Individuals filing federal income tax returns prior to March 31 ceived an average refund of $1080. Consider the population of last inute filers who mail their tax return "late" in April. A researcher ggests that a reason individuals wait until the last minute is that on verage these individuals receive lower refunds than do early filers. or a sample of 400 individuals who filed a tax return in April, the

Individuals filing federal income tax returns prior to March 31 ceived an average refund of $1080. Consider the population of last inute filers who mail their tax return "late" in April. A researcher ggests that a reason individuals wait until the last minute is that on verage these individuals receive lower refunds than do early filers. or a sample of 400 individuals who filed a tax return in April, the

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter4: Equations Of Linear Functions

Section: Chapter Questions

Problem 8SGR

Related questions

Topic Video

Question

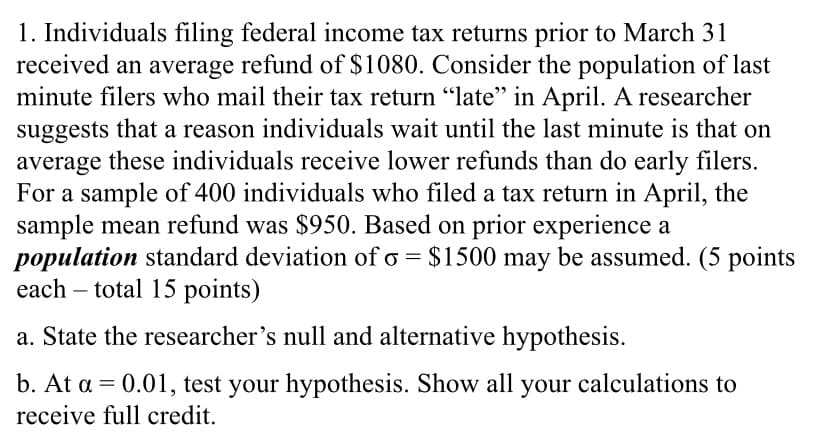

a. State the researcher’s null and alternative hypothesis.

b. At α = 0.01, test your hypothesis. Show all your calculations to receive full credit.

Transcribed Image Text:1. Individuals filing federal income tax returns prior to March 31

received an average refund of $1080. Consider the population of last

minute filers who mail their tax return "late" in April. A researcher

suggests that a reason individuals wait until the last minute is that on

average these individuals receive lower refunds than do early filers.

For a sample of 400 individuals who filed a tax return in April, the

sample mean refund was $950. Based on prior experience a

population standard deviation of o = $1500 may be assumed. (5 points

each – total 15 points)

a. State the researcher's null and alternative hypothesis.

b. At a = 0.01, test your hypothesis. Show all your calculations to

receive full credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill