in valu ought it nomina

Q: Given the following information for Smashville, Inc., construct a balance sheet:

A: Answer:

Q: ot less than seven sentences, answer the following questions below: s an auditor, what do you think…

A: 1. While ascertaining audit procedures for PPE we need to test multiple audit results, valuation…

Q: materials (fiberglas labor le manufacturing ovex ed on direct labor ho manufacturing overhea .000 +…

A: The journal entries have been mentioned below.

Q: XYZ Corporation wants to issue ten-year $1,000 bonds 6% stated rate paying interest annually. Market…

A: Bonds represents the obligation of the company arose by borrowing financial help from the public by…

Q: Which statement is FALSE?

A: ANSWER The Second Statement is FALSE As it establishes a mutuality of interest between KPMG and the…

Q: IZZY Company recorded the following transactions for the year 2018: Collecnon of sccounts recervable…

A: Cash Provided from Investing Activities: It is necessary to employ cash for lengthy periods of time…

Q: Convert the cash flow shown in figure B to a future amount at t=7 when i=2%. a. $1110 $370 $370 $370…

A: To convert these cash inflows and outflows, we need to multiply the amount of cash inflows and…

Q: Problem 1 - Prepare a bank reconciliation The following information relates to M Park Corporation…

A: Bank reconciliation is the summary showing balances as per the bank and books which are required to…

Q: The comparative statements of Waterway Company are presented here. Waterway Company Income…

A: given Waterway CompanyIncome StatementsFor the Years Ended December 3120222021Net sales$1,813,300…

Q: What amount of money deposited 20 years ago at 4% interest would provide perpetual payment of Php…

A: An unending annuity can be defined as a perpetuity. That is payment of an equal amount of money at…

Q: Hello, in the above question 3 on the change in policy on the depreciation why not calculate the…

A: Depreciation is the loss in the value of the asset caused due to its usage, wear and tear. There are…

Q: The Beatrice Manufacturing Company increased its merchandise inventory by $29,000 over the year. The…

A: Cost of goods sold = Sales - Gross profit Cost of goods sold = $1,035,000 - ($1,035,000 x 45%) Cost…

Q: annual demand for 100,000 bars to service customers. Each bar costs $5.00, and cost per order is…

A: economic order quantity is such quantity that minimizes the total cost that will be incurred in…

Q: Suppose that a company has fixed costs of $22 per unit and variable costs $9 per unit when 15,000…

A: A "fixed cost" is a cost that does not change as the quantity of goods or services produced and sold…

Q: From pages 10-2 and 10-3 of the VLN, when a corporation goes to the stock market and buys the…

A: Treasury stock is the stock recorded at the cost price in books when company buys its own shares…

Q: . How much is the fair value of the net identifiable assets acquired? a. P 1,965,000.00 b. P…

A: On January 1, 2022, Tatay, Co. and Walanay, Inc. combined. Last year, on July 1, 2021, Tatay, Co.…

Q: Which of the following would you recommend to clients who want to increase the potential for their…

A: The answer for the multiple choice question and relevant explanation are presented hereunder : There…

Q: Comparative income statements are available for Johanna's Fine Furs 2010 2009 P 850,000 325,000…

A: There are two methods of analysis: Horizontal analysis Vertical analysis Horizontal Analysis: It…

Q: $fill in the blank 2 Should Petoskey keep or drop Conway?

A: Introduction: The contribution margin can be expressed as a percentage of the total or as a…

Q: QUESTION This in the first year a taxpayer has used a vehicde for business. They drive 0,000…

A: Total Expenses: It would be an aggregate of all the operation expenses incurred during the period.…

Q: “Four Cs of credit analysis” is used by analysts to evaluate creditworthiness. For each of the…

A: Credit analysis When an investor does financial analysis on governments, companies, etc. to check…

Q: Assume that the moving activity has an expected cost of $80,000. Expected directlabor hours are…

A: The cost of Moving Activity will be assigned on the basis of number of moves.

Q: Use this information, along with other da ation at January 31, 2020. What percenta

A: 1. The calculation as, Total cost on Dec 31, 2020 $ 35,945 Balance after accumulated…

Q: Rip Tide Company manufactures surfboards. Its standard cost information follows: Standard Standard…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Walsh Company manufactures and sells one product. The following information pertains to each of the…

A: solution 1a: Computation of Unit Product Cost - Variable Costing Particulars Year 1 Year 2…

Q: Erika Company makes 70,000 units per year of a part it uses in the products it manufactures. The…

A: Every business organization aims is to earn maximum profit, In the competitive environment is it not…

Q: A company reports the following for one of its products. Direct materials standard (4 pounds @ $2…

A: Answer - (a) Direct material price variance = (Standard price - Actual price) * Actual quantity…

Q: Calculate the total estimated uncollectibles based on the below information. Number of…

A: Allowance for uncollectible accounts is considered a contra asset account. It is used for the…

Q: formed the Evergreen partnership by contributing the following assets in exchange for a 50 percent…

A: Tax refers to the mandatory charge levied by the government over the money earned or gained by an…

Q: Calculate the insurable earnings.

A: Answer:

Q: Explain the relationship between the price of a bond, coupon rate, yield and time.

A:

Q: The Northeast Regional Division of Bridgeport Corp. has been requested to prepare a quarterly…

A: Solution Working note- 1- Purchase amount : =Sales * Percentage of average purchase. = (725000…

Q: A company produces piastic kitchenware and uses process costing system. Products go through three…

A: In the manufacturing industry, a process costing system is a way for computing the entire production…

Q: On January 1, 2019, the Business Info Company had capitalized costs of P6,000,000 for a new computer…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: The material price variance is computed by multiplying the difference between the actual price and…

A: GIVEN Material Price Variance is the difference between the actual cost of Material purchased and…

Q: 1.ABC Company has an incentive compensation plan that pays its president a bonus equal to 10% of the…

A: Since you have asked multiple questions we can solve only first question for you if you want to get…

Q: From page 10-3 of the VLN, when the company sells 100 shares of the treasury stock for $11 per…

A: When the company sells 100 shares of treasury stock at $11 per share which were purchased at The $12…

Q: promissory note for the balance plus 10% intereat On January 1, 2021, West Company acquired a tract…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: 17.3 You are to open the books of F Polk, a trader, via the journal to record the assets and liabil-…

A:

Q: 1. Cash balance according to the company's records at August 31, $25,520. 2. Cash balance according…

A: Introduction: Bank Reconciliation statement: To reconcile the difference between bank book and cash…

Q: Prepare a Flexible budget for overheads on the basis of the following data. Ascertain the overhead…

A: In budgetary control, various budgets are prepared namely, purchase budget, sales budget, cash…

Q: A statement of comprehensive income that shows expenses by their function is said to have been…

A: The income statement represents the net income or net loss calculated by deducting the expenses from…

Q: $14,500, accounts receivable of $473,000, inventories of $482,250, and accounts payable of $169,055.…

A: A Cash Budget is a forecast of expected cash receipts & expected cash payments. The Cash Budget…

Q: Africa Traders, a registered VAT vendor, manufactures and sells plastic toys. The VAT rate is 15%.…

A: VAT stands for Value Added Tax,. Formula is mentioned below- VAT= Output Tax – Input Tax.

Q: Tezos Co. reported the following capital structure at the beginning of the current year: Ordinary…

A: Net income means PAT i.e Profit after taxation. Particulars Amount PAT 1,920,000 Less:…

Q: trademark

A: On January 1, 2005, Mambusao Company bought a trademark from Panitan Company for P6,000,000. In…

Q: A relatively low P/E ratio illustrates

A: The PE ratio is calculated by dividing the share price by the earnings per share of the company. The…

Q: 3. An Con any selis IIS

A: In Cost Volume Profit analysis we always try to see that how…

Q: If Comcast is upgrading its cable boxes and has 650 obsolete boxes in ending inventory. ITI Box cost…

A: Solution: Under FIFO method, inventory purchased first should be considered as sold first keeping…

Q: During 2019, Latte Inc., spent P5,000,000 developing its new "Hyperion" software package. Of this…

A: The question is related to Accounting for Intangible Assets. In developing an Intangible Assets…

Step by step

Solved in 2 steps with 2 images

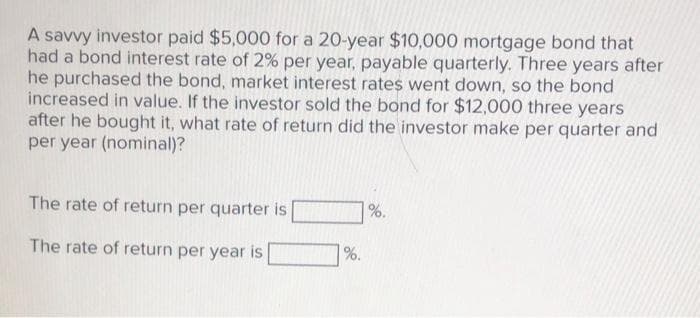

- Krystian Inc. issued 10-year bonds with a face value of $100,000 and a stated rate of 4% when the market rate was 6%. Interest was paid semi-annually. Calculate and explain the timing of the cash flows the purchaser of the bonds (the investor) will receive throughout the bond term. Would an investor be willing to pay more or less than face value for this bond?A savvy investor paid $6,500 for a 20-year $10,000 mortgage bond that had a bond interest rate of 12% per year, payable quarterly. Three years after he purchased the bond, market interest rates went down, so the bond increased in value. If the investor sold the bond for $11,500 three years after he bought it, what rate of return did the investor make per quarter and per year (nominal)?Four years earlier, Janice purchased a $1,000 face value corporate bond with a 6% annual coupon and maturing in 10 years. At the time of the purchase, it had an expected yield to maturity of 8.76%. If Janice sold the bond today for $1,088.39, what rate of return would she have earned for the last four years?

- Eren purchased a bond, costing 890, three years ago, with a current price of 925. This bond paid 100 year as interest payments ( end of each year). She wants to hold the bond for 4 more years and it is expected to be sold at the end of year four at 960. It is also expected that there will be no default of yearly interest payments. Assuming that the required rate of return is 11.25%. Compute the price of the bond?Last year, Sally purchased a $1,000 face value corporate bond with an 11.2 percent annual coupon rate and a 12-year maturity. At the time of the purchase, it had an expected yield to maturity of 11.9 percent. If Sally sold the bond today for $949.88, what rate of return would she have earned for the past year? a. 11.02% b. 11.20% c. 11.10% d. –0.69% e. 10.51%Manuel bought a $100,000 bond with a 5.5%coupon for $92,450 when it had five years remaining to maturity. What was the prevailing market rate at the time Manuel purchased the bond? Bond interest is paid semi-annually The bond was originally issued at its face value Bonds are redeemed at their face value at maturity Market rates of return and yields to maturity are compounded semiannually.

- A $9,000 bond had a coupon rate of 4.50% with interest paid semi-annually. Erin purchased this bond when there were 7 years left to maturity and when the market interest rate was 4.75% compounded semi-annually. He held the bond for 3 years, then sold it when the market interest rate was 4.25% compounded semi-annually. a. What was the purchase price of the bond? b. What was the selling price of the bond? c. What was Erin's gain or loss on this investment?. Please explain all three subparts. I will really upvotePlease assist with the following question below with handwritten working: An investor purchased a bond that pays $5 coupons annually at the end of every year for five years. The purchase price was $100 and it was redeemed at par after five years. If the annual effective inflation rate over the time period was 3%, calculate the real rate of return earned by the investor on this bond.