On June 30, Chub invested cash in an amount equal to the current market value of Max's partnership capital. Max, the managing partner, would earn two- thirds of partnership profits. Chub agreed to accept one-third of the profits. During the remainder of the year, the partnership earned P450,000. The temporary withdrawals of Max and Chub were P352,000 and P230,000, respectively.

On June 30, Chub invested cash in an amount equal to the current market value of Max's partnership capital. Max, the managing partner, would earn two- thirds of partnership profits. Chub agreed to accept one-third of the profits. During the remainder of the year, the partnership earned P450,000. The temporary withdrawals of Max and Chub were P352,000 and P230,000, respectively.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

ChapterMB: Model-building Problems

Section: Chapter Questions

Problem 9M

Related questions

Question

About accounting formation. Please provide solution/explanation. Thank you!

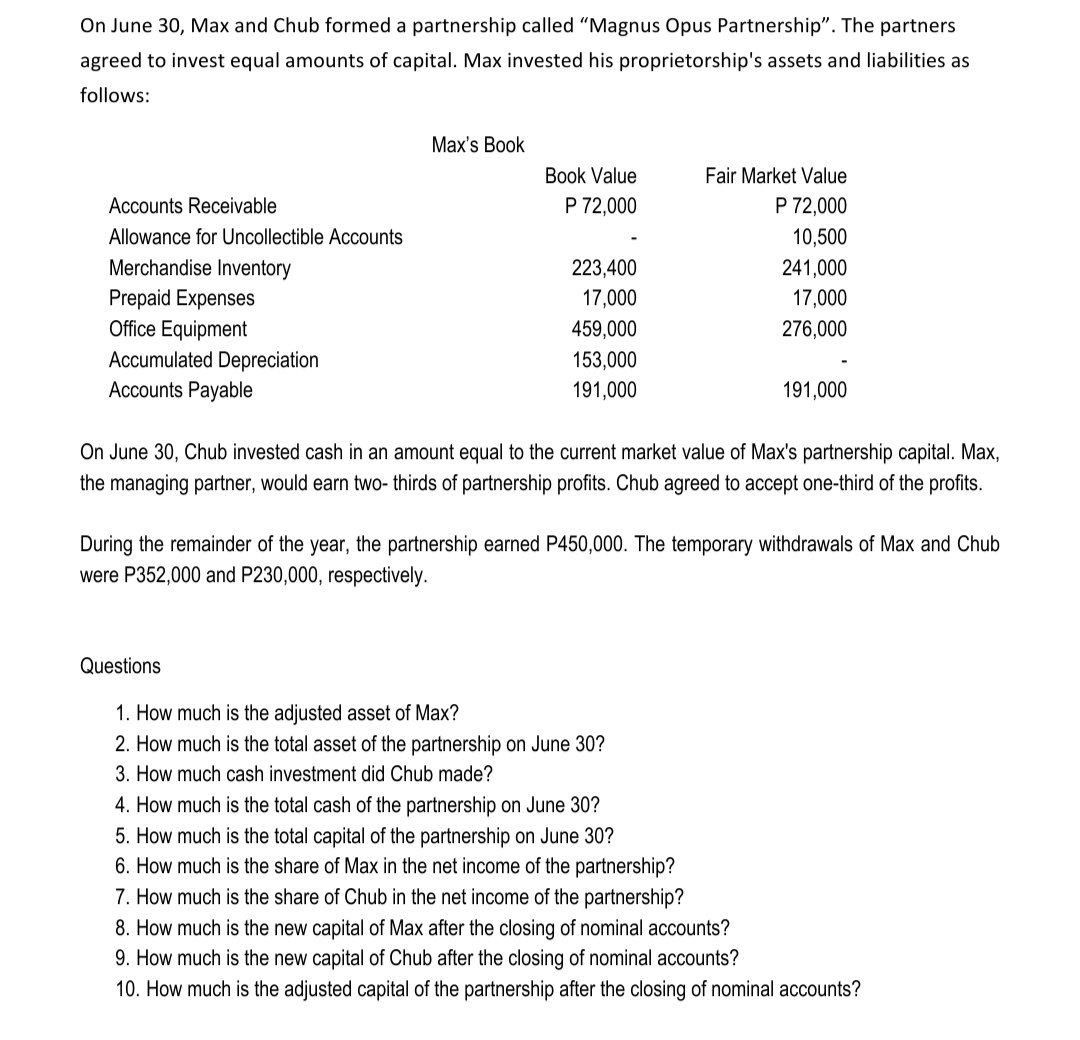

Transcribed Image Text:On June 30, Max and Chub formed a partnership called "Magnus Opus Partnership". The partners

agreed to invest equal amounts of capital. Max invested his proprietorship's assets and liabilities as

follows:

Max's Book

Book Value

Fair Market Value

Accounts Receivable

P 72,000

P 72,000

Allowance for Uncollectible Accounts

10,500

Merchandise Inventory

223,400

241,000

17,000

Prepaid Expenses

Office Equipment

17,000

459,000

276,000

Accumulated Depreciation

Accounts Payable

153,000

191,000

191,000

On June 30, Chub invested cash in an amount equal to the current market value of Max's partnership capital. Max,

the managing partner, would earn two- thirds of partnership profits. Chub agreed to accept one-third of the profits.

During the remainder of the year, the partnership earned P450,000. The temporary withdrawals of Max and Chub

were P352,000 and P230,000, respectively.

Questions

1. How much is the adjusted asset of Max?

2. How much is the total asset of the partnership on June 30?

3. How much cash investment did Chub made?

4. How much is the total cash of the partnership on June 30?

5. How much is the total capital of the partnership on June 30?

6. How much is the share of Max in the net income of the partnership?

7. How much is the share of Chub in the net income of the partnership?

8. How much is the new capital of Max after the closing of nominal accounts?

9. How much is the new capital of Chub after the closing of nominal accounts?

10. How much is the adjusted capital of the partnership after the closing of nominal accounts?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 2 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage