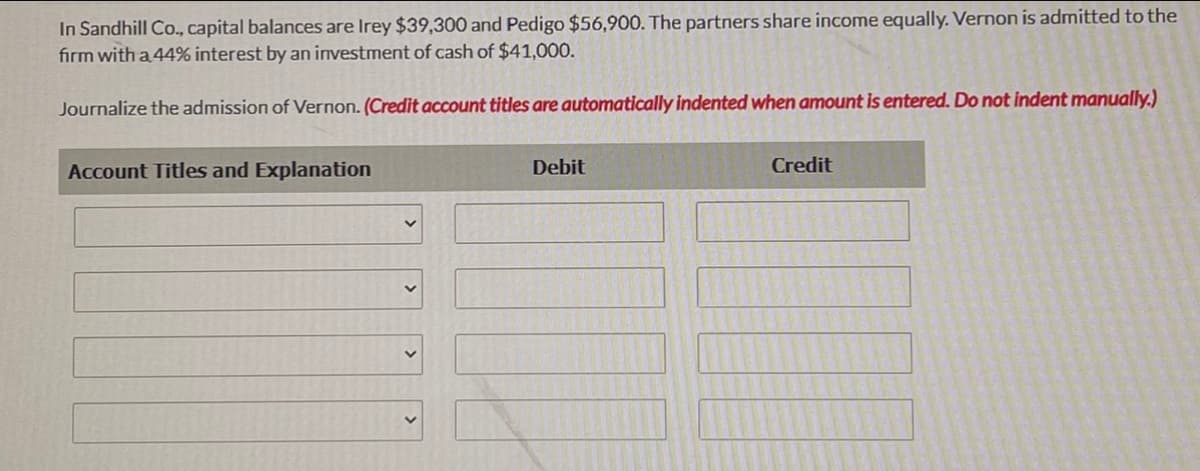

In Sandhill Co., capital balances are Irey $39,300 and Pedigo $56,900. The partners share income equally. Vernon is admitted to the firm with a 44% interest by an investment of cash of $41,000. Journalize the admission of Vernon. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Q: Prior to the distribution of cash to the partners, the accounts in the Carla Vista Company are Cash…

A: A Journal is made to record all the business transactions in chronological order. It is the first…

Q: The capital accounts of Angel Alvarez and Emma Allison have balances of $47,000 and $73,000,…

A: Statement of partnership equity is represented as below: Note: As there is no reference for the…

Q: In Sheridan Co. capital balances are Irey $40,000 and Pedigo $56.600. The partners share income…

A: Admission of the partner is the process where a new person is added into the business of partnership…

Q: The following debit (credit) balances on the account of SAM Partnership are as follows: Sucrose,…

A: Partnership agreement: It is an agreement between two persons to share profits of the business.

Q: The capital balances in the BEE are Betty's capital P600,000, Eli's capital P500,000, and Edna's…

A:

Q: Faith Busby and Jeremy Beatty started the B&B partnership on January 1, 2018. The business acquired…

A: Income Statement, Capital Statement, Balance Sheet and Statement of cash flows are the four…

Q: The capital accounts of Angel Alvarez and Emma Allison have balances of $105,000 and $77,000,…

A: The partnership comes into existence when two or more persons joins together to run the business and…

Q: On January 1, 2021, A and B, both sole proprietors, decided to form a partnership to expand both of…

A: Partnership is a joint association between two or more than two partners, in which they invest their…

Q: "In IAB Co., capital balances are Mohd $50,000 and Hani $70,000. The partners share income equally.…

A: The partnership is referred to as a form of business organization under which two or more than two…

Q: The capital accounts of Trent Henry and Tim Chou have balances of $160,000 and $100,000,…

A: a)

Q: nelly as a partner in business. Just before the partnership's formation, Marie books showed the…

A:

Q: P1, P2, and P3 are partners in XYZ Inc. Their capital balances on Dec 31, Year 5, are $189,807 for…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: Karasuma and Irina are partners who have capitals of P6,000 and P4,800 and who share profits in the…

A:

Q: Talent, a local HR consulting firm, has total partners’ equity of $764,000, which is made up of…

A: A partnership is a kind of business structure in which two or more people agree to carry out…

Q: Following are the capital account balances and profit and loss percentages (indicated…

A: Introduction: Partnership: Its an agreement between two or more partners for forming a business and…

Q: After the tangible assets have been adjusted to current market prices, the capital accounts of…

A:

Q: Jimmy, Johnny, and Joey are partners in the 3J Company sharing profits and losses equally. Joey has…

A: Partnership Firm: A partnership is a formal agreement between two or more partners who agree to…

Q: When Danny withdrew from John, Daniel, Harry, and Danny LLP, he was paid P80,000, although his…

A:

Q: Talent, a local HR consulting firm, has total partners’ equity of $798,000, which is made up of…

A: Hall capital+ Reynolds capital+ Morris capital = total capital let the total capital be X…

Q: eed answer asap, please. tysm! Marie admits Neri as a partner in business. Just before the…

A: Answer) Calculation of amount of cash Neri Should Invest for 1/3 share Amount to be invested = Fair…

Q: Faith Busby and Jeremy Beatty started the B&B partnership on January 1, Year 1. The business…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: At April 30, partners’ capital balances in Crane Company are G. Donley $ 54,080, C. Lamar $ 49,920,…

A: Journal entries are the primary reporting of the transactions taking place in the usual course of…

Q: Talent, a local HR consulting firm, has total partners’ equity of $794,000, which is made up of…

A: For (a): Existing capital = 617000+177000 = 794000 If Morris invests 198500, new capital =…

Q: Prepare journal entries regarding the partnership dissolution.

A:

Q: After the tangible assets have been adjusted to current market prices, the capital accounts of…

A: Part a:

Q: After the tangible assets have been adjusted to current market prices, the capital accounts of…

A: A partnership is a form of business in which the founders have unlimited personal liability for the…

Q: Ali and Fatima are partners whose capital balances are $400,000 and $300,000 and who share profits…

A: Note: Goodwill brought by Ahmed is divided between existing partners in the old ratio.

Q: Blossom Company at December 31 has cash $ 23,800, noncash assets $ 106,000, liabilities $ 51,600,…

A: Liquidation means where the company decide to close out the operations , sell all the assets and…

Q: Marie admits Neri as a partner in business. Just before the partnership’s formation, Marie's books…

A: Answer) Calculation of amount of Capital to be invested by Neri Amount of Capital to be invested by…

Q: 1. For Starrite Co., beginning capital balances on January 1, 2012, are Donna Noble $18,000 and Amy…

A: "Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: [The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested…

A: Allocation of Profit - There are two ways profit shall be allocated to the partners a. Equally b.…

Q: At April 30, partners' capital balances in Carla Vista Company are G. Donley $49,920, C. Lamar…

A: SOLUTION A JOURNAL IS A COMPANY'S OFFICIAL BOOK ON WHICH ALL BUSINESS TRANSACTIONS ARE RECORDED IN…

Q: PJ, Ian, and Lemuel are partners in an accounting firm. Their capital account balances at year-end…

A: The profits among the partners are distributed in profit sharing ratio after adjusting for salaries,…

Q: The capital balances in the BEE are Betty’s capital P600,000, Eli’s capital P500,000, and Edna’s…

A: Bonus is defined as the compensation which is beyond and above the normal or financial payment…

Q: LeAnne Gilbert and Becky Clarke are to be admitted to the partnership. Gilbert buys one-fifth of…

A: A partnership is known as an agreement between two or more persons to work together for a common…

Q: Marie admits Neri as a partner in business. Just before the partnership's formation, Marie's books…

A: Answer) Calculation of amount of Capital to be invested by Neri Amount of Capital to be invested by…

Q: Purkerson, Smith, and Traynor have operated a bookstore for a number of years as a partnership. At…

A: Partnership is a form of business organization which involves two or more people coming together and…

Q: PREPARE THE TRIAL BALANCE

A: Given: Capital contribution of partners are as follows : Maravi - Cash…

Q: Prepare the journal entries showing the above transactions admitting Menendez and Domski to the…

A: a) Journal Entries Particulars Debit Amount Credit Amount C's Capital $27,000 [ 90,000 *…

Q: The capital accounts of Trent Henry and Tim Chou have balances of $142,900 and $85,800,…

A: Trent Henry and Tim Chou's capital accounts will be debited with 1/5th and 1/4th of the respective…

Q: Bee, Cee and Dee, accountants, agree to form a partnership and to share profits in the ratio of…

A: Partnership accounting assesses the financial activities of every partner in a partnership. It…

Q: nce Income Ratio Trayer $ 64,500 50% Emig 35,000 30% Posada 34,500 20% (1)…

A: Journal entries are the initial recording of all the monetary business transactions in a…

Q: Love and Faith have been operating an accounting firm as partners for a number of years and at the…

A: Solution Partnership is an agreement between two or more persons who are agree to share the profits…

Q: The capital accounts of Angel Alvarez and Emma Allison have balances of $44,880 and $71,910,…

A: Debit the receiver and credit the giver. Debit what comes in and credit what goes out. Debit…

Q: Z admits A as a partner in business. Accounts in the ledger for Z on November 20, 2018, just before…

A: In a partnership, 2 or more parties comply with operate and manage a business and share the profits…

Q: On October 1, 2024, Apollo, Brett, and Clark formed the A, B and C partnership. Apollo…

A: On 01.10.2024, Apollo, Brett and Clark formed A, B & C partnership. The capital contribution of…

Q: In Indigo Co., capital balances are Adrienne $61,000 and Dino $79,000. The partners share income…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Karasuma and Irina are partners who have capitals of P6,000 and P4,800 and who share profits in the…

A:

Q: After the tangible assets have been adjusted to current market prices, the capital accounts of Brad…

A: In a partnership form of organization, it is generally owned and managed by 2 or more people who…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Which of the following entities is required to report on the accrual basis? An accounting firm operating as a Personal Service Corporation. A manufacturing business with $30 million of gross receipts operating as a regular C corporation. A corporation engaged in tropical fruit farming in Southern California. A partnership with gross receipts of $13 million and all of the partners are individuals with a December year-end.In Sandhill Co., the capital balances of the partners are A. Anderson $27,900 ; S. Harrin $23,250 ; and K. Robinson $33,480 . The partners share profit equally. On June 9 of the current year, D. Garcia is admitted to the partnership by purchasing one-half of K. Robinson's interest for $18,600 paid to him personally. Journalize the admission of Garcia on June 9. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)\\nDate Account Titles\\nDebit\\nCredit\\nJune 9\\nD. Garcit, Capi\\neTextbook and MediaTalent, a local HR consulting firm, has total partners’ equity of $764,000, which is made up of Hall, Capital, $602,000, and Reynolds, Capital, $162,000. The partners share profit/(losses) in a ratio of 75% to Hall and 25% to Reynolds. On July 1, Morris is admitted to the partnership and given a 20% interest in equity. Required: Prepare the journal entry to record the admission of Morris under each of the following unrelated assumptions, in which Morris invests cash of: a. $191,000 - Record the admission of Morris b. $232,000 -Record the admission of Morris c. $112,000 -Record the admission of Morris

- Talent, a local HR consulting firm, has total partners’ equity of $798,000, which is made up of Hall, Capital, $619,000, and Reynolds, Capital, $179,000. The partners share profit/(losses) in a ratio of 80% to Hall and 20% to Reynolds. On July 1, Morris is admitted to the partnership and given a 20% interest in equity.Required:Prepare the journal entry to record the admission of Morris under each of the following unrelated assumptions, in which Morris invests cash of:a. $199,500 Record the admission of morris b. $249,000 Record the admission of morris. c. $129,000 Record the admission of morrisThe capital accounts of Angel Alvarez and Emma Allison have balances of $47,000 and $73,000, respectively, on January 1, 20Y4, the beginning of the fiscal year. On March 10, Alvarez invested an additional $8,000. During the year, Alvarez and Allison withdrew $32,000 and $39,000, respectively, and net income for the year was $62,000. Revenues were $483,000, and expenses were $421,000. The articles of partnership make no referenceto the division of net income.a. Journalize the entries to close (1) the revenues and expenses and (2) the drawing accounts.b. Prepare a statement of partnership equity for the current year for the partnership of Alvarez and Allison.The capital accounts of Angel Alvarez and Emma Allison have balances of $105,000 and $77,000, respectively, on January 1, 20Y4, the beginning of the fiscal year. On March 10, Alvarez invested an additional $12,000. During the year, Alvarez and Allison withdrew $57,000 and $46,000, respectively, and net income for the year was $146,000. Revenues were $567,000, and expenses were $421,000. The articles of partnership make no reference to the division of net income. a. Journalize the entry to close the revenues and expenses. For a compound transaction, if an amount box does not require an entry, leave it blank. Angel Alvarez, Capital fill in the blank e37f5f05b059f91_2 fill in the blank e37f5f05b059f91_3 Emma Allison, Capital fill in the blank e37f5f05b059f91_5 fill in the blank e37f5f05b059f91_6 Emma Allison, Drawing fill in the blank e37f5f05b059f91_8 fill in the blank e37f5f05b059f91_9 fill in the blank e37f5f05b059f91_11 fill in the blank…

- The capital accounts of Angel Alvarez and Emma Allison have balances of $47,000 and $73,000, respectively, on January 1, 20Y4, the beginning of the fiscal year. On March 10, Alvarez invested an additional $8,000. During the year, Alvarez and Allison withdrew $32,000 and $39,000, respectively, and net income for the year was $62,000. Revenues were $483,000, and expenses were $421,000. The articles of partnership make no reference to the division of net income. -Prepare a statement of partnership equity for the current year for the partnership of Alvarez and Allison. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries.The capital accounts of Angel Alvarez and Emma Allison have balances of $44,880 and $71,910, respectively, on January 1, 20Y4, the beginning of the fiscal year. On March 10, Alvarez invested an additional $7,750. During the year, Alvarez and Allison withdrew $30,730 and $38,870, respectively, and net income for the year was $62,000. Revenues were $483,000, and expenses were $421,000. The articles of partnership make no reference to the division of net income. Required: A. Journalize the entries to close (1) the revenues and expenses and (2) the drawing accounts on December 31. B. Prepare a statement of partnership equity for the current year for the partnership of Alvarez and Allison.The following debit (credit) balances on the account of SAM Partnership are as follows: Sucrose, Capital (P1,000,000) Albedo, Capital ( 1,200,000) Mona, Capital ( 800,000) Sucrose, Loan 100,000 Albedo, Loan 300,000 Mona, Loan ( 100,000) Sucrose, Albedo and Mona currently allocate their profits and losses based on the ratio of 3:4:3, respectively. With the consent of the remaining partners, Albedo decided to retire from the partnership by selling 75% of his capital to…

- Kareen Labor, Lalaine Dajao and Leah Magno were partners in a business engaged in printingand publishing. The statement of financial position reveals that their business has no obligationto outside creditors. The partners share profit or loss 30%, 20%, and 50%, respectively. ASSETS PARTNER'S EQUITYCash 120,000 Labor, Capital 400,000Accounts receivable 150,000 Dajao, Capital 280,000Inventory 260,000 Magno, Capital 150,000Equipment 300,000Total 830,000 Total 830,000 On January 1, 2021, the partners agree to admit Jimwell Acenas as a new partner afterconsidering the following revaluation and adjustments:1. Allowance for doubtful accounts of P20,000 is to be established for possible uncollectibleaccount.2. Inventories should be recorded at their net realizable value of P240,000.3. The net book value of the equipment should be adjusted at…At April 30, partners’ capital balances in Crane Company are G. Donley $ 54,080, C. Lamar $ 49,920, and J. Pinkston $ 18,720. The income sharing ratios are 5 : 4 : 1, respectively. On May 1, the PDLT Company is formed by admitting J. Terrell to the firm as a partner. (1) Terrell purchases 50% of Pinkston’s ownership interest by paying Pinkston $ 16,640 in cash. (2) Terrell purchases 331/3% of Lamar’s ownership interest by paying Lamar $ 15,600 in cash. (3) Terrell invests $ 64,480 for a 30% ownership interest, and bonuses are given to the old partners. (4) Terrell invests $ 43,680 for a 30% ownership interest, which includes a bonus to the new partner. Journalize the admission of Terrell under each of the following independent assumptions.Tyson Tapestries is an unincorporated partnership formed by Brenda Tyson, Rhonda Lentil, and Constance Cummings. They contributed initial capital of $90,000, $60,000 and $40,000 respectively. During the year Brenda contributed an additional $10,000 and withdraw $13,250 from her capital account. Net income was $100,000 and income is distributed to the partners in the ratio of their capital contributions. Required 1: What is the balance of the equity account of Brenda Tyson in the year end financial statements? Required 2: What is the balance of the capital account of Rhonda Lentil in the year end financial statements? Required 3: What is the balance of the capital account of Constance Cummings in the year end financial statements?