All sales are made on credit. Based on past experience, The Beverly Hillbillies Trading Company estimates 0.5% of net credit sales are uncollectible. What adjusting entry should Jed Clampett make at the end of the current year to record its estimated bad debts expense? Multiple Choice cccccccccccc Debit Bad Debts Expense $4,045; credit Allowance for Doubtful counts $4,045. O. Debit Bad Debts Expense $2,410; credit Allowance for Doubtful Accounts $2,410. Debit Bad Debts Expense $1,820; credit Allowance for Doubtful Accounts $1,820. cococco

All sales are made on credit. Based on past experience, The Beverly Hillbillies Trading Company estimates 0.5% of net credit sales are uncollectible. What adjusting entry should Jed Clampett make at the end of the current year to record its estimated bad debts expense? Multiple Choice cccccccccccc Debit Bad Debts Expense $4,045; credit Allowance for Doubtful counts $4,045. O. Debit Bad Debts Expense $2,410; credit Allowance for Doubtful Accounts $2,410. Debit Bad Debts Expense $1,820; credit Allowance for Doubtful Accounts $1,820. cococco

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 2SEB: UNCOLLECTIBLE ACCOUNTS-PERCENTAGE OF SALES Nicoles Neckties has total credit sales for the year of...

Related questions

Question

Transcribed Image Text:F2

Multiple Choice

#3

Debit Bad Debts Expense $4,045; credit Allowance for Doubtful Accounts $4,045.

Debit Bad Debts Expense $2,410; credit Allowance for Doubtful Accounts $2,410.

Debit Bad Debts Expense $1,820; credit Allowance for Doubtful Accounts $1,820.

Debit Bad Debts Expense $4,635; credit Allowance for Doubtful counts $4,635.

Debit Bad Debts Expense $3,455; credit Allowance for Doubtful Accounts $3,455.

80

F3

E

D

$

4

F4

R

F

%

5

F5

< Prev

T

G

23 of 40

MacBook Air

F6

Y

::

&

7

H

F7

Next >

U

*00

8

J

DII

F8

1

(

9

F9

K

)

0

Transcribed Image Text:2

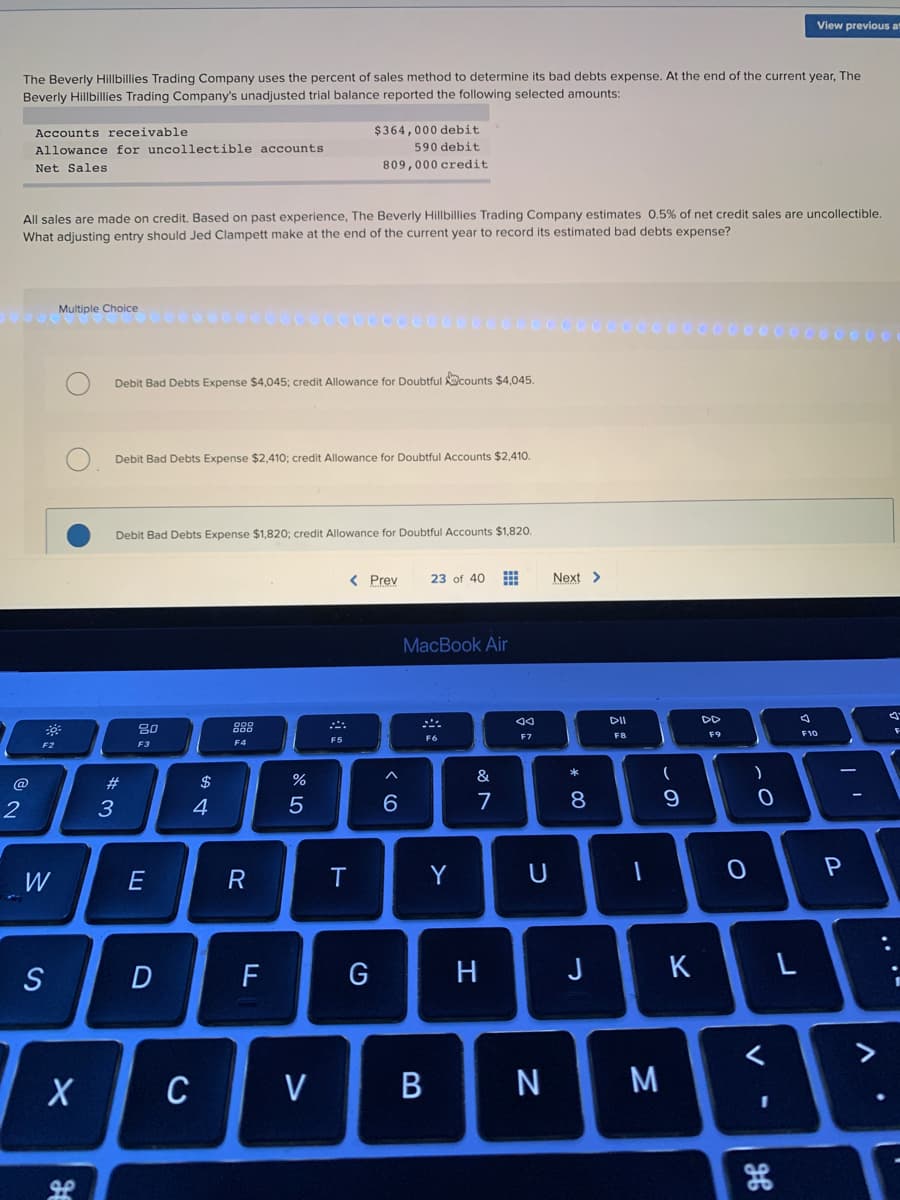

The Beverly Hillbillies Trading Company uses the percent of sales method to determine its bad debts expense. At the end of the current year, The

Beverly Hillbillies Trading Company's unadjusted trial balance reported the following selected amounts:

Accounts receivable

Allowance for uncollectible accounts

Net Sales.

F2

All sales are made on credit. Based on past experience, The Beverly Hillbillies Trading Company estimates 0.5% of net credit sales are uncollectible.

What adjusting entry should Jed Clampett make at the end of the current year to record its estimated bad debts expense?

W

S

Multiple Choice

X

مو

Debit Bad Debts Expense $4,045; credit Allowance for Doubtful counts $4,045.

Debit Bad Debts Expense $2,410; credit Allowance for Doubtful Accounts $2,410.

Debit Bad Debts Expense $1,820; credit Allowance for Doubtful Accounts $1,820.

#3

80

F3

E

D

$

4

C

F4

R

F

07 dº

%

$364,000 debit

590 debit

809,000 credit.

5

V

< Prev

T

G

6

23 of 40 ⠀

MacBook Air

B

F6

Y

&

7

H

AA

F7

U

N

Next >

* 00

8

J

DII

F8

1

M

(

9

K

DD

F9

O

)

0

<

View previous at

I

L

F10

-

P

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning