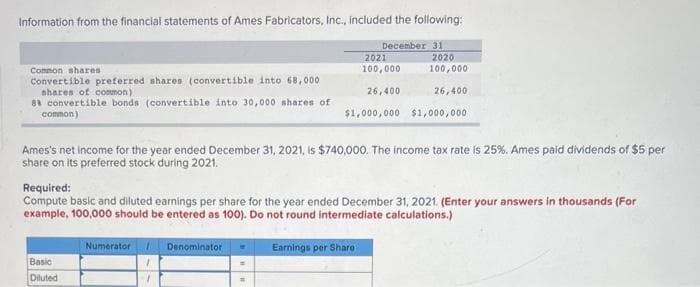

Information from the financial statements of Ames Fabricators, Inc., included the following: December 31 Common shares Convertible preferred shares (convertible into 68,000 shares of common) 88 convertible bonds (convertible into 30,000 shares of common) 2021 100,000 26,400 $1,000,000 2020 100,000 26,400 Numerator Denominator $1,000,000 Ames's net income for the year ended December 31, 2021, is $740,000. The income tax rate is 25%. Ames paid dividends of $5 per share on its preferred stock during 2021. Required: Compute basic and diluted earnings per share for the year ended December 31, 2021. (Enter your answers in thousands (For example, 100,000 should be entered as 100). Do not round intermediate calculations.) Earnings per Share

Q: Problem 19-2A a b C d e f g1 g2 Correct Materials Correct Accounts Payable Correct Work in Process…

A: A business contract is entered as a journal entry inside the company's accounting records. In…

Q: Angelo Ltd produces a range of tools used in the construction industry. The costing system indicates…

A: Formulas for Material Variance 1) Material Price Variance (MPV) MPV = (SP - AP) x AQ. Where, SP =…

Q: Use the following account heading: 100 Cash; 110 Supplies; 120 Accounts Receivable; 130 Prepaid…

A: Journal entries recording is the first step in accounting cycle process, under which atleast one…

Q: 10 Jacob was provided with a computer for private use on 1 October 2021. The market value of the…

A: Treatment of assets provided solely for personal use in tax law: There are specific rules for how…

Q: Discuss the circumstances that require a contingent liability to be disclosed in the notes to the…

A: A contingent liability is a liability that may (or may not) occur in future. The occurrence of…

Q: Using sec.gov, go to Regulations then Staff Interpretations. Locate Staff Accounting Bulletin No. 99…

A: SAB 99 addresses the accounting treatment of certain revenue arrangements. It provides guidance on…

Q: A company is thinking of investing in one of two potential new products for sale. The projections…

A: The cost of revenue is the sum of all expenditures incurred directly in manufacturing, selling, and…

Q: In a perpetual inventory system, the actual amount of inventory on hand may differ from what the…

A: Inventory refers to the raw materials or stock that are available for purchase or manufacture. Three…

Q: Enterprises is owned by Edmund Wilson and has a January 31 fiscal year end. The company prepares…

A: Adjusting entries are the entries in the accounting which are made at year end after the unadjusted…

Q: 7. The calculation of depreciation using the declining-balance method ignores salvage value in…

A: Double declining balance method is the method of depreciation in which depreciation is charged at…

Q: Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for…

A: Journal entries refers to the entries which are made at the end of the period or year and it records…

Q: 2 3 Cash 4 Accounts Receivable 1 Prepare the statement of Financial Positioning The December 31,…

A: Statement of Financial Position

Q: Explain the concept of contribution and limiting factors and how it can be effectively used in…

A: Contribution and limiting factors are concepts that can be used to evaluate the potential success of…

Q: Q.2 Amsterdam Corporation produces medical grade isotopes. The isotopes are produced in a single…

A: Answer- Cost per Equivalent Units - The cost per equivalent unit is calculated for direct…

Q: What would be the tax treatment of a superficial loss?

A: A: Permanently denied is incorrect because a superficial loss is not permanently denied, but rather…

Q: Mary, a widow, died in 2022. Her personal representative filed a federal estate tax return showing…

A: As per the provisions of IRS publication, fair market value of the contribution is to be determined…

Q: In the equation Y = 200 + 0.8X, Y represents Question 54 options: a) Variable cost per unit of…

A: The total cost of production is calculated as sum of variable and fixed cost. The variable cost…

Q: A company manufactures three products using the same production process. The costs incurred up to…

A:

Q: Assume that you desire to operate a food truck business. You have five food trucks. Some trucks will…

A: EXPECTED CASH FLOW Expected Cash Flow is Computed by multiplying Probability with Cash Flow.…

Q: 1. Acquired $35,000 cash from the issue of common stock. 2. Borrowed $35,000 cash from National…

A: Percentage of asset provided by investors, creditors, and earnings represents the ratio of cash…

Q: An auditor is not responsible for obtaining absolute assurance but only reasonable assurance.…

A: Auditor is referred to the professional who is responsible to verify the accounting records of a…

Q: Kingbird Enterprises is using a discounted cash flow model. Identify which model Kingbird might use…

A: There are two approaches of estimating the fair value Traditional Approach Expected cash flow…

Q: se the adjusted trial balance for Stockton Company to answer the question that follow Stockton…

A: The balance sheet represents the financial position of the business with assets and liabilities on a…

Q: Return on assets The financial statements of The Hershey Company (HSY) are shown in Exhibits 6…

A: In case of multiple subparts, we are allowed to solve only first 3 subparts. If you want other…

Q: Direct materials Schedule of Cost of Goods Manufactured For Year Ended December 31 Raw materials…

A: The cost of the products manufactured seems to be significant since it provides management with a…

Q: Apple Inc. 's market value is 2.15 T USD with the last trading price135.68. If an investor expects…

A: Market cap Market cap is defined as the entire value of all shares lying in the company's stock. It…

Q: Directions: Include the answers to the following questions in the Answers box below. 1. Apple…

A: Income Statement :— It is one of the financial statement that shows revenue, expenses, net income…

Q: Investors are more willing to put money into limited liability companies than partnerships because:…

A: A partnership is formed when two or more individuals or businesses come together to do business for…

Q: ential house and lot located in Manila on January 5, 2018 for 8,000,000. The property was purchased…

A: Capital Gain - A capital gain is a rise in the value of a capital asset that is realized upon the…

Q: K Chuck has $58,000 of salary and $11,850 of emized deductions. Casey has $86,000 of salary and…

A: Tax refers to the amount charged by the government from the individual and organisation on the…

Q: 57. FurryCats, Inc. makes cat beds and has budgeted 4 yards of fabric for each bed and fabric costs…

A: Direct material efficiency variance is the difference between the actual quantity of direct material…

Q: Sheridan Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes.…

A: Activity-based costing is a costing method that identifies activities in an organization and assigns…

Q: 2. How long will it take Php24,000 to increase to Php30,000 if the simple interest rate is 6.5%?

A: Nper stands for Number of periods which states the time period or time frame required to get the…

Q: Ivanhoe Company sells goods to Pharoah Company during 2025. It offers Pharoah the following rebates…

A: Revenue refers to the amount that is being earned from selling goods or services to customers that…

Q: PUZZLE 11.4 COMPREHENSIVE EXAMPLE-BASIC AND DILUTED Extracts from group financial statements of AB,…

A: Earnings Per Share - The term "earnings per share" (EPS) refers to a company's net profit divided by…

Q: 3) A generator was purchased two years ago at a price of P 1, 250,000 with a governmental tax of 4%…

A: Depreciation can be referred to as a decline in the book value of asset due to its usage in normal…

Q: Novak Co. has equipment that cost $84,000 and that has been depreciated $49.900. Record the disposal…

A: A) Loss on disposal of equipment = Cost - Accumulated depreciation Book value = cost - depreciation…

Q: Part of your job is to review customer requests for credit. You have three new credit applications…

A: The current ratio evaluates a business' ability to pay short-term loans or those that are due within…

Q: (The following information applies to the questions displayed below] Onslow Company purchased a used…

A: Depreciation seems to be an expense that is accountable for lowering the value of fixed assets as…

Q: Veronica works part-time and is currently in a 15% federal marginal tax bracket however, as of next…

A:

Q: Prepare the statement of Financial Positioning

A: Financial position or balance sheet is a financial statement that shows company's financial position…

Q: Scala Oil has the following information available regarding its three divisions: production,…

A: The corporation may have numerous departments, and one department may sell its output to another…

Q: Apex Corporation estimates that its production for the coming year will be 10,000 units with the…

A: Predetermined overhead rate is calculated on the starting of accounting period. It is calculated by…

Q: Exercise 9-15 Alternative depreciation methods On April 1, 2023, Ice Drilling Co. purchased a…

A: Depreciation is considered an expense charge on the value of the assets and it is charged by the…

Q: The following accounts balances and other financial information are drawn from the records of the…

A: Liability: It implies to the amount that is outstanding and due to be paid by the business to the…

Q: Bonita Corporation issues $470,000 of 9% bonds, due in 9 years, with interest payable semiannually.…

A:

Q: Analysts following the Ivanhoe Golf Company were given the following balance sheet information for…

A: Cash flow statement shows the cash inflow and cash outflow of the company. It involves the…

Q: xuestion/ A company issues new shares to fund a new manufacturing plant. Explain the meaning of the…

A: Arbitrage pricing theory (APT) is a multi-factor asset pricing model based on the concept that an…

Q: Thank you so much for the help. according to the tables: What is the Utility Payable balance in the…

A: Trail balance is a statement of all debit and credit balances of accounts. It is prepared under…

Q: 1 Nina Corporation, with the total assets of P15,000,000 (MSME), shows the following data duri Sales…

A: Itemized deductions are those deductions which can be deducted from the taxable income and help in…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Given the following year-end information, compute Greenwood Corporations basic and diluted earnings per share. Net income, 15,000 The income tax rate, 30% 4,000 shares of common stock were outstanding the entire year. shares of 10%, 50 par (and issuance price) convertible preferred stock were outstanding the entire year. Dividends of 2,500 were declared on this stock during the year. Each share of preferred stock is convertible into 5 shares of common stock.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.

- Longmont Corporation earned net income of $90,000 this year. The company began the year with 600 shares of common stock and issued 500 more on April 1. They issued $5,000 in preferred dividends for the year. What is the numerator of the EPS calculation for Longmont?Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.

- Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. (a)Received 20,000 for the balance due on subscriptions for preferred stock with a par value of 40,000 and issued the stock. (b)Purchased 10,000 shares of common treasury stock for 18 per share. (c)Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d)Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e)Sold 5,000 shares of common treasury stock for Si00,000. (f)Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g)Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.

- Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.