In January of year 0, Justin paid $5,400 for an insurance policy that covers his business property for accidents and casualties. Justin is a calendar-year taxpayer who uses the cash method of accounting. What amount of the insurance premium may Justin deduct in year 0 in each of the following alternative scenarios? (Leave no answers blank. Enter zero if applicable.) a. The policy covers the business property from April 1 of year 0 through March 31 of year 1. Deductible amount

In January of year 0, Justin paid $5,400 for an insurance policy that covers his business property for accidents and casualties. Justin is a calendar-year taxpayer who uses the cash method of accounting. What amount of the insurance premium may Justin deduct in year 0 in each of the following alternative scenarios? (Leave no answers blank. Enter zero if applicable.) a. The policy covers the business property from April 1 of year 0 through March 31 of year 1. Deductible amount

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 11DQ

Related questions

Question

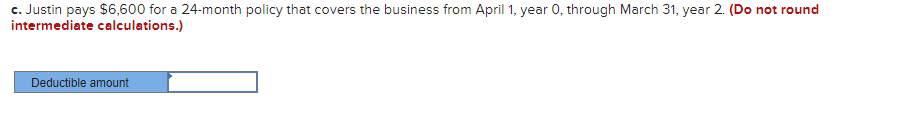

Transcribed Image Text:c. Justin pays $6,600 for a 24-month policy that covers the business from April 1, year 0, through March 31, year 2. (Do not round

intermediate calculations.)

Deductible amount

![!

Required information

[The following information applies to the questions displayed below.]

In January of year 0, Justin paid $5,400 for an insurance policy that covers his business property for accidents and

casualties. Justin is a calendar-year taxpayer who uses the cash method of accounting.

What amount of the insurance premium may Justin deduct in year O in each of the following alternative scenarios? (Leave

no answers blank. Enter zero if applicable.)

a. The policy covers the business property from April 1 of year 0 through March 31 of year 1.

Deductible amount](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fe19829b4-644f-404e-87f3-f5b022e1f288%2F4aae77d7-d6c3-4b8b-86ba-2354ed9c3895%2Fggppm5f_processed.png&w=3840&q=75)

Transcribed Image Text:!

Required information

[The following information applies to the questions displayed below.]

In January of year 0, Justin paid $5,400 for an insurance policy that covers his business property for accidents and

casualties. Justin is a calendar-year taxpayer who uses the cash method of accounting.

What amount of the insurance premium may Justin deduct in year O in each of the following alternative scenarios? (Leave

no answers blank. Enter zero if applicable.)

a. The policy covers the business property from April 1 of year 0 through March 31 of year 1.

Deductible amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT