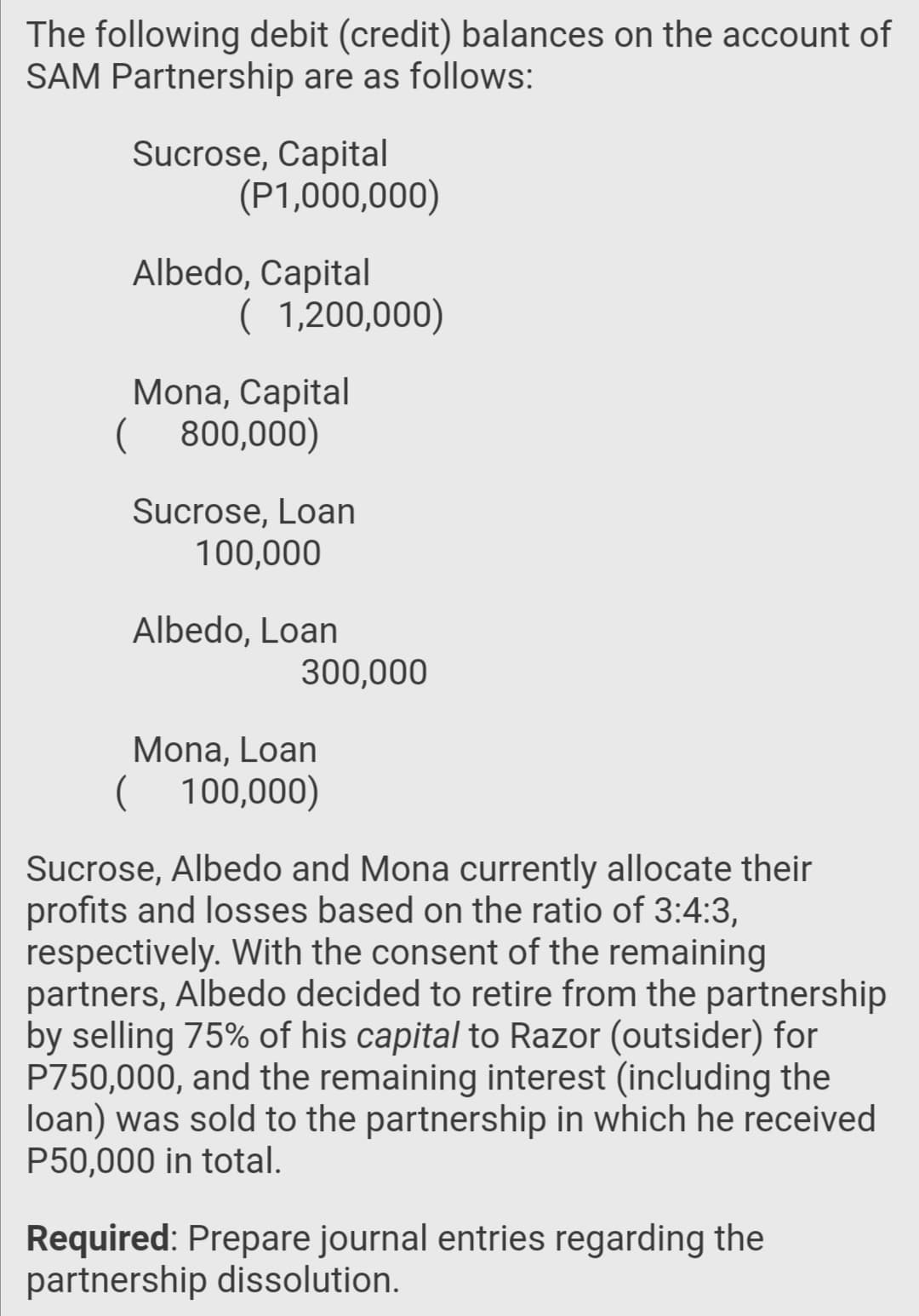

The following debit (credit) balances on the account of SAM Partnership are as follows: Sucrose, Capital (P1,000,000) Albedo, Capital ( 1,200,000) Mona, Capital ( ( 800,000) Sucrose, Loan 100,000 Albedo, Loan 300,000 Mona, Loan ( 100,000) Sucrose, Albedo and Mona currently allocate their profits and losses based on the ratio of 3:4:3, respectively. With the consent of the remaining partners, Albedo decided to retire from the partnership by selling 75% of his capital to Razor (outsider) for P750,000, and the remaining interest (including the loan) was sold to the partnership in which he received P50,000 in total. Required: Prepare journal entries regarding the partnership dissolution.

The following debit (credit) balances on the account of SAM Partnership are as follows: Sucrose, Capital (P1,000,000) Albedo, Capital ( 1,200,000) Mona, Capital ( ( 800,000) Sucrose, Loan 100,000 Albedo, Loan 300,000 Mona, Loan ( 100,000) Sucrose, Albedo and Mona currently allocate their profits and losses based on the ratio of 3:4:3, respectively. With the consent of the remaining partners, Albedo decided to retire from the partnership by selling 75% of his capital to Razor (outsider) for P750,000, and the remaining interest (including the loan) was sold to the partnership in which he received P50,000 in total. Required: Prepare journal entries regarding the partnership dissolution.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 3PB

Related questions

Question

Can you help me with this one

Transcribed Image Text:The following debit (credit) balances on the account of

SAM Partnership are as follows:

Sucrose, Capital

(P1,000,000)

Albedo, Capital

( 1,200,000)

Mona, Capital

( 800,000)

Sucrose, Loan

100,000

Albedo, Loan

300,000

Mona, Loan

( 100,000)

Sucrose, Albedo and Mona currently allocate their

profits and losses based on the ratio of 3:4:3,

respectively. With the consent of the remaining

partners, Albedo decided to retire from the partnership

by selling 75% of his capital to Razor (outsider) for

P750,000, and the remaining interest (including the

loan) was sold to the partnership in which he received

P50,000 in total.

Required: Prepare journal entries regarding the

partnership dissolution.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College