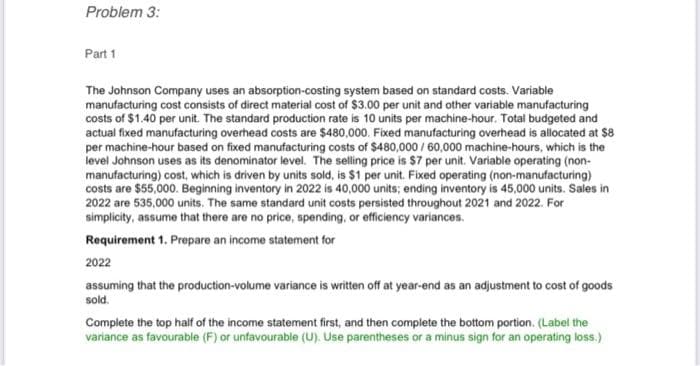

The Johnson Company uses an absorption-costing system based on standard costs. Variable manufacturing cost consists of direct material cost of $3.00 per unit and other variable manufacturing costs of $1.40 per unit. The standard production rate is 10 units per machine-hour. Total budgeted and actual fixed manufacturing overhead costs are $480,000. Fixed manufacturing overhead is allocated at $8 per machine-hour based on fixed manufacturing costs of $480,000/60,000 machine-hours, which is the level Johnson uses as its denominator level. The selling price is $7 per unit. Variable operating (non- manufacturing) cost, which is driven by units sold, is $1 per unit. Fixed operating (non-manufacturing) costs are $55,000. Beginning inventory in 2022 is 40,000 units; ending inventory is 45,000 units. Sales in 2022 are 535,000 units. The same standard unit costs persisted throughout 2021 and 2022. For simplicity, assume that there are no price, spending, or efficiency variances. Requirement 1. Prepare an income statement for 2022 assuming that the production-volume variance is written off at year-end as an adjustment to cost of goods sold. Complete the top half of the income statement first, and then complete the bottom portion. (Label the

The Johnson Company uses an absorption-costing system based on standard costs. Variable manufacturing cost consists of direct material cost of $3.00 per unit and other variable manufacturing costs of $1.40 per unit. The standard production rate is 10 units per machine-hour. Total budgeted and actual fixed manufacturing overhead costs are $480,000. Fixed manufacturing overhead is allocated at $8 per machine-hour based on fixed manufacturing costs of $480,000/60,000 machine-hours, which is the level Johnson uses as its denominator level. The selling price is $7 per unit. Variable operating (non- manufacturing) cost, which is driven by units sold, is $1 per unit. Fixed operating (non-manufacturing) costs are $55,000. Beginning inventory in 2022 is 40,000 units; ending inventory is 45,000 units. Sales in 2022 are 535,000 units. The same standard unit costs persisted throughout 2021 and 2022. For simplicity, assume that there are no price, spending, or efficiency variances. Requirement 1. Prepare an income statement for 2022 assuming that the production-volume variance is written off at year-end as an adjustment to cost of goods sold. Complete the top half of the income statement first, and then complete the bottom portion. (Label the

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter8: Standard Cost Accounting—materials, Labor, And Factory Overhead

Section: Chapter Questions

Problem 17P: Shinto Corp. uses a standard cost system and manufactures one product. The variable costs per...

Related questions

Question

please help me tomsolve this problem

Transcribed Image Text:Problem 3:

Part 1

The Johnson Company uses an absorption-costing system based on standard costs. Variable

manufacturing cost consists of direct material cost of $3.00 per unit and other variable manufacturing

costs of $1.40 per unit. The standard production rate is 10 units per machine-hour. Total budgeted and

actual fixed manufacturing overhead costs are $480,000. Fixed manufacturing overhead is allocated at $8

per machine-hour based on fixed manufacturing costs of $480,000/60,000 machine-hours, which is the

level Johnson uses as its denominator level. The selling price is $7 per unit. Variable operating (non-

manufacturing) cost, which is driven by units sold, is $1 per unit. Fixed operating (non-manufacturing)

costs are $55,000. Beginning inventory in 2022 is 40,000 units; ending inventory is 45,000 units. Sales in

2022 are 535,000 units. The same standard unit costs persisted throughout 2021 and 2022. For

simplicity, assume that there are no price, spending, or efficiency variances.

Requirement 1. Prepare an income statement for

2022

assuming that the production-volume variance is written off at year-end as an adjustment to cost of goods

sold.

Complete the top half of the income statement first, and then complete the bottom portion. (Label the

variance as favourable (F) or unfavourable (U). Use parentheses or a minus sign for an operating loss.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub