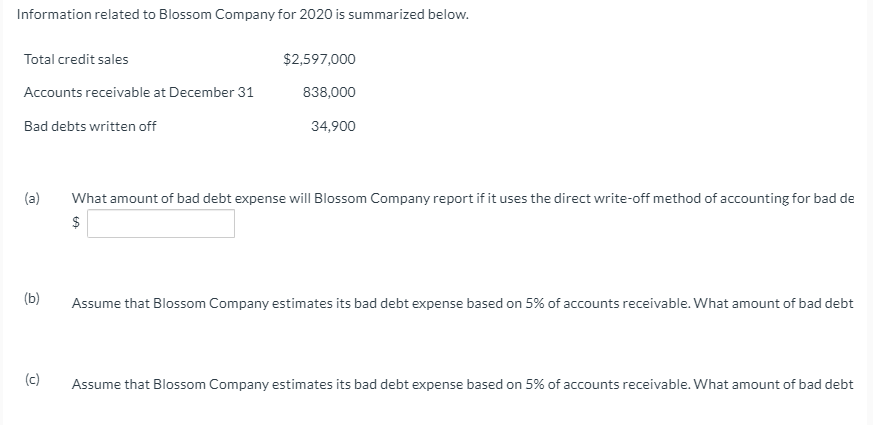

Information related to Blossom Company for 2020 is summarized below. Total credit sales $2,597,000 Accounts receivable at December 31 838,000 Bad debts written off 34,900 (a) What amount of bad debt expense will Blossom Company report if it uses the direct write-off method of accounting for bad debts? $enter a dollar amount (b) Assume that Blossom Company estimates its bad debt expense based on 5% of accounts receivable. What amount of bad debt expense will Blossom record if it has an Allowance for Doubtful Accounts credit balance of $3,500? $enter a dollar amount (c) Assume that Blossom Company estimates its bad debt expense based on 5% of accounts receivable. What amount of bad debt expense will Blossom record if it has an Allowance for Doubtful Accounts debit balance of $3,500? $enter a dollar amount

Information related to Blossom Company for 2020 is summarized below. Total credit sales $2,597,000 Accounts receivable at December 31 838,000 Bad debts written off 34,900 (a) What amount of bad debt expense will Blossom Company report if it uses the direct write-off method of accounting for bad debts? $enter a dollar amount (b) Assume that Blossom Company estimates its bad debt expense based on 5% of accounts receivable. What amount of bad debt expense will Blossom record if it has an Allowance for Doubtful Accounts credit balance of $3,500? $enter a dollar amount (c) Assume that Blossom Company estimates its bad debt expense based on 5% of accounts receivable. What amount of bad debt expense will Blossom record if it has an Allowance for Doubtful Accounts debit balance of $3,500? $enter a dollar amount

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 9E: Estimating Bad Debts from Receivables Balances The following information is extracted from Shelton...

Related questions

Question

Information related to Blossom Company for 2020 is summarized below.

| Total credit sales | $2,597,000 | |

| 838,000 | ||

| 34,900 |

| (a) | What amount of bad debt expense will Blossom Company report if it uses the direct write-off method of accounting for bad debts? $enter a dollar amount |

|

| (b) | Assume that Blossom Company estimates its bad debt expense based on 5% of accounts receivable. What amount of bad debt expense will Blossom record if it has an Allowance for Doubtful Accounts credit balance of $3,500? $enter a dollar amount | |

| (c) | Assume that Blossom Company estimates its bad debt expense based on 5% of accounts receivable. What amount of bad debt expense will Blossom record if it has an Allowance for Doubtful Accounts debit balance of $3,500? $enter a dollar amount |

Transcribed Image Text:Information related to Blossom Company for 2020 is summarized below.

Total credit sales

$2,597,000

Accounts receivable at December 31

838,000

Bad debts written off

34,900

(a)

What amount of bad debt expense will Blossom Company report if it uses the direct write-off method of accounting for bad de

$

(b)

Assume that Blossom Company estimates its bad debt expense based on 5% of accounts receivable. What amount of bad debt

(c)

Assume that Blossom Company estimates its bad debt expense based on 5% of accounts receivable. What amount of bad debt

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning