Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 17P

Related questions

Question

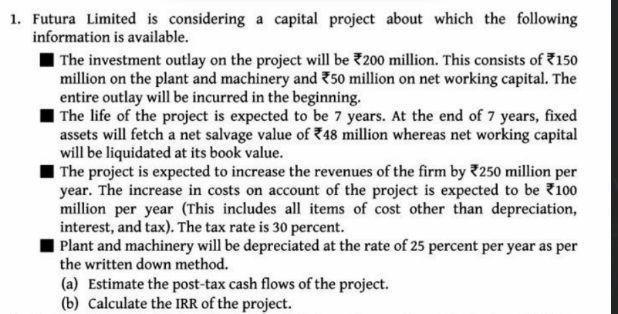

Transcribed Image Text:1. Futura Limited is considering a capital project about which the following

information is available.

I The investment outlay on the project will be 200 million. This consists of 7150

million on the plant and machinery and 750 million on net working capital. The

entire outlay will be incurred in the beginning.

The life of the project is expected to be 7 years. At the end of 7 years, fixed

assets will fetch a net salvage value of 748 million whereas net working capital

will be liquidated at its book value.

| The project is expected to increase the revenues of the firm by 7250 million per

year. The increase in costs on account of the project is expected to be 100

million per year (This includes all items of cost other than depreciation,

interest, and tax). The tax rate is 30 percent.

| Plant and machinery will be depreciated at the rate of 25 percent per year as per

the written down method.

(a) Estimate the post-tax cash flows of the project.

(b) Calculate the IRR of the project.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub