EXERCISE 7-10. Journal Entries and Problem Solving 1: Withdrawal or retirement of a partner. Rizal, Bonifacio, Mabini, and Luna, partners in a business with a trade name Modern Heroes Trading, share profits and losses in the ratio of 40:30:15:15, respectively. After revenue, expense, and drawing accounts had been closed on December 31. 2019, remaining real accounts had the following balances: Cash P 298,500 Notes Payable P115,000 Accounts Receivable 175,000 Mortgage Payable 150.000 Merchandise Inventory 95.000 Rizal, Capital 139,000 Equipment 250,000 Bonifacio, Capital 118,000 Accumulated Depreciation - Equipment 67,500 Mabini. Capital 95.000 Accounts Payable 60.000 Luna, Capital 74,000 On that date, Bonifacio decided to withdraw from the partnership due to health reasons. The partnership agreement provides that in the event of dissolution, all assets and liabilities should be revalued. It was determined that all assets and liabilities were properly revalued except for merchandise inventory and equipment with agreed-upon values of P172,000 and P190,000, respectively. REQUIRED: 1. Prepare journal entry regarding payment to Bonifacio under the following independent situations: 2. Paid by Rizal at an amount equal to 105% of his capital account balance after the revaluation 3. Paid by Rizal and Luna proportionally at an amount equal to 90% of his capital account balance after the revaluation 4. Paid by the partnership at amount equal to his capital account balance after the revaluation 5. Paid by the partnership at an amount equal to P10,000 more than his capital account balance after the revaluation 6. Paid by the partnership at an amount equal to P8.000 less than his capital account balance after the revaluation 7. Determine the capital account balances of the continuing partners after the withdrawal of Bonifacio under situations a to e in Requirement 1. Activa

EXERCISE 7-10. Journal Entries and Problem Solving 1: Withdrawal or retirement of a partner. Rizal, Bonifacio, Mabini, and Luna, partners in a business with a trade name Modern Heroes Trading, share profits and losses in the ratio of 40:30:15:15, respectively. After revenue, expense, and drawing accounts had been closed on December 31. 2019, remaining real accounts had the following balances: Cash P 298,500 Notes Payable P115,000 Accounts Receivable 175,000 Mortgage Payable 150.000 Merchandise Inventory 95.000 Rizal, Capital 139,000 Equipment 250,000 Bonifacio, Capital 118,000 Accumulated Depreciation - Equipment 67,500 Mabini. Capital 95.000 Accounts Payable 60.000 Luna, Capital 74,000 On that date, Bonifacio decided to withdraw from the partnership due to health reasons. The partnership agreement provides that in the event of dissolution, all assets and liabilities should be revalued. It was determined that all assets and liabilities were properly revalued except for merchandise inventory and equipment with agreed-upon values of P172,000 and P190,000, respectively. REQUIRED: 1. Prepare journal entry regarding payment to Bonifacio under the following independent situations: 2. Paid by Rizal at an amount equal to 105% of his capital account balance after the revaluation 3. Paid by Rizal and Luna proportionally at an amount equal to 90% of his capital account balance after the revaluation 4. Paid by the partnership at amount equal to his capital account balance after the revaluation 5. Paid by the partnership at an amount equal to P10,000 more than his capital account balance after the revaluation 6. Paid by the partnership at an amount equal to P8.000 less than his capital account balance after the revaluation 7. Determine the capital account balances of the continuing partners after the withdrawal of Bonifacio under situations a to e in Requirement 1. Activa

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 16EA: Discuss how each of the following transactions for Watson, International, will affect assets,...

Related questions

Question

need help with 1, 2, 3

Transcribed Image Text:EXERCISE 7-10. Journal Entries and Problem Solving 1:

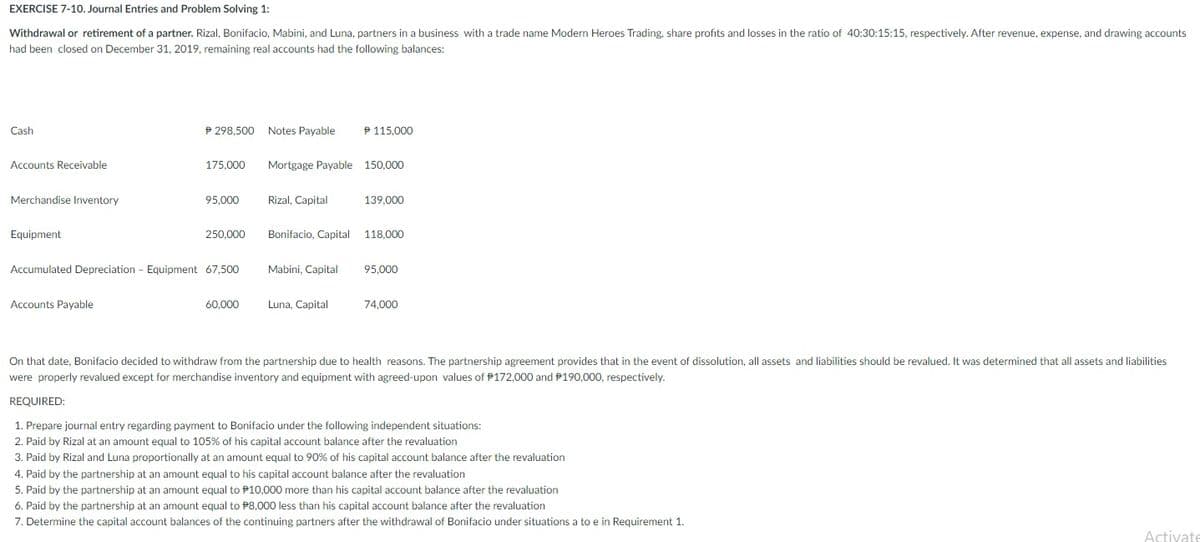

Withdrawal or retirement of a partner. Rizal, Bonifacio, Mabini, and Luna, partners in a business with a trade name Modern Heroes Trading, share profits and losses in the ratio of 40:30:15:15, respectively. After revenue, expense, and drawing accounts

had been closed on December 31, 2019, remaining real accounts had the following balances:

Cash

P 298,500 Notes Payable

P 115,000

Accounts Receivable

175,000

Mortgage Payable 150,000

Merchandise Inventory

95,000

Rizal, Capital

139,000

Equipment

250,000

Bonifacio, Capital

118,000

Accumulated Depreciation - Equipment 67,500

Mabini, Capital

95,000

Accounts Payable

60,000

Luna, Capital

74,000

On that date, Bonifacio decided to withdraw from the partnership due to health reasons. The partnership agreement provides that in the event of dissolution, all assets and liabilities should be revalued. It was determined that all assets and liabilities

were properly revalued except for merchandise inventory and equipment with agreed-upon values of P172,000 and P190,000, respectively.

REQUIRED:

1. Prepare journal entry regarding payment to Bonifacio under the following independent situations:

2. Paid by Rizal at an amount equal to 105% of his capital account balance after the revaluation

3. Paid by Rizal and Luna proportionally at an amount equal to 90% of his capital account balance after the revaluation

4. Paid by the partnership at an amount equal to his capital account balance after the revaluation

5. Paid by the partnership at an amount equal to P10,000 more than his capital account balance after the revaluation

6. Paid by the partnership at an amount equal to P8,000 less than his capital account balance after the revaluation

7. Determine the capital account balances of the continuing partners after the withdrawal of Bonifacio under situations a to e in Requirement 1.

Activate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,