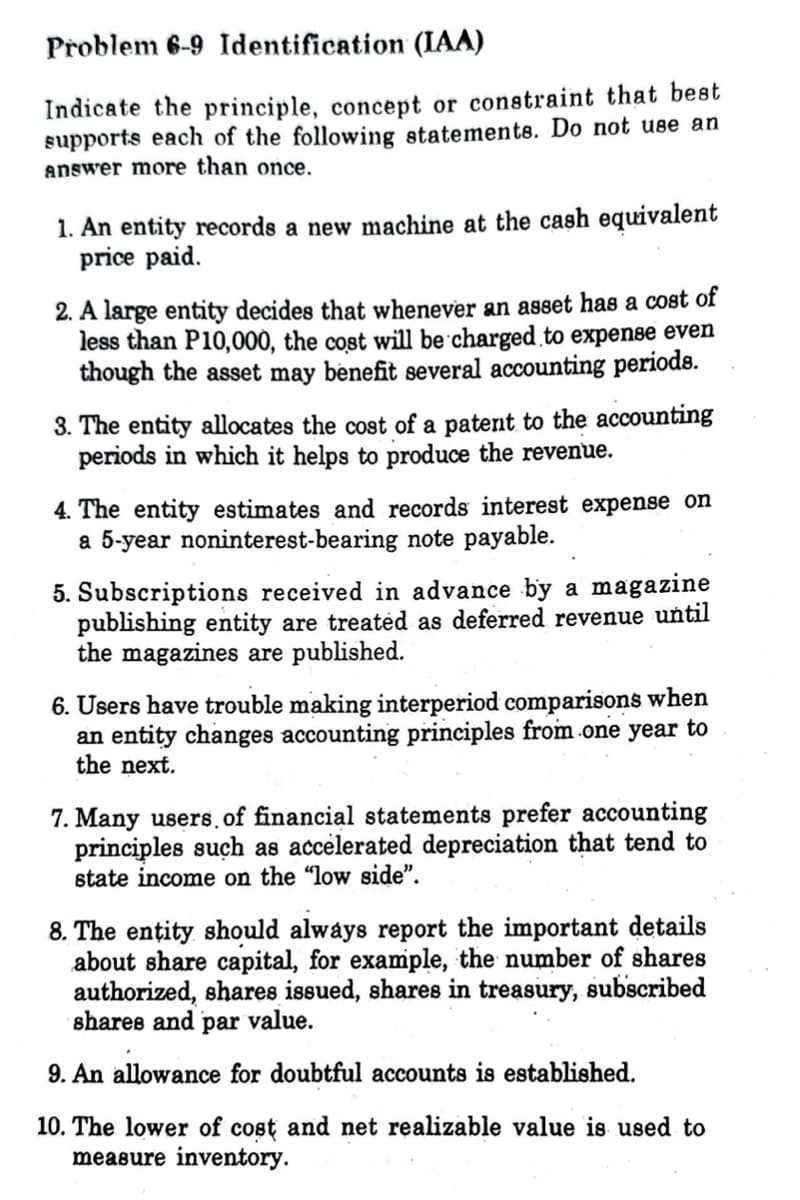

Indicate the principle, concept or constraint that best supports each of the following statements. Do not use an answer more than once. 1. An entity records a new machine at the cash equivalent price paid. 2. A large entity decides that whenever an asset has a cost of less than P10,000, the cost will be charged to expense even though the asset may benefit several accounting periods. 3. The entity allocates the cost of a patent to the accounting periods in which it helps to produce the revenue. 4. The entity estimates and records interest expense on a 5-year noninterest-bearing note payable. 5. Subscriptions received in advance by a magazine publishing entity are treated as deferred revenue until the magazines are published. 6. Users have trouble making interperiod comparisons when an entity changes accounting principles from one year to the next. 7. Many users, of financial statements prefer accounting principles such as accelerated depreciation that tend to state income on the "low side". 8. The entity should always report the important details about share capital, for example, the number of shares authorized, shares issued, shares in treasury, subscribed shares and par value. 9. An allowance for doubtful accounts is established. 10. The lower of cost and net realizable value is used to measure inventory.

Indicate the principle, concept or constraint that best supports each of the following statements. Do not use an answer more than once. 1. An entity records a new machine at the cash equivalent price paid. 2. A large entity decides that whenever an asset has a cost of less than P10,000, the cost will be charged to expense even though the asset may benefit several accounting periods. 3. The entity allocates the cost of a patent to the accounting periods in which it helps to produce the revenue. 4. The entity estimates and records interest expense on a 5-year noninterest-bearing note payable. 5. Subscriptions received in advance by a magazine publishing entity are treated as deferred revenue until the magazines are published. 6. Users have trouble making interperiod comparisons when an entity changes accounting principles from one year to the next. 7. Many users, of financial statements prefer accounting principles such as accelerated depreciation that tend to state income on the "low side". 8. The entity should always report the important details about share capital, for example, the number of shares authorized, shares issued, shares in treasury, subscribed shares and par value. 9. An allowance for doubtful accounts is established. 10. The lower of cost and net realizable value is used to measure inventory.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 62BPSB: Problem 2-62B Comprehensive Problem Mulberry Services sells electronic data processing services to...

Related questions

Question

Kindly answer numbers 1-10.

Transcribed Image Text:Problem 6-9 Identification (IAA)

Indicate the principle, concept or constraint that best

supports each of the following statements. Do not use an

answer more than once.

1. An entity records a new machine at the cash equivalent

price paid.

2. A large entity decides that whenever an asset has a cost of

less than P10,000, the cost will be charged to expense even

though the asset may benefit several accounting periods.

3. The entity allocates the cost of a patent to the accounting

periods in which it helps to produce the revenue.

4. The entity estimates and records interest expense on

a 5-year noninterest-bearing note payable.

.

5. Subscriptions received in advance by a magazine

publishing entity are treated as deferred revenue until

the magazines are published.

6. Users have trouble making interperiod comparisons when

an entity changes accounting principles from one year to

the next.

7. Many users, of financial statements prefer accounting

principles such as accelerated depreciation that tend to

state income on the "low side".

8. The entity should always report the important details

about share capital, for example, the number of shares

authorized, shares issued, shares in treasury, subscribed

shares and par value.

9. An allowance for doubtful accounts is established.

10. The lower of cost and net realizable value is used to

measure inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning