Record the entry to eliminate the effects of the intercompany ownership in Suspect bonds for 20X5. Note: Enter debits before credits. Event 1 Accounts Debit Credit

Record the entry to eliminate the effects of the intercompany ownership in Suspect bonds for 20X5. Note: Enter debits before credits. Event 1 Accounts Debit Credit

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 2E

Related questions

Question

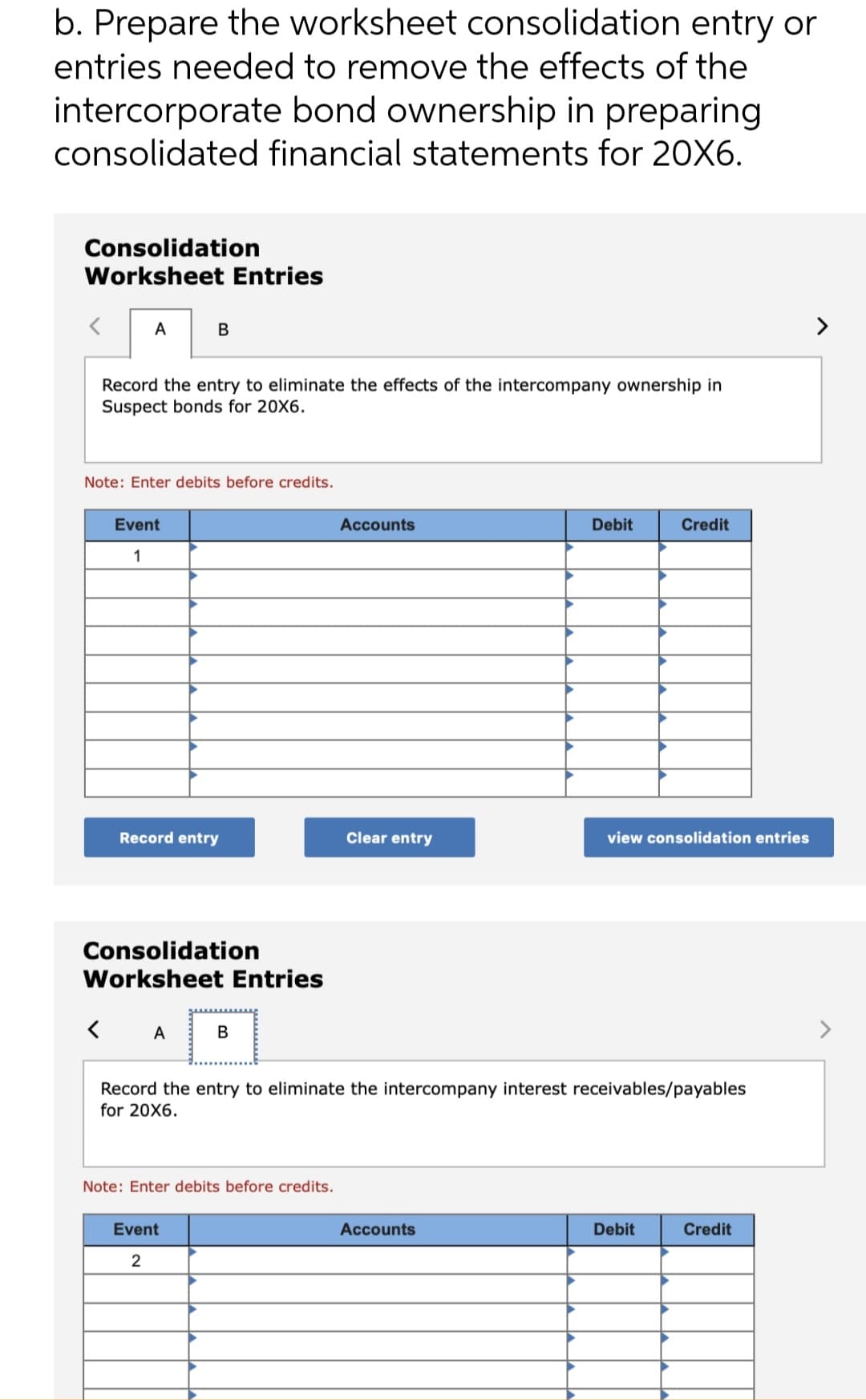

Transcribed Image Text:b. Prepare the worksheet consolidation entry or

entries needed to remove the effects of the

intercorporate bond ownership in preparing

consolidated financial statements for 20X6.

Consolidation

Worksheet Entries

A

Record the entry to eliminate the effects of the intercompany ownership in

Suspect bonds for 20X6.

B

Note: Enter debits before credits.

Event

1

Record entry

Consolidation

Worksheet Entries

<A B

Note: Enter debits before credits.

Event

2

Accounts

Clear entry

Debit

Record the entry to eliminate the intercompany interest receivables/payables

for 20X6.

