Industry Average Ratio Actual 2003 Actual 2002 Current ratio 1.80 1.84 Quick ratio Inventory turnover Average collection 0.70 0.78 2.50 2.59

Industry Average Ratio Actual 2003 Actual 2002 Current ratio 1.80 1.84 Quick ratio Inventory turnover Average collection 0.70 0.78 2.50 2.59

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 83E

Related questions

Question

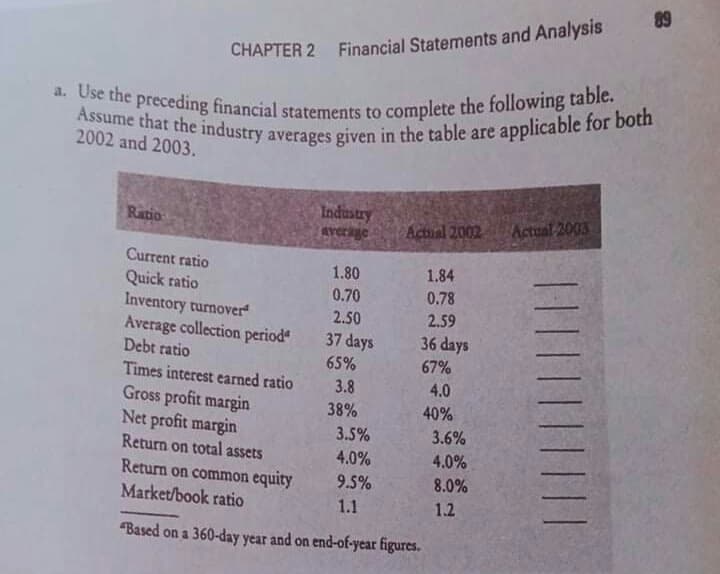

A. Use the preceding financial statements to complete the following table. Assume that the industry averages given in the table are applicable for both 2002 and 2003. Thank you

Transcribed Image Text:89

a. Use the preceding financial statements to complete the following table.

Assume that the industry averages given in the table are applicable for both

CHAPTER 2 Financial Statements and Analysis

Assum preceding financial statements to complete the following table.

2002 and 2003.

Industry

averige

Ratio

Actial 2002

Actual-2003

Current ratio

1.80

1.84

Quick ratio

Inventory turnover

Average collection period

Debt ratio

0.70

0.78

2.50

2.59

37 days

36 days

65%

67%

Times interest earned ratio

3.8

4.0

Gross profit margin

Net profit margin

Return on total assets

38%

40%

3.5%

3.6%

4.0%

4.0%

Return on common equity

Market/book ratio

9.5%

1.1

8.0%

1.2

"Based on a 360-day year and on end-of-year figures.

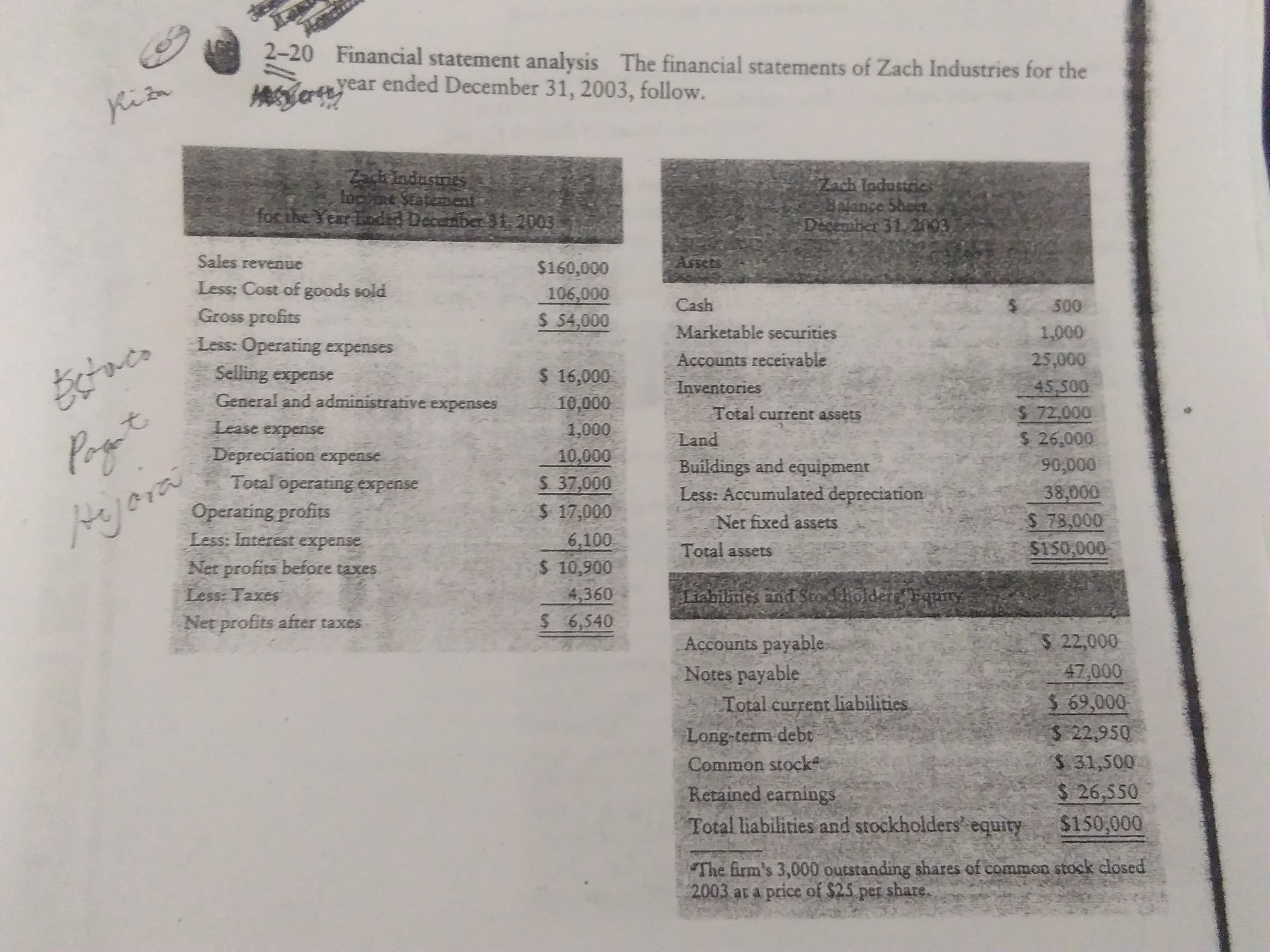

Transcribed Image Text:2-20 Financial statement analysis The financial statements of Zach Industries for the

year ended December 31, 2003, follow.

Kiza

Zach ladustics

for the Year oded December 31,2003

December 31, 2003

Sales revenue

$160,000

$233S

Less: Cost of goods sold

000'901

Cash

Gross profits

$ 54,000

00S

Marketable securities

Less: Operating expenses

Accounts receivable

$ 16,000

00000

Selling expense

Inventories

45,500

000'0

0000 0

General and administrative expenses

Total current assets

Lease expense

pur

Buildings and equipment

to

000

Depreciation expense

Total operating expense

$ 37,000

Less: Accumulated depreciation

38,000

000 0

6,100

Operating profits

Net fixed assets

$ 78,000

Less: Interést expense

Total assetS

Net profits before taxes

4,360

Liabilines and Stockliolderg Fquity

Less: Taxes

Net profits after taxes

%246,540

Accounts payable

$ 22,000

Notes payable

Total current liabilities

$ 22,950

$ 31,500

Long-term debt

Common stock

Retained earnings

2426,550

Total liabilities and stockholders' equity

The firm's 3,000 outstanding shares of common stock closed

2003 at a price of $25 per share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning