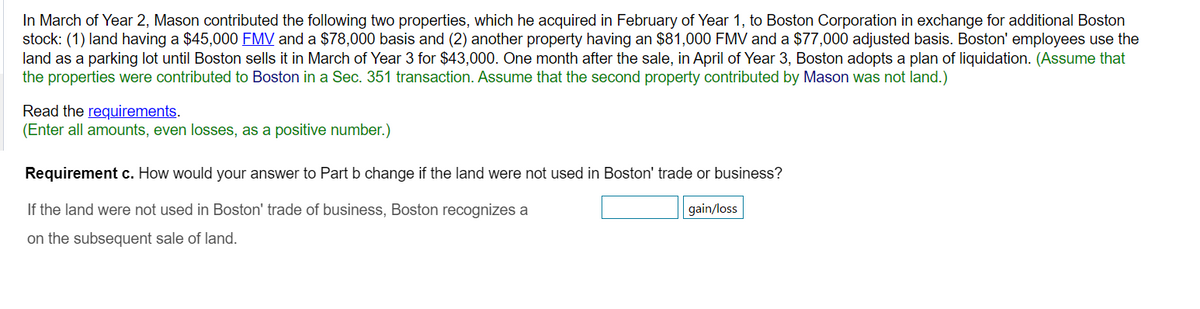

In March of Year 2, Mason contributed the following two properties, which he acquired in February of Year 1, to Boston Corporation in exchange for additional Boston stock: (1) land having a $45,000 FMV and a $78,000 basis and (2) another property having an $81,000 FMV and a $77,000 adjusted basis. Boston' employees use the land as a parking lot until Boston sells it in March of Year 3 for $43,000. One month after the sale, in April of Year 3, Boston adopts a plan of liquidation. (Assume that the properties were contributed to Boston in a Sec. 351 transaction. Assume that the second property contributed by Mason was not land.) Read the requirements. (Enter all amounts, even losses, as a positive number.) Requirement c. How would your answer to Part b change if the land were not used in Boston' trade or business? If the land were not used in Boston' trade of business, Boston recognizes a gain/loss on the subsequent sale of land.

In March of Year 2, Mason contributed the following two properties, which he acquired in February of Year 1, to Boston Corporation in exchange for additional Boston stock: (1) land having a $45,000 FMV and a $78,000 basis and (2) another property having an $81,000 FMV and a $77,000 adjusted basis. Boston' employees use the land as a parking lot until Boston sells it in March of Year 3 for $43,000. One month after the sale, in April of Year 3, Boston adopts a plan of liquidation. (Assume that the properties were contributed to Boston in a Sec. 351 transaction. Assume that the second property contributed by Mason was not land.) Read the requirements. (Enter all amounts, even losses, as a positive number.) Requirement c. How would your answer to Part b change if the land were not used in Boston' trade or business? If the land were not used in Boston' trade of business, Boston recognizes a gain/loss on the subsequent sale of land.

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 55P

Related questions

Question

Transcribed Image Text:In March of Year 2, Mason contributed the following two properties, which he acquired in February of Year 1, to Boston Corporation in exchange for additional Boston

stock: (1) land having a $45,000 FMV and a $78,000 basis and (2) another property having an $81,000 FMV and a $77,000 adjusted basis. Boston' employees use the

land as a parking lot until Boston sells it in March of Year 3 for $43,000. One month after the sale, in April of Year 3, Boston adopts a plan of liquidation. (Assume that

the properties were contributed to Boston in a Sec. 351 transaction. Assume that the second property contributed by Mason was not land.)

Read the requirements.

(Enter all amounts, even losses, as a positive number.)

Requirement c. How would your answer to Part b change if the land were not used in Boston' trade or business?

If the land were not used in Boston' trade of business, Boston recognizes a

gain/loss

on the subsequent sale of land.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT