b) Which basis of accounting (cash or accrual) provides more useful information for decision-makers?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 2SEQ: On January 24, 20Y8, Niche Consulting collected $5,700 it had hilled its clients for services...

Related questions

Question

Transcribed Image Text:E4-5 In its first year of operations, Ramirez Company recognized $28,000 in service

revenue, $6,000 of which was on account and still outstanding at year-end. The remaining

$22,000 was received in cash from customers.

The company incurred operating expenses of $15,800. Of these expenses, $12,000 were

paid in cash; $3,800 was still owed on account at year-end. In addition, Ramirez prepaid

$2,400 for insurance coverage that would not be used until the second year of operations.

Instructions

(a) Calculate ne first year's net earnings under the cash basis of accounting, and calculate

the first year's net earnings under the accrual basis of accounting.

(b) Which basis of accounting (cash or accrual) provides more useful information for

decision-makers?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning