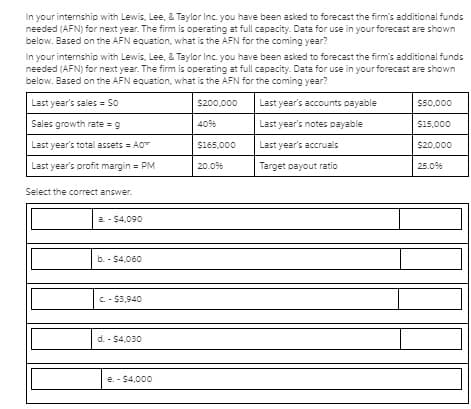

In your internship with Lewis, Lee, & Taylor Inc. you have been asked to forecast the firm's additional funds needed (AFN) for next year. The firm is operating at full capacity. Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year? In your internship with Lewis, Lee, & Taylor Inc. you have been asked to forecast the firm's additional funds needed (AFN) for next year. The firm is operating at full capacity. Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year? Last year's sales = So S200,000 Last year's accounts payable S50.000 Sales growth rate g 40% Last year's notes payable S15,000 Last year's total assets = AO S165,000 Last year's accruals $20,000 Last year's profit margin = PM 20.0% Target payout ratio 25.0% Select the correct answer. a- $4,090 b. - 54,060 C- S3,940 d. - $4,030 e. - $4,000

In your internship with Lewis, Lee, & Taylor Inc. you have been asked to forecast the firm's additional funds needed (AFN) for next year. The firm is operating at full capacity. Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year? In your internship with Lewis, Lee, & Taylor Inc. you have been asked to forecast the firm's additional funds needed (AFN) for next year. The firm is operating at full capacity. Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year? Last year's sales = So S200,000 Last year's accounts payable S50.000 Sales growth rate g 40% Last year's notes payable S15,000 Last year's total assets = AO S165,000 Last year's accruals $20,000 Last year's profit margin = PM 20.0% Target payout ratio 25.0% Select the correct answer. a- $4,090 b. - 54,060 C- S3,940 d. - $4,030 e. - $4,000

Chapter9: Projecting Financial Statements

Section: Chapter Questions

Problem 11DQ

Related questions

Question

Transcribed Image Text:In your internship with Lewis, Lee, & Taylor Inc. you have been asked to forecast the firm's additional funds

needed (AFN) for next year. The firm is operating at full capacity. Data for use in your forecast are shown

below. Based on the AFN equation, what is the AFN for the coming year?

In your internship with Lewis, Lee, & Taylor Inc. you have been asked to forecast the firm's additional funds

needed (AFN) for next year. The firm is operating at full capacity. Data for use in your forecast are shown

below. Based on the AFN equation, what is the AFN for the coming year?

Last year's sales = So

S200,000

Last year's accounts payable

$50,000

Sales growth rate =9

40%

Last year's notes payable

S15,000

Last year's total assets = AO

S165,000

Last year's accruals

$20,000

Last year's profit margin = PM

20.0%

Target payout ratio

25.0%

Select the correct answer.

a - $4,090

b. - $4,060

C. - $3,940

d. - $4,030

e. - $4,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you