Accounts

Credit

view consolidation entries

Debit

Credit

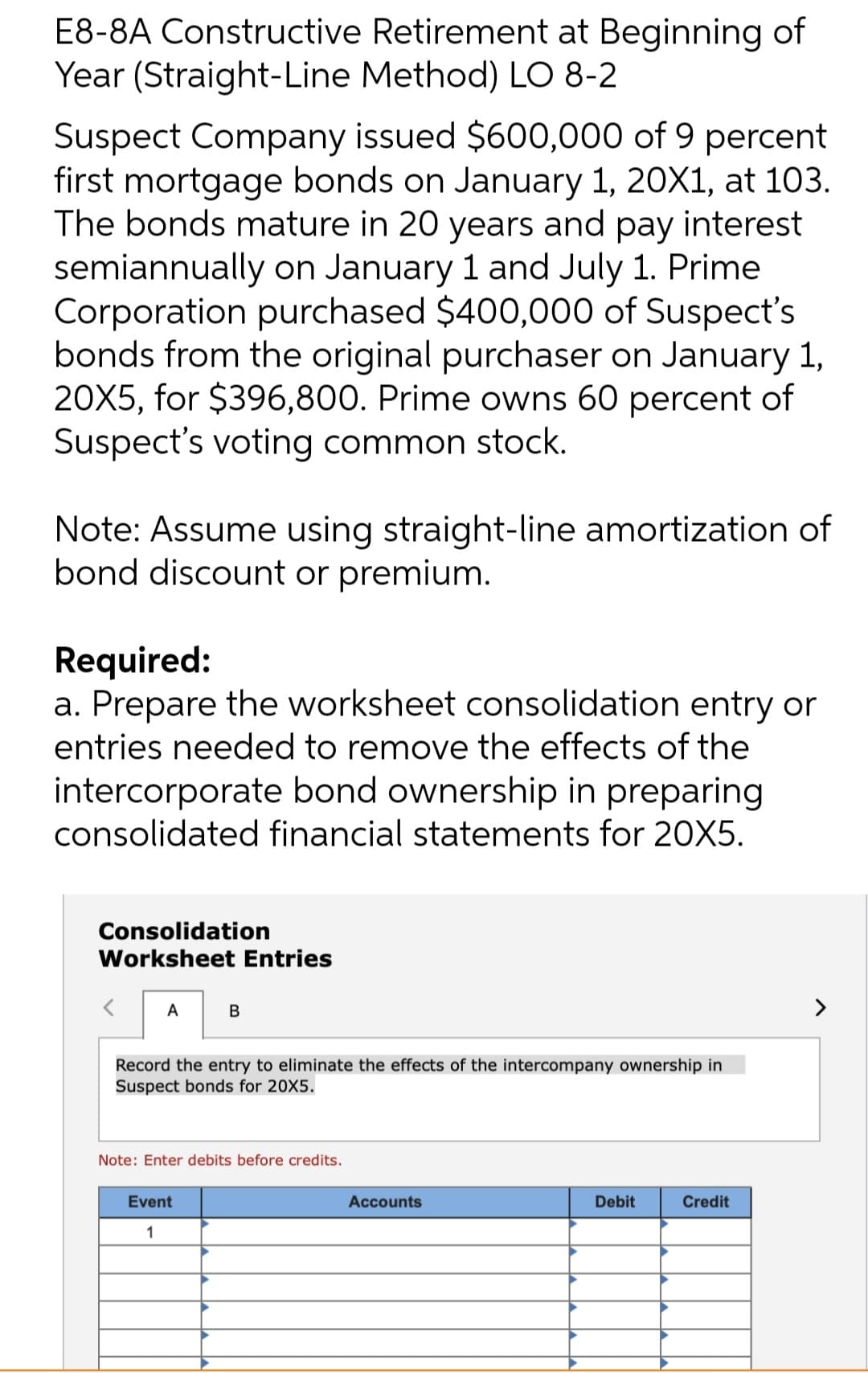

Transcribed Image Text:E8-8A Constructive

Year (Straight-Line

Suspect Company issued $600,000 of 9 percent

first mortgage bonds on January 1, 20X1, at 103.

The bonds mature in 20 years and pay interest

semiannually on January 1 and July 1. Prime

Corporation purchased $400,000 of Suspect's

bonds from the original purchaser on January 1,

20X5, for $396,800. Prime owns 60 percent of

Suspect's voting common stock.

Note: Assume using straight-line amortization of

bond discount or premium.

Required:

a. Prepare the worksheet consolidation entry or

entries needed to remove the effects of the

intercorporate bond ownership in preparing

consolidated financial statements for 20X5.

Consolidation

Worksheet Entries

A

Retirement at Beginning of

Method) LO 8-2

B

Record the entry to eliminate the effects of the intercompany ownership in

Suspect bonds for 20X5.

Note: Enter debits before credits.

Event

1

Accounts

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,