Income for the year amounted to P 300,000. How much profit will be distributed to Juan?

Income for the year amounted to P 300,000. How much profit will be distributed to Juan?

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 3EA: The partnership of Tasha and Bill shares profits and losses in a 50:50 ratio, and the partners have...

Related questions

Question

Juan and Pedro’s

Juan, capital ending balance – P 3,000,000

Debits: June 1 - P 500,000

Credits: March 30 – P 1,000,000

Credits: October 30 – P 500,000

Pedro, capital ending capital balance – P 4,500,000

Credits: May 1 – P 1,000,000

Credits: August 31 – P 1,000,000

Income for the year amounted to P 300,000. How much profit will be distributed to Juan?

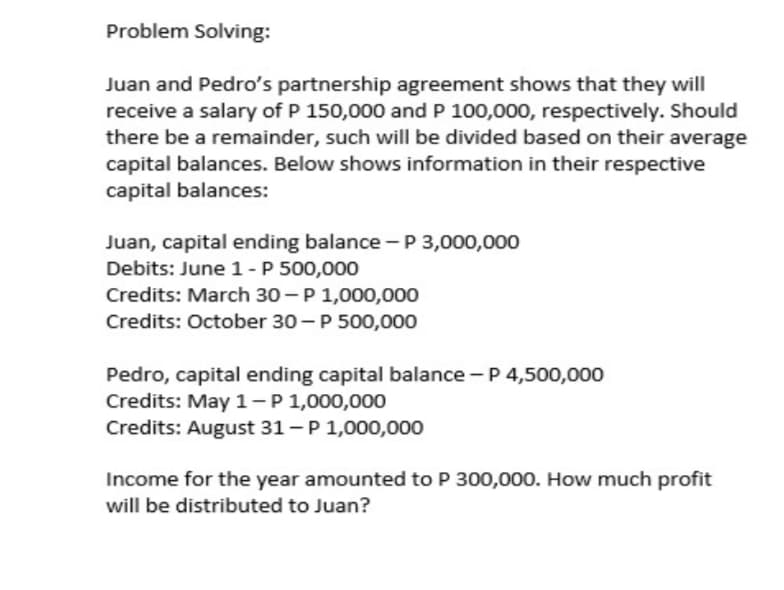

Transcribed Image Text:Problem Solving:

Juan and Pedro's partnership agreement shows that they will

receive a salary of P 150,000 and P 100,000, respectively. Should

there be a remainder, such will be divided based on their average

capital balances. Below shows information in their respective

capital balances:

Juan, capital ending balance -P 3,000,000

Debits: June 1-P 500,000

Credits: March 30 – P 1,000,000

Credits: October 30 - P 500,000

Pedro, capital ending capital balance - P 4,500,000

Credits: May 1-P1,000,000

Credits: August 31 - P 1,000,000

Income for the year amounted to P 300,000. How much profit

will be distributed to Juan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning