In the loanable funds market Multiple Choice demand for loanable funds shifts right if the interost rate falls. supply is vertical because loanable funds are fixed in any relevant time frame. demand is downward sloping because lower interest rates make more capital projects profitable. demand for loannble funds shifts right in the interest rate rises.

In the loanable funds market Multiple Choice demand for loanable funds shifts right if the interost rate falls. supply is vertical because loanable funds are fixed in any relevant time frame. demand is downward sloping because lower interest rates make more capital projects profitable. demand for loannble funds shifts right in the interest rate rises.

Chapter16: Labor Markets

Section: Chapter Questions

Problem 16.12P

Related questions

Question

Transcribed Image Text:In the loanable funds market

Multiple Choice

demand for loanable funds shifts right if the interest rate falls.

supply is vertical because loanable funds are fixed in any relevant time frame.

demand is downward sloping because lowver interest rates make more capital projects profitable.

demand for loanable funds shifts right in the interest rate rises

Say a firm that sells its product at a price of $40 is using 20 units of capital. If the marginal product of the last unit of capital used was 50, and the

constant rental rate of capital is $2,000, then this firm should

Multiple Choice

decrease its output.

decrease the amount of capital,

acquire more capital.

continue to use same units of capital.

In the market for loanable funds an increase in the government budget deficit will

Multiple Choice

increase the market rate of interest.

decrease the market rate of interest

have no effect over the market rate of interest.

increase the supply of loanable funds.

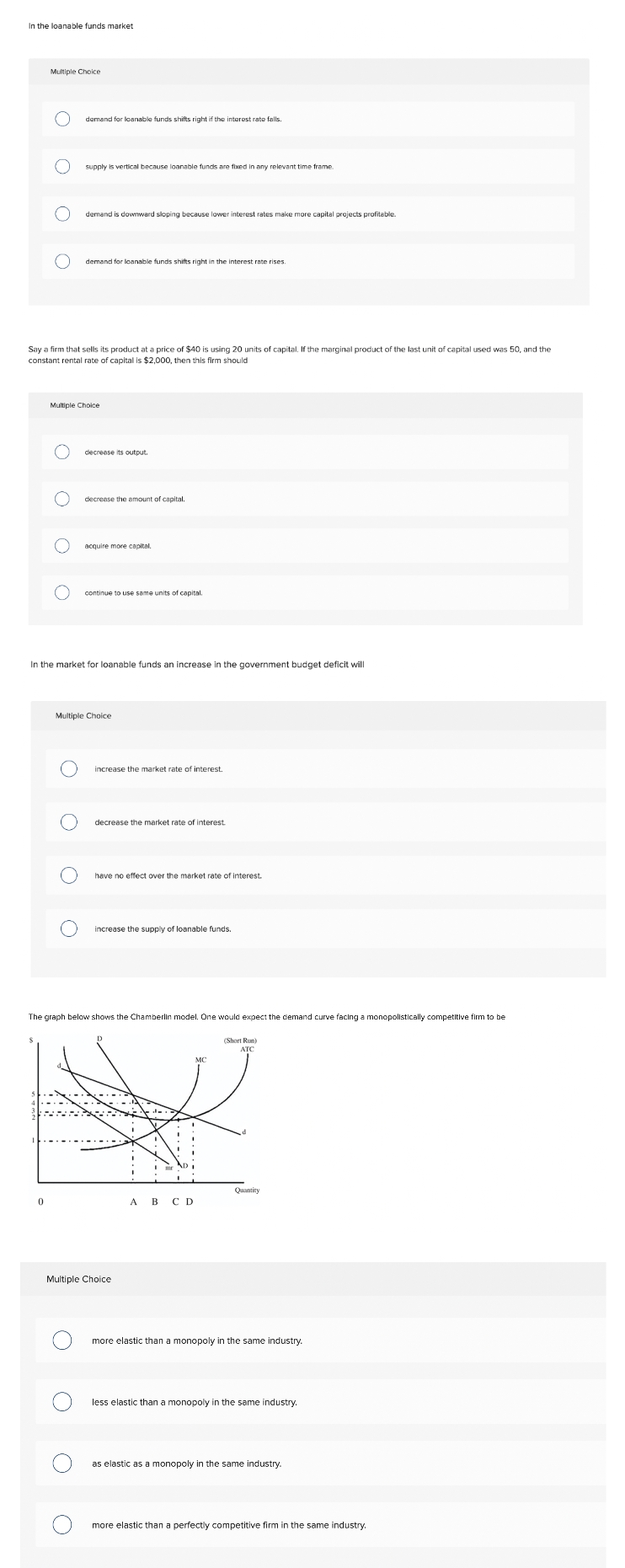

The graph below shows the Chamberlin model. One would expect the demand curve facing a monopolistically competitive firm to be

(Short Run)

АТС

Quantity

A B C D

Multiple Choice

more elastic than a monopoly in the same industry.

less elastic than a monopoly in the same industry.

as elastic as a monopoly in the same industry

more elastic than a perfectly competitive firm in the same industry.

O O O O

O O

O O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning