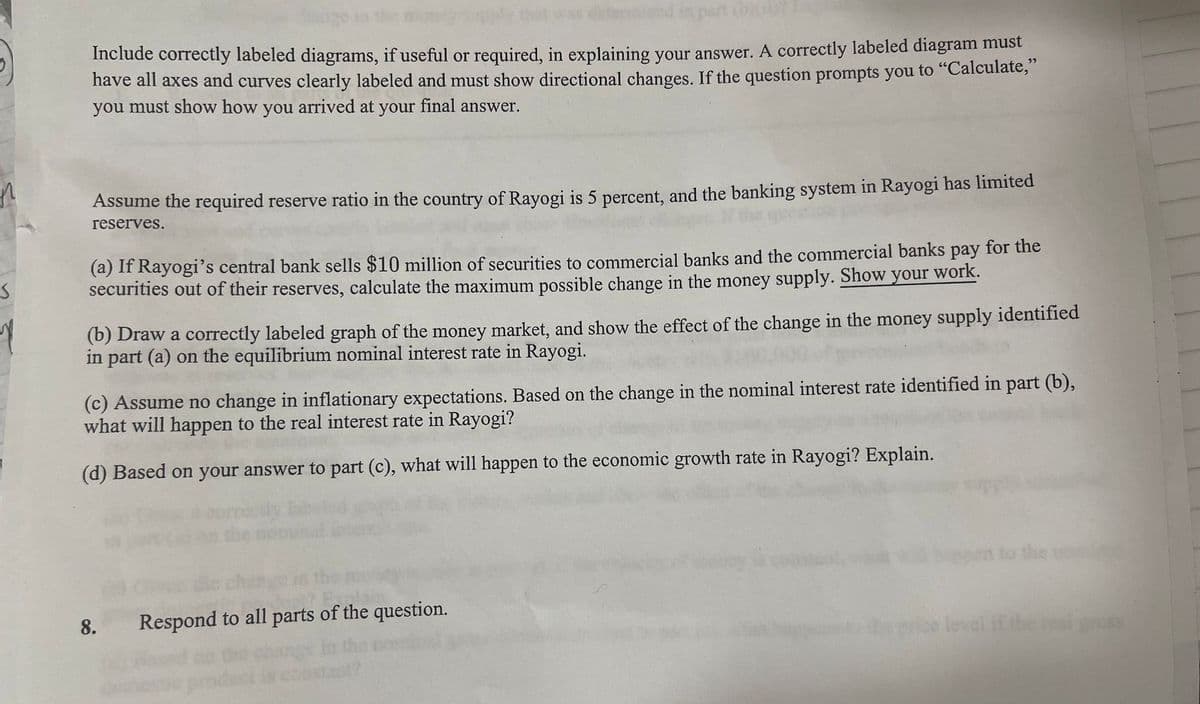

Include correctly labeled diagrams, if useful or required, in explaining your answer. A correctly labeled diagram must have all axes and curves clearly labeled and must show directional changes. If the question prompts you to "Calculate," you must show how you arrived at your final answer. Assume the required reserve ratio in the country of Rayogi is 5 percent, and the banking system in Rayogi has limited reserves. (a) If Rayogi's central bank sells $10 million of securities to commercial banks and the commercial banks pay for the securities out of their reserves, calculate the maximum possible change in the money supply. Show your work. (b) Draw a correctly labeled graph of the money market, and show the effect of the change in the money supply identified in part (a) on the equilibrium nominal interest rate in Rayogi. (c) Assume no change in inflationary expectations. Based on the change in the nominal interest rate identified in part (b), what will happen to the real interest rate in Rayogi? (d) Based on your answer to part (c), what will happen to the economic growth rate in Rayogi? Explain. 8. Respond to all parts of the question. to the wo if the real gr

Include correctly labeled diagrams, if useful or required, in explaining your answer. A correctly labeled diagram must have all axes and curves clearly labeled and must show directional changes. If the question prompts you to "Calculate," you must show how you arrived at your final answer. Assume the required reserve ratio in the country of Rayogi is 5 percent, and the banking system in Rayogi has limited reserves. (a) If Rayogi's central bank sells $10 million of securities to commercial banks and the commercial banks pay for the securities out of their reserves, calculate the maximum possible change in the money supply. Show your work. (b) Draw a correctly labeled graph of the money market, and show the effect of the change in the money supply identified in part (a) on the equilibrium nominal interest rate in Rayogi. (c) Assume no change in inflationary expectations. Based on the change in the nominal interest rate identified in part (b), what will happen to the real interest rate in Rayogi? (d) Based on your answer to part (c), what will happen to the economic growth rate in Rayogi? Explain. 8. Respond to all parts of the question. to the wo if the real gr

Chapter14: Banking And The Money Supply

Section: Chapter Questions

Problem 3.4P

Related questions

Question

do it on a piece of paper

Transcribed Image Text:Apart

Include correctly labeled diagrams, if useful or required, in explaining your answer. A correctly labeled diagram must

have all axes and curves clearly labeled and must show directional changes. If the question prompts you to "Calculate,”

you must show how you arrived at your final answer.

S

1

Assume the required reserve ratio in the country of Rayogi is 5 percent, and the banking system in Rayogi has limited

reserves.

(a) If Rayogi's central bank sells $10 million of securities to commercial banks and the commercial banks pay for the

securities out of their reserves, calculate the maximum possible change in the money supply. Show your work.

(b) Draw a correctly labeled graph of the money market, and show the effect of the change in the money supply identified

in part (a) on the equilibrium nominal interest rate in Rayogi.

(c) Assume no change in inflationary expectations. Based on the change in the nominal interest rate identified in part (b),

what will happen to the real interest rate in Rayogi?

(d) Based on your answer to part (c), what will happen to the economic growth rate in Rayogi? Explain.

8.

Respond to all parts of the question.

en to the

real gross

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1: Explain monetary policy and economic growth connection

VIEWStep 2: Find the maximum possible change in the money supply

VIEWStep 3: Show part a in a diagram

VIEWStep 4: Explain the effect on real interest rate from part b explanation

VIEWStep 5: Explain the effect on the economic growth rate from part c explanation

VIEWSolution

VIEWTrending now

This is a popular solution!

Step by step

Solved in 6 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you