Keira purchased several pieces of equipment (all 7-year property) during 2021 for $2.100.000. She ues the half-year convention for 2021. She has taxable income of $3,050.000 before computing depreciation. What is the total amount of depreciation she can deduct for these assets for 2021. assuming she elects to use the maximum amount of Section 179 that she qualifies for but she elects out of Bonus depreciation for the year? O $1,637,166 $638,643 O $1,200,045

Keira purchased several pieces of equipment (all 7-year property) during 2021 for $2.100.000. She ues the half-year convention for 2021. She has taxable income of $3,050.000 before computing depreciation. What is the total amount of depreciation she can deduct for these assets for 2021. assuming she elects to use the maximum amount of Section 179 that she qualifies for but she elects out of Bonus depreciation for the year? O $1,637,166 $638,643 O $1,200,045

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 27P

Related questions

Question

1.

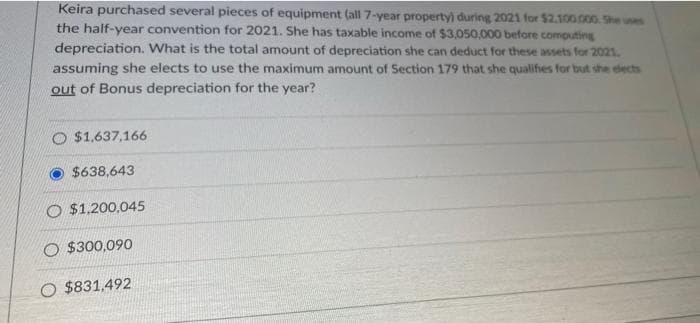

Transcribed Image Text:Keira purchased several pieces of equipment (all 7-year property) during 2021 for $2.100.000. She uses

the half-year convention for 2021. She has taxable income of $3,050,000 before computing

depreciation. What is the total amount of depreciation she can deduct for these assets for 2021.

assuming she elects to use the maximum amount of Section 179 that she qualifies for but she elects

out of Bonus depreciation for the year?

O $1,637,166

$638,643

O $1,200,045

O $300,090

O $831,492

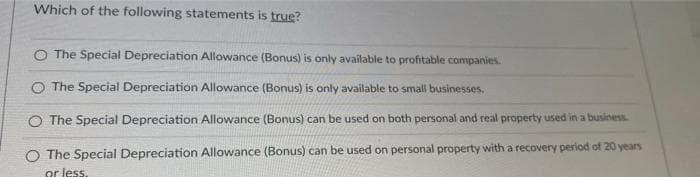

Transcribed Image Text:Which of the following statements is true?

O The Special Depreciation Allowance (Bonus) is only available to profitable companies.

O The Special Depreciation Allowance (Bonus) is only available to small businesses.

O The Special Depreciation Allowance (Bonus) can be used on both personal and real property used in a business

The Special Depreciation Allowance (Bonus) can be used on personal property with a recovery period of 20 years

or less.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT