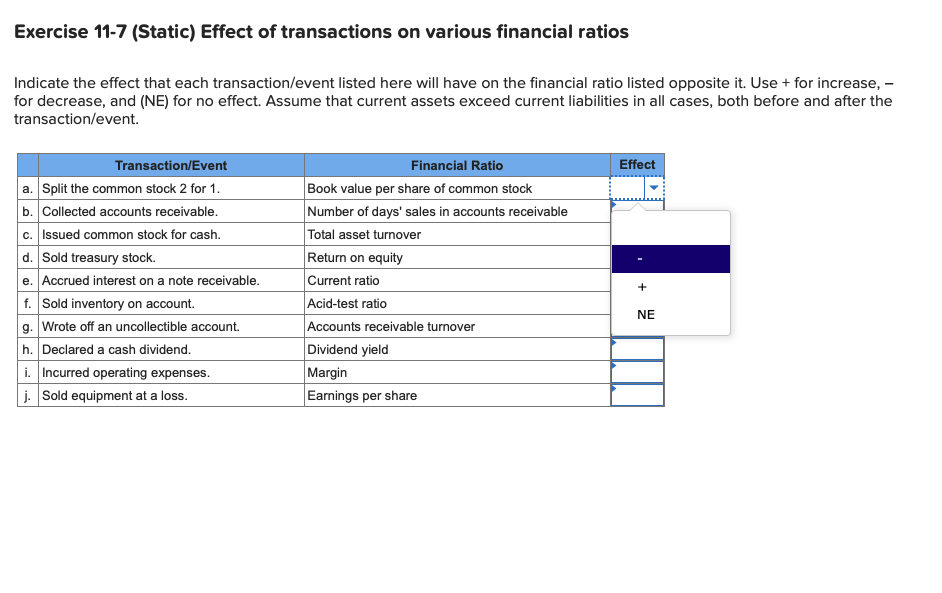

Indicate the effect that each transaction/event listed here will have on the financial ratio listed opposite it. Use + for increase, - for decrease, and (NE) for no effect. Assume that current assets exceed current liabilities in all cases, both before and after the transaction/event. Transaction/Event Financial Ratio Effect a. Split the common stock 2 for 1. b. Collected accounts receivable. c. Issued common stock for cash. d. Sold treasury stock. e. Accrued interest on a note receivable. f. Sold inventory on account. g. Wrote off an uncollectible account. h. Declared a cash dividend. i. Incurred operating expenses. j. Sold equipment at a loss. Book value per share of common stock Number of days' sales in accounts receivable Total asset turnover Return on equity Current ratio Acid-test ratio Accounts receivable turnover Dividend yield Margin NE Earnings per share

Indicate the effect that each transaction/event listed here will have on the financial ratio listed opposite it. Use + for increase, - for decrease, and (NE) for no effect. Assume that current assets exceed current liabilities in all cases, both before and after the transaction/event. Transaction/Event Financial Ratio Effect a. Split the common stock 2 for 1. b. Collected accounts receivable. c. Issued common stock for cash. d. Sold treasury stock. e. Accrued interest on a note receivable. f. Sold inventory on account. g. Wrote off an uncollectible account. h. Declared a cash dividend. i. Incurred operating expenses. j. Sold equipment at a loss. Book value per share of common stock Number of days' sales in accounts receivable Total asset turnover Return on equity Current ratio Acid-test ratio Accounts receivable turnover Dividend yield Margin NE Earnings per share

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter24: Analysis Of Financial Statements

Section: Chapter Questions

Problem 10SPB: RATIO ANALY SIS OF COMPARATI VE FIN ANCIAL STATE MENT S Refer to the financial statements in Problem...

Related questions

Question

Transcribed Image Text:Exercise 11-7 (Static) Effect of transactions on various financial ratios

Indicate the effect that each transaction/event listed here will have on the financial ratio listed opposite it. Use + for increase, –

for decrease, and (NE) for no effect. Assume that current assets exceed current liabilities in all cases, both before and after the

transaction/event.

Transaction/Event

Financial Ratio

Effect

a. Split the common stock 2 for 1.

b. Collected accounts receivable.

c. Issued common stock for cash.

d. Sold treasury stock.

e. Accrued interest on a note receivable.

f. Sold inventory on account.

g. Wrote off an uncollectible account.

h. Declared a cash dividend.

i. Incurred operating expenses.

j. Sold equipment at a loss.

Book value per share of common stock

Number of days' sales in accounts receivable

Total asset turnover

Return on equity

Current ratio

Acid-test ratio

Accounts receivable turnover

Dividend yield

Margin

NE

Earnings per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning